Unpacking the Latest Options Trading Trends in Riot Platforms

Unpacking the Latest Options Trading Trends in Riot Platforms

High-rolling investors have positioned themselves bearish on Riot Platforms (NASDAQ:RIOT), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in RIOT often signals that someone has privileged information.

高投资者仍持这股空头看淡立场(NASDAQ: RIOT),重要性重要。\我方今天通过对Benzinga的公开期权市场数据追踪,发现了这一动态。这些投资者的身份不确定,但是Riot平台的重要动向通常暗示某些人获取了内幕信息。

Today, Benzinga's options scanner spotted 16 options trades for Riot Platforms. This is not a typical pattern.

今天,Benzinga的期权扫描器发现了16笔针对riot platforms的期权交易。这不是一个典型的模式。

The sentiment among these major traders is split, with 12% bullish and 87% bearish. Among all the options we identified, there was one put, amounting to $43,925, and 15 calls, totaling $983,247.

这些主要交易者中的情绪分为两派,12%看涨,87%看跌。在我们识别的所有期权中,有一笔看跌,金额为$43,925,以及15笔看涨,总计$983,247。

Projected Price Targets

预计价格目标

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $12.0 for Riot Platforms during the past quarter.

分析这些合同中的成交量和未平仓量,看起来大玩家在过去一个季度一直在关注riot platforms的价格区间从$5.0到$12.0。

Volume & Open Interest Trends

成交量和未平仓量趋势

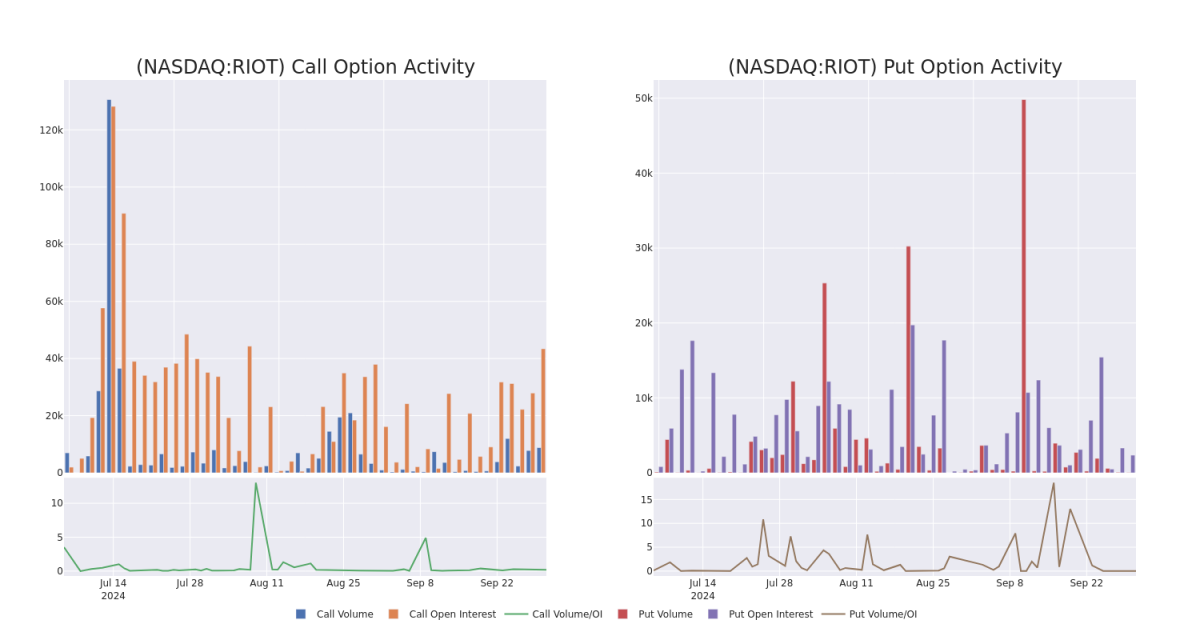

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

这些数据可以帮助您跟踪Coinbase Glb期权的流动性和利益,以给定的行权价格为基础。

This data can help you track the liquidity and interest for Riot Platforms's options for a given strike price.

这些数据可以帮助您追踪riot platforms期权在特定行权价上的流动性和兴趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Riot Platforms's whale activity within a strike price range from $5.0 to $12.0 in the last 30 days.

