Shanghai Anlogic Infotech Co., Ltd. (SHSE:688107) shares have had a really impressive month, gaining 35% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 39% in the last twelve months.

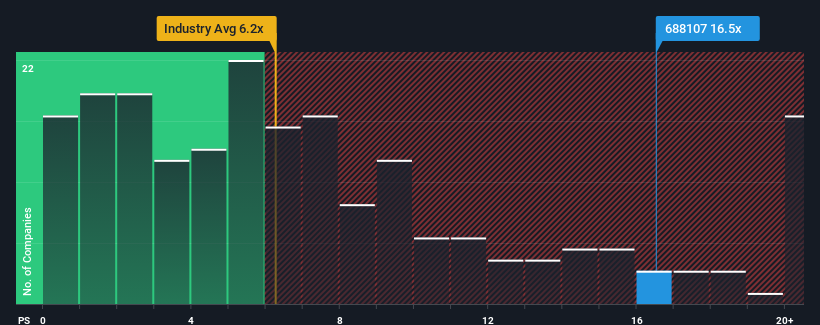

Since its price has surged higher, Shanghai Anlogic Infotech may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 16.5x, when you consider almost half of the companies in the Semiconductor industry in China have P/S ratios under 6.2x and even P/S lower than 3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Has Shanghai Anlogic Infotech Performed Recently?

Shanghai Anlogic Infotech could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Shanghai Anlogic Infotech's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Shanghai Anlogic Infotech's is when the company's growth is on track to outshine the industry decidedly.

The only time you'd be truly comfortable seeing a P/S as steep as Shanghai Anlogic Infotech's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 34%. Regardless, revenue has managed to lift by a handy 14% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 42% during the coming year according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 36%, which is noticeably less attractive.

In light of this, it's understandable that Shanghai Anlogic Infotech's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Shanghai Anlogic Infotech's P/S?

Shanghai Anlogic Infotech's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Shanghai Anlogic Infotech maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Semiconductor industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 2 warning signs for Shanghai Anlogic Infotech that you need to take into consideration.

If you're unsure about the strength of Shanghai Anlogic Infotech's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.