Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. For example, the Qinghai Jinrui Mineral Development Co., Ltd (SHSE:600714) share price is up 41% in the last 5 years, clearly besting the market return of around 18% (ignoring dividends).

The past week has proven to be lucrative for Qinghai Jinrui Mineral Development investors, so let's see if fundamentals drove the company's five-year performance.

Given that Qinghai Jinrui Mineral Development only made minimal earnings in the last twelve months, we'll focus on revenue to gauge its business development. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 5 years Qinghai Jinrui Mineral Development saw its revenue grow at 15% per year. That's a pretty good long term growth rate. While the share price has beat the market, compounding at 7% yearly, over five years, there's certainly some potential that the market hasn't fully considered the growth track record. The key question is whether revenue growth will slow down, and if so, how quickly. Lack of earnings means you have to project further into the future justify the valuation on the basis of future free cash flow.

In the last 5 years Qinghai Jinrui Mineral Development saw its revenue grow at 15% per year. That's a pretty good long term growth rate. While the share price has beat the market, compounding at 7% yearly, over five years, there's certainly some potential that the market hasn't fully considered the growth track record. The key question is whether revenue growth will slow down, and if so, how quickly. Lack of earnings means you have to project further into the future justify the valuation on the basis of future free cash flow.

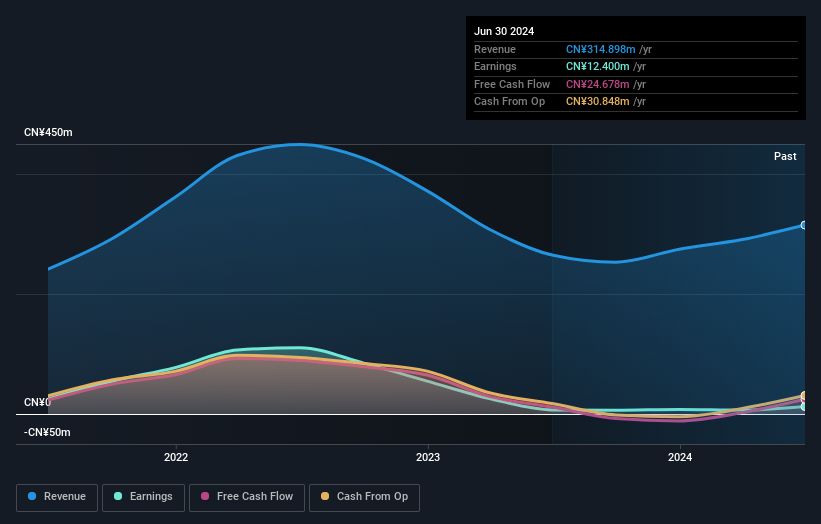

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on Qinghai Jinrui Mineral Development's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 3.3% in the last year, Qinghai Jinrui Mineral Development shareholders lost 7.9% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 7% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 2 warning signs we've spotted with Qinghai Jinrui Mineral Development (including 1 which is significant) .

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.