The Jinzhou Yongshan Lithium Co., Ltd (SHSE:603399) share price has done very well over the last month, posting an excellent gain of 26%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 16% in the last twelve months.

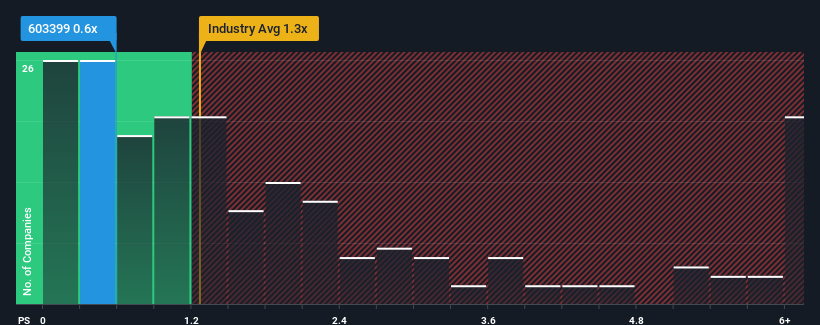

In spite of the firm bounce in price, considering around half the companies operating in China's Metals and Mining industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Jinzhou Yongshan Lithium as an solid investment opportunity with its 0.6x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does Jinzhou Yongshan Lithium's P/S Mean For Shareholders?

For example, consider that Jinzhou Yongshan Lithium's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Jinzhou Yongshan Lithium's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Jinzhou Yongshan Lithium?

In order to justify its P/S ratio, Jinzhou Yongshan Lithium would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Jinzhou Yongshan Lithium would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 26% decrease to the company's top line. Even so, admirably revenue has lifted 121% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 13%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in mind, we find it intriguing that Jinzhou Yongshan Lithium's P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

The latest share price surge wasn't enough to lift Jinzhou Yongshan Lithium's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We're very surprised to see Jinzhou Yongshan Lithium currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Jinzhou Yongshan Lithium with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Jinzhou Yongshan Lithium's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.