While it may not be enough for some shareholders, we think it is good to see the Guangdong Xiongsu Technology Group Co., Ltd (SZSE:300599) share price up 26% in a single quarter. But that doesn't help the fact that the three year return is less impressive. Truth be told the share price declined 45% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

On a more encouraging note the company has added CN¥385m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

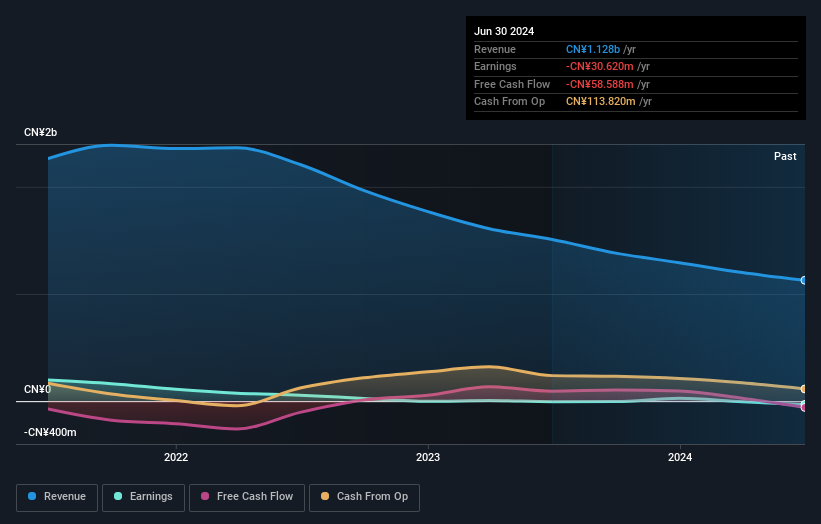

Guangdong Xiongsu Technology Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years Guangdong Xiongsu Technology Group saw its revenue shrink by 26% per year. That means its revenue trend is very weak compared to other loss making companies. With revenue in decline, the share price decline of 13% per year is hardly undeserved. The key question now is whether the company has the capacity to fund itself to profitability, without more cash. Of course, it is possible for businesses to bounce back from a revenue drop - but we'd want to see that before getting interested.

In the last three years Guangdong Xiongsu Technology Group saw its revenue shrink by 26% per year. That means its revenue trend is very weak compared to other loss making companies. With revenue in decline, the share price decline of 13% per year is hardly undeserved. The key question now is whether the company has the capacity to fund itself to profitability, without more cash. Of course, it is possible for businesses to bounce back from a revenue drop - but we'd want to see that before getting interested.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Guangdong Xiongsu Technology Group the TSR over the last 3 years was -41%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market gained around 3.3% in the last year, Guangdong Xiongsu Technology Group shareholders lost 20% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 3 warning signs we've spotted with Guangdong Xiongsu Technology Group .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.