Guosheng Shian Technology Co., Ltd. (SHSE:603778) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 34% in the last twelve months.

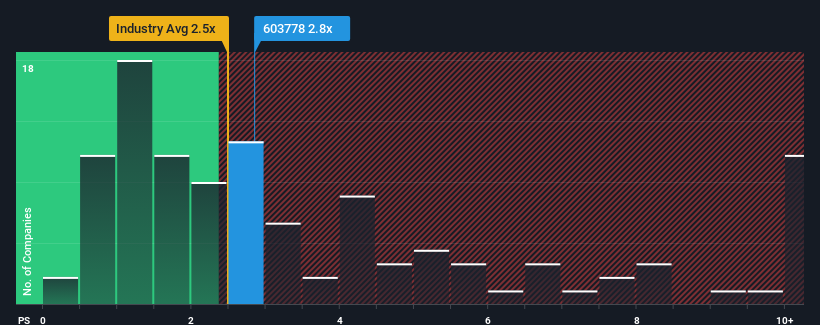

Although its price has surged higher, there still wouldn't be many who think Guosheng Shian Technology's price-to-sales (or "P/S") ratio of 2.8x is worth a mention when the median P/S in China's Commercial Services industry is similar at about 2.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Guosheng Shian Technology Has Been Performing

Revenue has risen firmly for Guosheng Shian Technology recently, which is pleasing to see. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. Those who are bullish on Guosheng Shian Technology will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Guosheng Shian Technology will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Guosheng Shian Technology's is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like Guosheng Shian Technology's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. This was backed up an excellent period prior to see revenue up by 229% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 28% shows it's noticeably more attractive.

With this information, we find it interesting that Guosheng Shian Technology is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does Guosheng Shian Technology's P/S Mean For Investors?

Guosheng Shian Technology appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

To our surprise, Guosheng Shian Technology revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It is also worth noting that we have found 3 warning signs for Guosheng Shian Technology (2 don't sit too well with us!) that you need to take into consideration.

If you're unsure about the strength of Guosheng Shian Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.