In the 'Chart Patterns' reversal series, in the four subcategories (head and shoulders, tops and bottoms, V-shapes, and reversals), the first three have been explained, now moving on to the fourth 'reversal' subseries. When it comes to reversals, it refers to a reversal in the trend of stock indexes or individual stocks, which can be from rising to falling or from falling to rising. If the reversal occurs within one day, a tendency of rising to falling is seen opening at or near the daily high, closing at or near the daily low. In candlestick charts, long bearish candles (large bearish candles, upper shadow bearish candles, upper and lower shadow bearish candles) should be observed; and in the case of a reversal from falling to rising, it is the opposite - opening low and trending higher, with long bullish candles (large bullish candles, lower shadow bullish candles, upper and lower shadow bullish candles). Note that such changes do not have to occur within a single day, with the transformation completed over two days, still classified under this 'reversal' subseries.

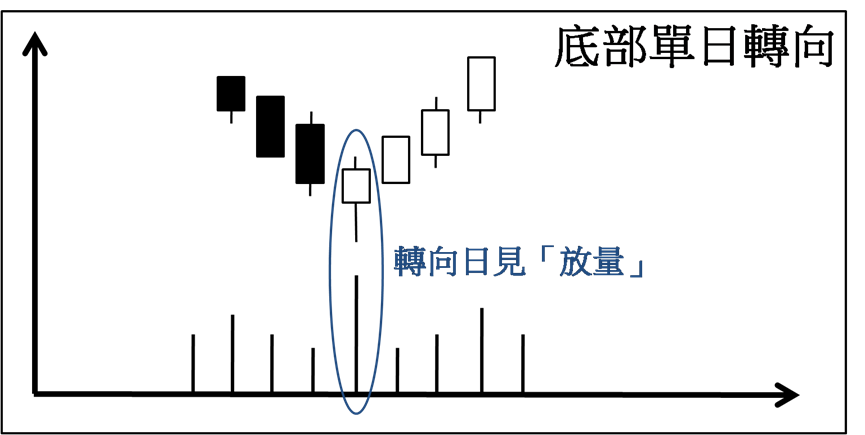

The first pattern to observe is the 'single-day bottom reversal,' which represents the trend of stock indexes or individual stocks declining for a period of time (usually not less than two weeks), then showing a turning point at a low level and resuming the upward trend. At the turning point, the aforementioned long bullish candles are seen, with unique characteristics in price volume interaction. As stock indexes or individual stocks decline, the relative trading amount or volume gradually decreases, forming a 'price drop, volume contraction,' proving that the selling pressure is weakening. After the turning point, stock indexes or individual stocks gradually begin to rise, with relative trading amounts or volume gradually increasing, forming 'price and volume rising together.' The transition from 'price drop, volume contraction' to 'price and volume rising together' occurs at the turning point, with a sharp increase in trading amount or volume.

At that time, the 'volume' significantly stands out, generally three times or more than usual. In the 'single-day bottom reversal,' after a period of dominance by the sellers, the advantage gradually diminishes, and when at its weakest, the buyers make a strong comeback. Therefore, when the turning point occurs, there is a sharp increase in 'volume,' mainly from the buyers, putting in all efforts to regain the advantage. The result of the reversal from falling to rising seen in stock indexes or individual stocks on the same day proves the success of the buyers' counterattack, allowing opportunistic market entry at that time. However, for the cautious ones, if concerned about the possibility of a 'false breakout' in the trend, they can wait for two more trading days after the turning point to see stock indexes or individual stocks still rising before deploying their positions. Indeed, entering the market with such carefulness may bring peace of mind; but remember that the returns may be less successful if the turning point is missed.

