①IPO前,卡罗特引入了经纬创投、元生资本两名基石投资者,合共投资4000万美元。此前,卡罗特一直保持独立发展,未引入投资机构。②海外渠道中,亚马逊以及沃尔玛的收入增长飞速,今年一季度达到2.35亿元,占比达到52.2%,可以看出海外成为其主要的销售渠道。

《科创板日报》10月3日讯(记者 徐赐豪) 浙江85后厂二代的“锅厂”上市了。

日前,厨具品牌卡罗特(商业)有限公司(下称“卡罗特”)在港交所挂牌上市,此次IPO,卡罗特每股定价5.78港元,共发行1.299亿股股份,所得款项净额将约为6.93亿港元。

上市首日,卡罗特股价势头强劲,开盘即报9.5港元/股,较发行价大幅飙升64%。截至10月2日收盘,股价稳稳收于9.15港元/股,涨幅依然高达58.3%,公司市值随之跃升至49亿港元。

上市首日,卡罗特股价势头强劲,开盘即报9.5港元/股,较发行价大幅飙升64%。截至10月2日收盘,股价稳稳收于9.15港元/股,涨幅依然高达58.3%,公司市值随之跃升至49亿港元。

值得关注的是,卡罗特在IPO前一直保持独立自主的姿态,未曾引入外部投资人。此番上市,经纬创投和元生资本作为基石投资者,各自斥资2000万美元,分别持有5.06%的股份。

创始人夫妇暴涨至36.74亿

卡罗特的来历,要从一个厂二代“爆改”说起。

据《招股书》披露,卡罗特的实控权掌握在章国栋与吕伊俐这对年轻夫妇手中。两人均出身于1988年的浙江,自幼便与厨具制造业结下了不解之缘。1992年,他们的父母——李惠平与章之慧,携手创立了永康市特牌电器有限公司,这便是卡罗特的前身。

李惠平的女儿吕伊俐和章之慧的儿子章国栋,均赴澳洲格里菲斯大学留学,一个读会计、一个读市场,2010年毕业后,双双进入卡罗特任职。

后来,章国栋与吕伊俐结为夫妻,共同接班,成为卡罗特的实际控制人和核心高管,章国栋担任董事长和CEO,吕伊俐是执行董事兼首席产品官。

卡罗特成立于2007年,其实在做品牌之前,主要为国际市场提供OEM服务;2013 年,卡罗特第一次转型,做ODM,有了自己的研发团队,业务从贴牌代工转为为国际品牌设计、开发新产品,甚至还有定制业务。品牌声量完成第一次原始积累。

赶上电商发展最快的阶段,章国栋夫妇在2016年推出了自有品牌卡罗特(CAROTE),开始进军线上零售,做DTC重视做品牌。

2022年初,卡罗特剥离生产业务,转向完全外包及轻资产模式。

自此,卡罗特从一家处于产业链底端的传统生产工厂,升级为一家产业链顶端、整合行业资源的品牌商。

IPO前,卡罗特引入了经纬创投、元生资本两名基石投资者,合共投资4000万美元(约3.12亿港元),每家认购2000万美元,认购额占此次最高集资额约42%。

根据招股书,上市前章国栋和吕伊俐夫妇持有卡罗特98.60%的股权,为最大股东。其余持股者是Denk Trade,持股1%,Carote CM持股0.4%。其中,Denk Trade是卡罗特OEM的客户。

上市后,章国栋和吕伊俐夫妇持股74.99%,两家基石投资者各持股5.06%。基石投资者的禁售期是6个月。以此计算,章国栋和吕伊俐夫妇随着卡罗特的成功上市成功收获36.74亿身家。

以海外渠道为主

招股书显示,2021年、2022年、2023年、2024年第一季度,卡罗特分别推出520个、1305个、1374个及361个SKU的自有品牌产品,不断扩大产品系列。

如今,卡罗特产品组合包括超过2200个涵盖不同厨具类别的SKU,主要包括不粘锅具、铸铁锅及精选炊具套件、厨房收纳盒、容器、刀具、砧板、锅铲、长柄杓、饮水容器、马克杯、玻璃杯、空气炸锅、电煮锅等炊具、厨具、饮具等。

