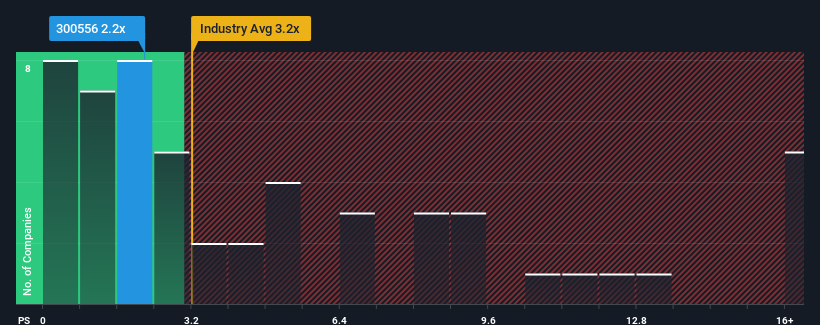

With a price-to-sales (or "P/S") ratio of 2.2x Silkroad Visual Technology Co., Ltd. (SZSE:300556) may be sending bullish signals at the moment, given that almost half of all the Professional Services companies in China have P/S ratios greater than 3.2x and even P/S higher than 9x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

What Does Silkroad Visual Technology's P/S Mean For Shareholders?

For instance, Silkroad Visual Technology's receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Although there are no analyst estimates available for Silkroad Visual Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Silkroad Visual Technology?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Silkroad Visual Technology's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Comparing that to the industry, which is predicted to deliver 31% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

In light of this, it's understandable that Silkroad Visual Technology's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

In line with expectations, Silkroad Visual Technology maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Silkroad Visual Technology is showing 2 warning signs in our investment analysis, and 1 of those is significant.

If these risks are making you reconsider your opinion on Silkroad Visual Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.