Let's look at an extreme example – Evergrande (03333) recorded a high of 3.060 yuan in November 23, 2021, after which the stock price softened, closing at 1.650 yuan on March 18, 2022 (Friday), falling by over 46.00% in less than four months. The next trading day (March 21) was suspended before the market opened, all because they needed to delay the release of the 2021 full-year performance. Finally resumed trading on August 28, 2023, opening significantly lower by over 86.00%, at 0.220 yuan, although it was already at a daily low; the stock price gradually recovered, reaching a high of 0.410 yuan, ultimately closing nearly six-tenths higher than the opening at 0.350 yuan, forming a 'long bullish candle.'

Considering the market's pessimism towards Evergrande's prospects at that time, yet still closing with a long bullish candle and a trading volume close to 1.85 billion shares, significantly higher than the less than 0.209 billion shares on the last trading day before the suspension – an obvious 'rising on high volume' scenario. From early September 2023, the stock price gradually strengthened, reaching 0.940 yuan on September 12, nearly 1.70 times higher than the closing at 0.350 yuan on August 28, with a period of about half a month. It is also worth noting that from August 29 to September 5, the closing prices hovered between 0.270 and 0.350 yuan, a difference of only sixteen price points, less than twenty, indicating a relatively small fluctuation range. Combined with the single-day reversal on August 28, it proves that investors had ample time to enter at low prices and seize the opportunity for significant profit.

Considering the market's pessimism towards Evergrande's prospects at that time, yet still closing with a long bullish candle and a trading volume close to 1.85 billion shares, significantly higher than the less than 0.209 billion shares on the last trading day before the suspension – an obvious 'rising on high volume' scenario. From early September 2023, the stock price gradually strengthened, reaching 0.940 yuan on September 12, nearly 1.70 times higher than the closing at 0.350 yuan on August 28, with a period of about half a month. It is also worth noting that from August 29 to September 5, the closing prices hovered between 0.270 and 0.350 yuan, a difference of only sixteen price points, less than twenty, indicating a relatively small fluctuation range. Combined with the single-day reversal on August 28, it proves that investors had ample time to enter at low prices and seize the opportunity for significant profit.

[Author Introduction] Nie Zhenbang (Nie Sir)

Graduated from the Department of Financial Services at The Hong Kong Polytechnic University.

With over 17 years of experience in the financial industry and investment teaching.

Author of four investment and financial books.

Licensed by the Hong Kong Securities and Futures Commission.

[Disclaimer] The author confirms that neither the author nor any related party has engaged in the following two situations: firstly, trading the aforementioned analyzed stocks in the thirty days prior to writing; secondly, trading the aforementioned stocks within three business days after the article is published.

Furthermore, the author currently does not hold the aforementioned stocks. The above is purely personal research sharing, not representing any third-party institution's position, nor providing any investment advice or inducement. Readers are advised to use their own independent thinking abilities to make investment decisions.

观乎当时市场对恒大前景感悲观,最终仍已长阳烛收市,以及当日成交量接近18.50亿股,较停牌前最后交易日不足2.09亿股出现明显「放量」,可理解为「底部单日转向」出现。自2023年9月初开始股价渐见走强,至9月12日高见0.940元,较8月28日收报0.350元,约半个月累升近1.70倍。另可留意8月29日至9月5日收市位徘徊在0.270至0.350元,差距仅十六个价位,少于廿格反映波幅偏小,配合8月28日的单日转向,证明投资者有充裕日子以低价进场,顺利捉紧倍升获利机会并非难事。

观乎当时市场对恒大前景感悲观,最终仍已长阳烛收市,以及当日成交量接近18.50亿股,较停牌前最后交易日不足2.09亿股出现明显「放量」,可理解为「底部单日转向」出现。自2023年9月初开始股价渐见走强,至9月12日高见0.940元,较8月28日收报0.350元,约半个月累升近1.70倍。另可留意8月29日至9月5日收市位徘徊在0.270至0.350元,差距仅十六个价位,少于廿格反映波幅偏小,配合8月28日的单日转向,证明投资者有充裕日子以低价进场,顺利捉紧倍升获利机会并非难事。