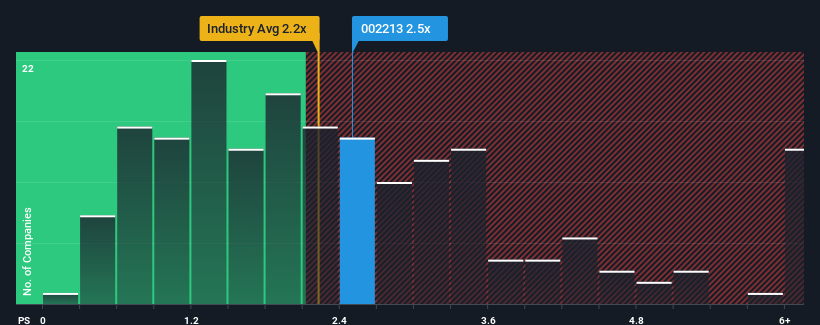

There wouldn't be many who think Shenzhen Dawei Innovation Technology Co., Ltd.'s (SZSE:002213) price-to-sales (or "P/S") ratio of 2.5x is worth a mention when the median P/S for the Auto Components industry in China is similar at about 2.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

How Has Shenzhen Dawei Innovation Technology Performed Recently?

With revenue growth that's exceedingly strong of late, Shenzhen Dawei Innovation Technology has been doing very well. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Shenzhen Dawei Innovation Technology will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

Shenzhen Dawei Innovation Technology's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 61% gain to the company's top line. Pleasingly, revenue has also lifted 76% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Retrospectively, the last year delivered an exceptional 61% gain to the company's top line. Pleasingly, revenue has also lifted 76% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 23% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it interesting that Shenzhen Dawei Innovation Technology is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Shenzhen Dawei Innovation Technology's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Shenzhen Dawei Innovation Technology's average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. If recent medium-term revenue trends continue, the probability of a share price decline will become quite substantial, placing shareholders at risk.

Before you settle on your opinion, we've discovered 1 warning sign for Shenzhen Dawei Innovation Technology that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.