招股书显示,2021年、2022年、2023年、及2024年第一季度,卡罗特实现收入分别为6.75亿元、7.69亿元、15.83亿元、5.03亿元,期内利润分别约为0.32亿元、1.09亿元、2.37亿元、0.89亿元。

经过8年的时间,自有品牌业务(以下用“卡罗特”指品牌业务)已成为卡罗特最重要的营收来源。

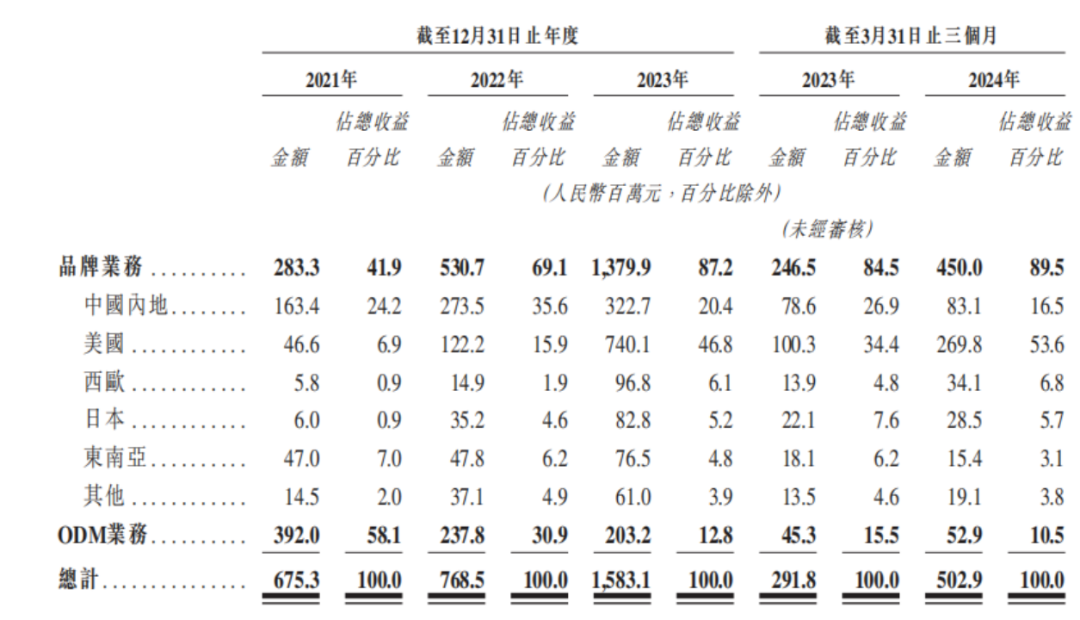

招股书显示,近年来卡罗特自营业务快速增长,营收从2021年的2.83亿元开始大幅增长,2022年达到5.31亿元,2023年达到13.8亿元,复合年增长率为120.7%;在总营收的占比中也从41.9%,到69.1%、87.2%。2024年第一季度实现营收4.50亿元,占总收入的占比上升至89.5%。

而ODM业务的营收逐年下降,2021年-2023年,从3.92亿元减至2.38亿元、2.03亿元,2024年一季度为0.53亿元,在总营收中占比为10.5%。

从渠道来看,虽然卡罗特也依托天猫、京东等第三方电商平台在国内进行销售,但其大部分营收来自海外市场,且去年因美国、西欧市场的销售成绩亮眼及品牌知名度提升,卡罗特的海外营收增长还超过一倍。

招股书显示,2021年、2022年、2023年以及2024年一季度,中国内地的营收为1.63亿元、2.74亿元、3.23亿元以及0.83亿元,在整个营收的占比分别为24.2%、35.6%、20.4%以及16.5%。

海外渠道中,亚马逊以及沃尔玛的收入增长飞速,单亚马逊的收入在2023年就达到了6.7亿元,占比为48.8%;今年一季度达到2.35亿元,占比达到52.2%。