Financial giants have made a conspicuous bearish move on CVS Health. Our analysis of options history for CVS Health (NYSE:CVS) revealed 17 unusual trades.

Delving into the details, we found 41% of traders were bullish, while 47% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $440,613, and 13 were calls, valued at $786,829.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $50.0 to $75.0 for CVS Health over the last 3 months.

Volume & Open Interest Development

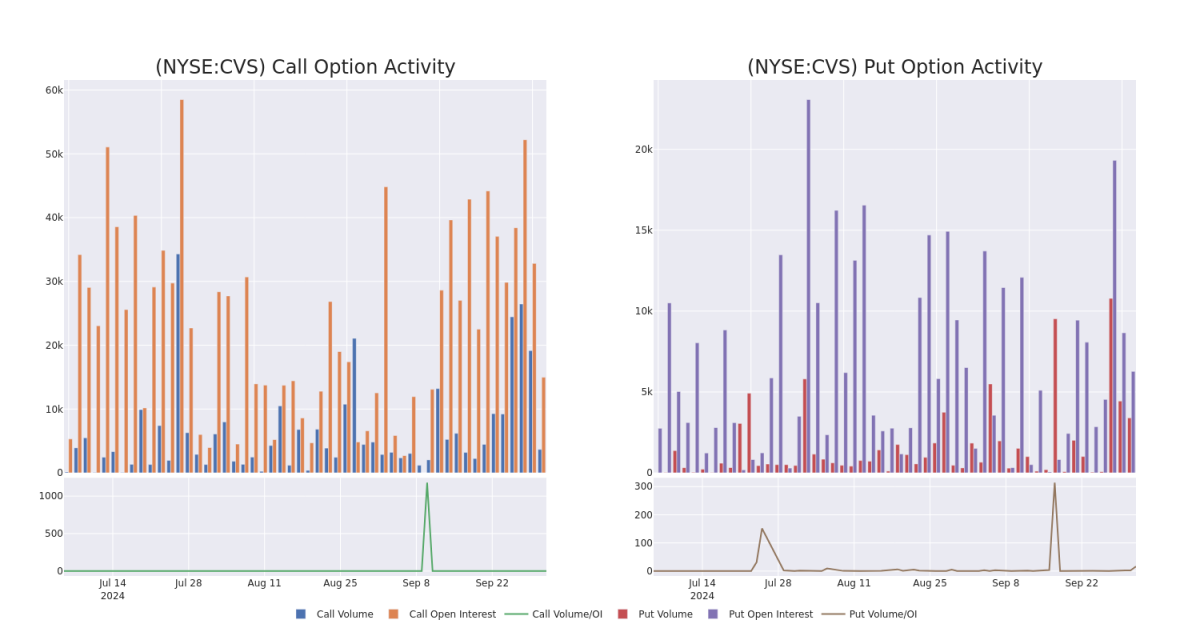

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for CVS Health's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of CVS Health's whale trades within a strike price range from $50.0 to $75.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for CVS Health's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of CVS Health's whale trades within a strike price range from $50.0 to $75.0 in the last 30 days.

CVS Health Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVS | PUT | TRADE | BULLISH | 10/18/24 | $1.23 | $1.12 | $1.14 | $62.00 | $284.9K | 607 | 2.5K |

| CVS | CALL | SWEEP | NEUTRAL | 01/16/26 | $10.4 | $10.1 | $10.2 | $60.00 | $180.5K | 987 | 178 |

| CVS | CALL | TRADE | BEARISH | 11/15/24 | $2.85 | $2.37 | $2.4 | $65.00 | $168.0K | 7.3K | 57 |

| CVS | PUT | SWEEP | BEARISH | 01/16/26 | $5.1 | $5.0 | $5.1 | $55.00 | $91.3K | 3.7K | 179 |

| CVS | CALL | SWEEP | BEARISH | 03/21/25 | $10.6 | $10.5 | $10.5 | $55.00 | $75.6K | 474 | 73 |

About CVS Health

CVS Health offers a diverse set of healthcare services. Its roots are in its retail pharmacy operations, where it operates over 9,000 stores primarily in the us. CVS is also a large pharmacy benefit manager (acquired through Caremark), processing about 2 billion adjusted claims annually. It also operates a top-tier health insurer (acquired through Aetna) where it serves about 26 million medical members. The company's recent acquisition of Oak Street adds primary care services to the mix, which could have significant synergies with all its existing business lines.

CVS Health's Current Market Status

- Trading volume stands at 10,926,257, with CVS's price up by 2.06%, positioned at $62.8.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 35 days.

What The Experts Say On CVS Health

4 market experts have recently issued ratings for this stock, with a consensus target price of $63.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from RBC Capital downgraded its action to Outperform with a price target of $68. * In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Neutral, setting a price target of $62. * Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Neutral with a new price target of $62.* An analyst from Cantor Fitzgerald has revised its rating downward to Neutral, adjusting the price target to $62.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for CVS Health with Benzinga Pro for real-time alerts.