Unfortunately, investing is risky - companies can and do go bankrupt. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the Fantasia Holdings Group Co., Limited (HKG:1777) share price has soared 156% in the last 1 year. Most would be very happy with that, especially in just one year! And in the last week the share price has popped 337%. Zooming out, the stock is actually down 60% in the last three years.

The past week has proven to be lucrative for Fantasia Holdings Group investors, so let's see if fundamentals drove the company's one-year performance.

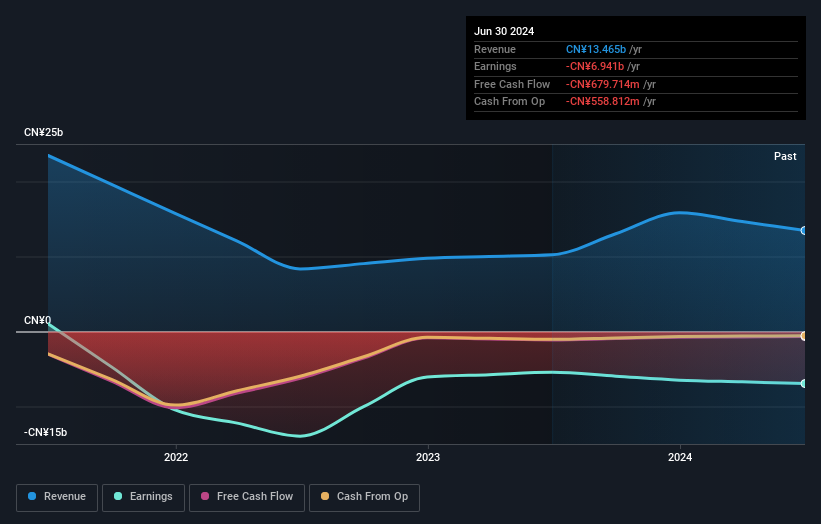

Given that Fantasia Holdings Group didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over the last twelve months, Fantasia Holdings Group's revenue grew by 32%. That's a fairly respectable growth rate. The revenue growth is decent but the share price had an even better year, gaining 156%. Given that the business has made good progress on the top line, it would be worth taking a look at its path to profitability. But investors need to be wary of how the 'fear of missing out' could influence them to buy without doing thorough research.

Over the last twelve months, Fantasia Holdings Group's revenue grew by 32%. That's a fairly respectable growth rate. The revenue growth is decent but the share price had an even better year, gaining 156%. Given that the business has made good progress on the top line, it would be worth taking a look at its path to profitability. But investors need to be wary of how the 'fear of missing out' could influence them to buy without doing thorough research.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Fantasia Holdings Group stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Fantasia Holdings Group shareholders have received a total shareholder return of 156% over the last year. There's no doubt those recent returns are much better than the TSR loss of 12% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 4 warning signs for Fantasia Holdings Group you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.