Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like ANTA Sports Products (HKG:2020). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

ANTA Sports Products' Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. It certainly is nice to see that ANTA Sports Products has managed to grow EPS by 20% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

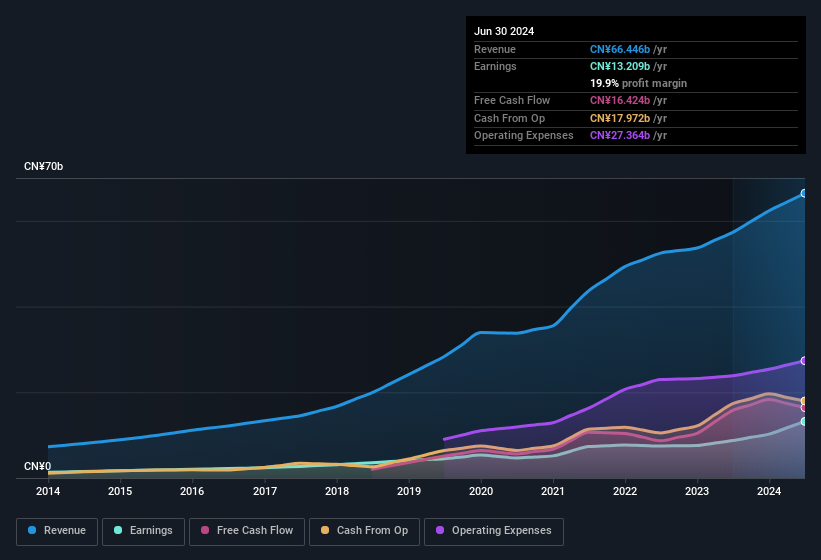

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note ANTA Sports Products achieved similar EBIT margins to last year, revenue grew by a solid 16% to CN¥66b. That's a real positive.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note ANTA Sports Products achieved similar EBIT margins to last year, revenue grew by a solid 16% to CN¥66b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of ANTA Sports Products' forecast profits?

Are ANTA Sports Products Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We did see some selling in the last twelve months, but that's insignificant compared to the whopping CN¥10m that the Executive Director, Jie Zheng spent acquiring shares. The average price of which was CN¥67.32 per share. Insider buying like this is a rare occurrence and should stoke the interest of the market and shareholders alike.

Along with the insider buying, another encouraging sign for ANTA Sports Products is that insiders, as a group, have a considerable shareholding. We note that their impressive stake in the company is worth CN¥1.2b. We note that this amounts to 0.4% of the company, which may be small owing to the sheer size of ANTA Sports Products but it's still worth mentioning. This still shows shareholders there is a degree of alignment between management and themselves.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because on our analysis the CEO, Yonghua Wu, is paid less than the median for similar sized companies. The median total compensation for CEOs of companies similar in size to ANTA Sports Products, with market caps over CN¥56b, is around CN¥6.9m.

ANTA Sports Products' CEO took home a total compensation package of CN¥2.1m in the year prior to December 2023. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add ANTA Sports Products To Your Watchlist?

For growth investors, ANTA Sports Products' raw rate of earnings growth is a beacon in the night. Moreover, the management and board of the company hold a significant stake in the company, with one party adding to this total. Astute investors will want to keep this stock on watch. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if ANTA Sports Products is trading on a high P/E or a low P/E, relative to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of ANTA Sports Products, you'll probably love this curated collection of companies in HK that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.