Financial giants have made a conspicuous bullish move on Atlassian. Our analysis of options history for Atlassian (NASDAQ:TEAM) revealed 15 unusual trades.

Delving into the details, we found 40% of traders were bullish, while 20% showed bearish tendencies. Out of all the trades we spotted, 10 were puts, with a value of $645,143, and 5 were calls, valued at $218,012.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $130.0 to $165.0 for Atlassian during the past quarter.

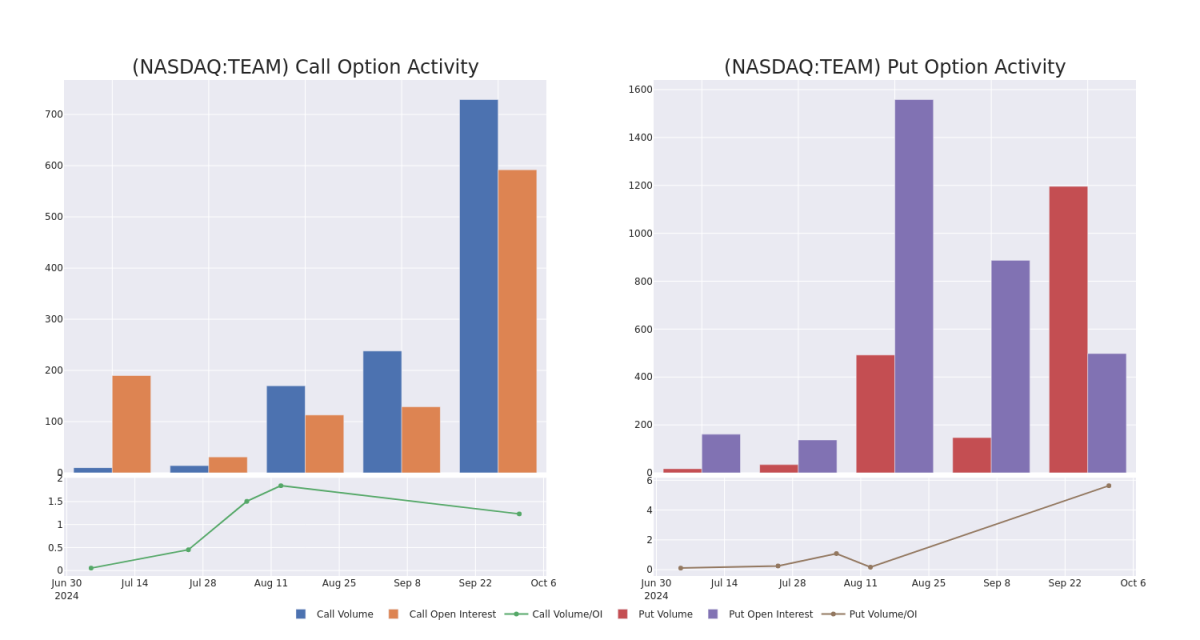

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Atlassian's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Atlassian's substantial trades, within a strike price spectrum from $130.0 to $165.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Atlassian's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Atlassian's substantial trades, within a strike price spectrum from $130.0 to $165.0 over the preceding 30 days.

Atlassian Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TEAM | PUT | SWEEP | BULLISH | 01/16/26 | $16.4 | $15.7 | $15.7 | $130.00 | $157.0K | 118 | 0 |

| TEAM | PUT | SWEEP | BEARISH | 01/16/26 | $27.3 | $26.3 | $27.16 | $155.00 | $136.3K | 159 | 100 |

| TEAM | PUT | TRADE | BULLISH | 01/15/27 | $23.7 | $22.0 | $22.64 | $130.00 | $113.2K | 2 | 0 |

| TEAM | CALL | TRADE | BULLISH | 11/15/24 | $10.3 | $8.9 | $9.9 | $165.00 | $85.1K | 72 | 65 |

| TEAM | PUT | SWEEP | BEARISH | 01/17/25 | $16.8 | $16.5 | $16.6 | $165.00 | $52.9K | 219 | 108 |

About Atlassian

Atlassian produces software that helps teams work together more efficiently and effectively. The company provides project planning and management software, collaboration tools, and IT help desk solutions. The company operates in four segments: subscriptions (term licenses and cloud agreements), maintenance (annual maintenance contracts that provide support and periodic updates and are generally attached to perpetual license sales), perpetual license (upfront sale for indefinite usage of the software), and other (training, strategic consulting, and revenue from the Atlassian Marketplace app store). Atlassian was founded in 2002 and is headquartered in Sydney.

In light of the recent options history for Atlassian, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Atlassian Standing Right Now?

- With a volume of 1,416,279, the price of TEAM is up 1.88% at $161.8.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 30 days.

What Analysts Are Saying About Atlassian

2 market experts have recently issued ratings for this stock, with a consensus target price of $215.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Raymond James has elevated its stance to Outperform, setting a new price target at $200. * Reflecting concerns, an analyst from Oppenheimer lowers its rating to Outperform with a new price target of $230.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Atlassian with Benzinga Pro for real-time alerts.