The Hang Seng Index surged 6.2% to 22,000 points, and the China Index rose 7.08%.

On October 2, the Hang Seng Index surged 6.2% to 22,000 points, and the National Index rose 7.08%. At one point, the Hang Seng Technology Index surged more than 9% intraday, and finally closed up 8.53%, standing at 5,100 points.

Technology stocks collectively surged, with Oriental Selection up more than 46%, Bilibili by 21%, Alibaba Health and Meituan by 14%, Kingdee International by more than 13%, Ideal Auto by 12%, JD Group by more than 10%, Kuaishou and Baidu Group by more than 9%, Yuewen Group and Shangtang by more than 7%, Xiaomi by more than 6%, Tencent by more than 5%, and Alibaba by more than 4%.

Let's take a look specifically:

Let's take a look specifically:

Brokerage stocks have gone crazy, and the Wind brokerage index surged more than 30% intraday to a record high.

Shenwan Hongyuan Hong Kong surged 206%, a record high of about five and a half years since March 2019; China Merchants Securities surged more than 81%, Orient Securities rose more than 51%, CITIC Construction Investment rose more than 47%, League Securities and CITIC Securities rose more than 39%, Xingzheng International rose more than 36%, GF Securities and Shenwan Hongyuan rose more than 33%, and CICC rose more than 31%.

According to CICC, brokerage firms are currently facing three major catalysts: first, macroeconomic and fiscal and monetary policy sentiment catalysis (with particular focus on fiscal strength); second, catalysing capital market-related reforms (such as leveling fund policies, implementation of exchange facilitation rules between securities fund insurance companies and central banks, etc.); and third, event catalysis for mergers and acquisitions within the industry. Regarding market continuity issues that the market is currently concerned about, the agency believes that the intensity and speed of market interpretation may exceed market expectations. Brokerage stocks are the core beneficiary sector of this policy shift, and are expected to show stronger market sensitivity under the active policy shift and liquidity improvement catalyzed.

Real estate stocks and property stocks boomed at the same time. Zhongliang Holdings rose more than 202%, Agile Group rose more than 160%, Shimao Group rose more than 97%, Sunac China rose more than 75%, R&F Real Estate rose more than 89%, Vanke rose more than 61%, Shimao Services rose more than 58%, China Jinmao rose more than 41%, Jinhui Holdings rose more than 32%, Evergrande Property rose more than 26%, Xincheng Development rose more than 25%, Longhu Group rose more than 24%, Country Garden Services rose more than 23%, China Greentown rose more than 23% 18%

According to the news, October 1 is the first day of implementation of the new real estate policy in Kitakami, Guangshen. From buyers and intermediaries to developers, the volume of transactions in first-tier cities is clearly active.

According to Huafu Securities, with the support of many favorable policies, it is expected that the short-term second-hand housing market will be more sensitive, prioritizing storage of new homes, and promoting a steady recovery in housing prices. As old second-hand housing prices are fully adjusted and moved to warehouses, their housing prices first rise and spread to the next new and new homes. Under a strong beta market, it is recommended to allocate index targets while taking into account the low PB index of Hong Kong stocks.

Insurance stocks surged, with China Reinsurance up more than 17%, Zhongan Online by more than 16%, China Taibao and China Taibao by more than 13%, Ping An of China by more than 12%, Xinhua Insurance by more than 11%, and China Life Insurance by more than 9%.

Consumer sectors such as home appliances and dairy products were active. Midea Group rose more than 25%, Hisense appliances rose more than 17%, Mengniu Dairy rose more than 10%, Haier Smart Home rose more than 7%, Australia Premium rose more than 6%, Yum China rose more than 4%, and TCL Electronics rose more than 3%.

Auto stocks generally rose; Ideal Auto rose more than 12%, Great Wall Motor rose more than 9%, Geely Auto rose more than 7%, GAC Group and BYD rose more than 5%, NIO rose more than 4%, and Xiaopeng Motor rose more than 3%.

The semiconductor sector strengthened, with Shanghai Fudan up more than 15%, Huahong Semiconductor up more than 8%, Hongguang Semiconductor up more than 7%, and SMIC up more than 6%.

At the individual stock level, China's financial investment management fluctuated and increased. At the end of the session, it rose more than 900%, and finally closed up 730%. Huarong Financial Holdings rose more than 412%, Capital Venture Capital rose more than 400%, and Rongxin China rose more than 397%.

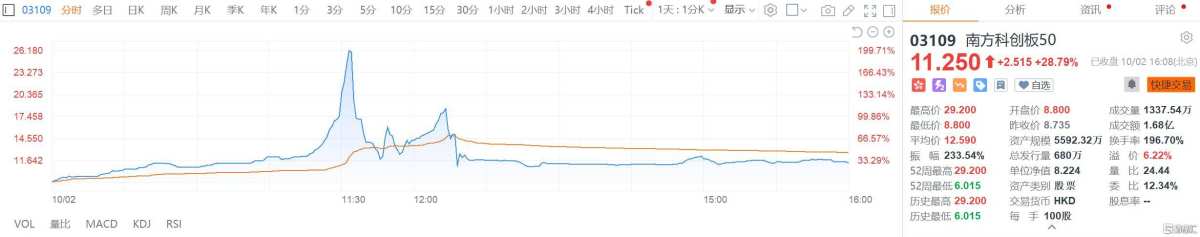

In addition, the Southern Dongying Science and Technology Innovation Board 50 ETF listed on the Hong Kong Stock Exchange once surged 234.3% in the intraday market today. Southern Dongying issued a risk alert stating that fund managers reminded shareholders of the Southern East Asia Science and Technology Innovation Board 50 Index ETF related market transaction risks, including but not limited to a large premium on the secondary market price.

As of September 30, the sub-fund's net asset value per share was RMB 7.4243. The announcement stated that investors should exercise caution when trading A-share ETFs, especially when the mainland securities market is closed during the National Day holiday. As of press release, the fund's gains have narrowed to 31.54%.

In response, Hong Hao, chief economist of Sirui Group, said that today's rise in Hong Kong stocks is believed to be speculated by domestic and Hong Kong investors. After all, the A-share market is closed today. Obviously, the entire market is very hopeful about policy expectations.