Zhejiang Shapuaisi Pharmaceutical Co.,Ltd. (SHSE:603168) shareholders should be happy to see the share price up 22% in the last month. But that doesn't change the reality of under-performance over the last twelve months. In fact, the price has declined 22% in a year, falling short of the returns you could get by investing in an index fund.

While the last year has been tough for Zhejiang Shapuaisi PharmaceuticalLtd shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Given that Zhejiang Shapuaisi PharmaceuticalLtd didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Zhejiang Shapuaisi PharmaceuticalLtd's revenue didn't grow at all in the last year. In fact, it fell 12%. That looks pretty grim, at a glance. The stock price has languished lately, falling 22% in a year. What would you expect when revenue is falling, and it doesn't make a profit? It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

Zhejiang Shapuaisi PharmaceuticalLtd's revenue didn't grow at all in the last year. In fact, it fell 12%. That looks pretty grim, at a glance. The stock price has languished lately, falling 22% in a year. What would you expect when revenue is falling, and it doesn't make a profit? It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

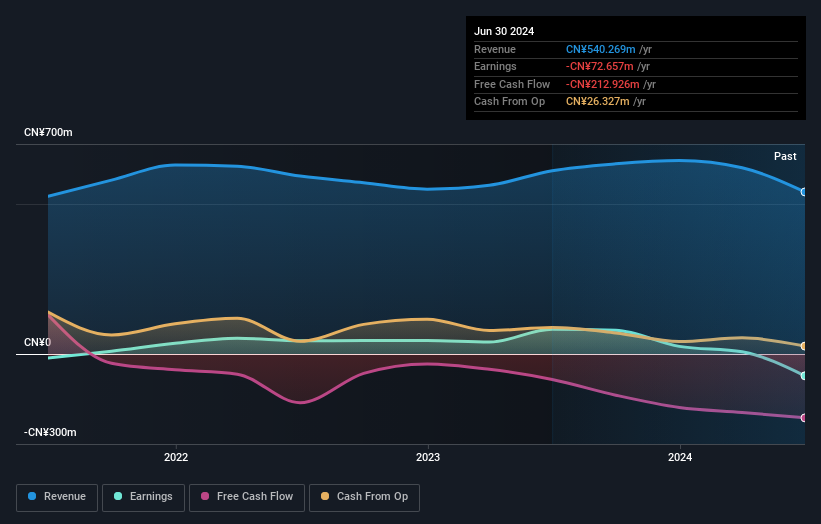

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Zhejiang Shapuaisi PharmaceuticalLtd's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Zhejiang Shapuaisi PharmaceuticalLtd shareholders are down 22% for the year (even including dividends), but the market itself is up 3.3%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.3% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You could get a better understanding of Zhejiang Shapuaisi PharmaceuticalLtd's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.