以下是在过去30天中,针对Riot Platforms所有的大宗交易活动,我们可以观察到看涨期权和看跌期权的成交量和未平仓量随着行权价格范围从5.0美元到12.0美元的演变。

Riot Platforms Option Activity Analysis: Last 30 Days

Riot Platforms期权活动分析:过去30天

Largest Options Trades Observed:

观察到的最大期权交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RIOT | CALL | SWEEP | BEARISH | 01/16/26 | $2.09 | $2.0 | $2.0 | $12.00 | $100.1K | 6.6K | 502 |

| RIOT | CALL | SWEEP | BEARISH | 01/16/26 | $3.8 | $3.75 | $3.75 | $5.00 | $75.0K | 3.0K | 821 |

| RIOT | CALL | SWEEP | BEARISH | 10/18/24 | $1.17 | $1.15 | $1.15 | $6.00 | $74.9K | 5.3K | 1.3K |

| RIOT | CALL | SWEEP | BEARISH | 10/18/24 | $1.17 | $1.15 | $1.15 | $6.00 | $74.9K | 5.3K | 687 |

| RIOT | CALL | TRADE | BEARISH | 01/16/26 | $3.8 | $3.7 | $3.74 | $5.00 | $74.8K | 3.0K | 409 |

| 标的 | 看跌/看涨 | 交易类型 | 情绪 | 到期日 | 卖盘 | 买盘 | 价格 | 执行价格 | 总交易价格 | 未平仓合约数量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RIOT | 看涨 | SWEEP | 看淡 | 01/16/26 | $2.09 | $2.0 | $2.0 | 12.00美元 | $100.1K | 6,600份 | 502 |

| RIOT | 看涨 | SWEEP | 看淡 | 01/16/26 | $3.8 | $3.75 | $3.75 | $5.00。 | $75.0K | 3.0K | 821 |

| RIOT | 看涨 | SWEEP | 看淡 | 10/18/24 | $1.17 | $1.15 | $1.15 | $6.00 | $74.9K | 5.3K | 1.3K |

| RIOT | 看涨 | SWEEP | 看淡 | 10/18/24 | $1.17 | $1.15 | $1.15 | $6.00 | $74.9K | 5.3K | 687 |

| RIOT | 看涨 | 交易 | 看淡 | 01/16/26 | $3.8 | $3.7 | $3.74 | $5.00。 | $74.8K | 3.0K | 409 |

About Riot Platforms

关于Riot Platforms

Riot Platforms Inc is a vertically integrated Bitcoin mining company focused on building, supporting, and operating blockchain technologies. The company's segments include Bitcoin Mining; Data Center Hosting and Engineering. It generates maximum revenue from the Bitcoin Mining segment which generates revenue from the Bitcoin the company earns through its mining activities.

Riot Platforms Inc是一家垂直整合的比特币挖矿公司,专注于构建、支持和运营区块链技术。该公司的业务包括比特币挖矿、数据中心托管和工程。它从比特币挖矿业务中获得最大收入,通过挖矿活动获得比特币并产生收入。

Having examined the options trading patterns of Riot Platforms, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了riot platforms的期权交易模式之后,我们现在将注意力直接转向该公司。这种转变使我们能够深入了解其当前的市场定位和表现

Riot Platforms's Current Market Status

Riot平台的当前市场地位

- Currently trading with a volume of 11,214,983, the RIOT's price is down by -4.65%, now at $7.08.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 35 days.

- 目前RIOT的交易量为11214983,价格下跌了-4.65%,目前为7.08美元。

- RSI读数表明该股目前可能接近超买水平。

- 预计财报发布还有35天。

What Analysts Are Saying About Riot Platforms

分析师们对riot平台有何看法

In the last month, 2 experts released ratings on this stock with an average target price of $19.0.

上个月,有2位专家对这只股票进行了评级,平均目标价为19.0美元。

Turn $1000 into $1270 in just 20 days?

在短短20天内,将1000美元变成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $23. * Reflecting concerns, an analyst from Macquarie lowers its rating to Outperform with a new price target of $15.

20年期权交易老手揭示了他的一行图表技术,显示何时买入和卖出。跟随他的交易,平均每20天获利27%。点击这里进行访问。* Cantor Fitzgerald分析师将其评级调降为超配,目标价为23美元。* 反映担忧,麦格理分析师将评级降低为表现良好,并设定新目标价为15美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Riot Platforms options trades with real-time alerts from Benzinga Pro.

期权交易存在较高风险和潜在回报。精明的交易员通过不断学习,调整策略,监控多个因子,并紧密关注市场走势来管理这些风险。通过Benzinga Pro实时警报了解最新的riot平台期权交易情况。

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $12.0 for Riot Platforms during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $5.0 to $12.0 for Riot Platforms during the past quarter.