Berkshire Hathaway's fundraising plan is closely watched by stock market investors because earlier this year, the company's purchase of shares in Japan's five major trading companies helped drive the Nikkei 225 Index to a historic high.

According to the Securities Times app, Berkshire Hathaway's return to the Japanese yen bond market has sparked speculation that the 'Stock God' Buffett is raising funds to increase his holdings in Japanese value stocks, with market observers suggesting that Buffett may be considering investing in Japanese financial and shipping companies.

It is reported that Berkshire Hathaway is planning to issue yen-denominated bonds for the second time this year. Reports indicate that Berkshire Hathaway has hired Bank of America Securities and Sumitomo Mitsui Securities to issue yen-denominated unsecured senior bonds.

Berkshire Hathaway's fundraising plan is closely watched by stock market investors because earlier this year, the company's purchase of shares in Japan's five major trading companies helped drive the Nikkei 225 Index to a historic high. In February of this year, Berkshire Hathaway mentioned in its annual shareholder letter that the company's practice of issuing yen-denominated bonds provided most of the funding for investing in Japanese companies.

Berkshire Hathaway's fundraising plan is closely watched by stock market investors because earlier this year, the company's purchase of shares in Japan's five major trading companies helped drive the Nikkei 225 Index to a historic high. In February of this year, Berkshire Hathaway mentioned in its annual shareholder letter that the company's practice of issuing yen-denominated bonds provided most of the funding for investing in Japanese companies.

Chief Technical Analyst Eiji Kinouchi of Daiwa Securities in Japan believes that insurance companies and shipping companies may be Buffett's next choice. In a research report this week, he said that although the news of Berkshire Hathaway issuing bonds led to a rise in the stock prices of Japanese insurance companies and shipping companies, they did not outperform the large cap significantly.

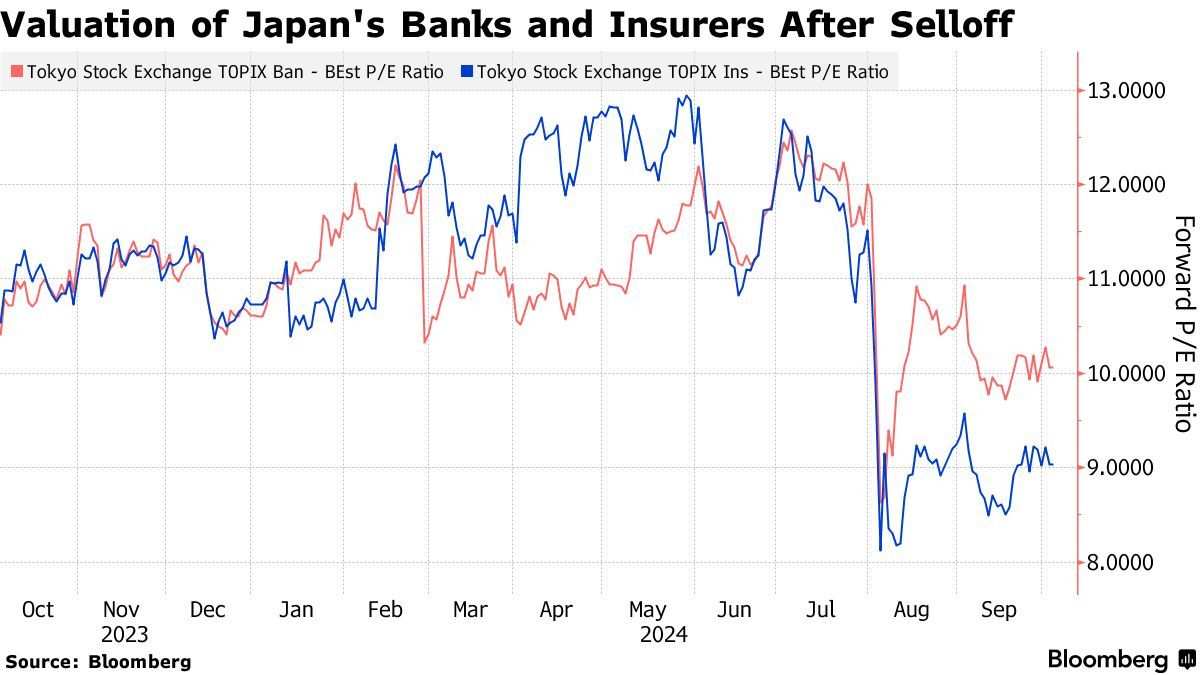

Data shows that the valuations of Japanese banks and insurance companies dropped slightly after a massive sell-off in the Japanese stock market in early August. The expected P/E ratios of the Tokyo Stock Exchange Insurance Index and the Bank Index are 9 times and 10.1 times respectively, lower than the expected P/E ratios in early July when these two indices hit historical highs (12.1 times and 12.4 times respectively).

Some analysts point out that if Buffett's investment choices in the Japanese stock market expand to industries beyond the five major trading companies, this will become a support factor for the volatile Japanese stock market in recent months due to political uncertainties and exchange rate fluctuations.

Nomura Securities' senior strategist Takashi Ito also believes that Buffett is likely to buy Japanese financial stocks. He said: "The fundamentals of the Japanese financial industry are strong, which meets Buffett's standards." He added that the Bank of Japan's monetary policy shift will improve the profitability of the financial industry.

Including analysts such as Tomochika Kitaoka, Nomura's stock screening found that financial companies like Mitsubishi UFJ Financial Group, Sumitomo Mitsui Trust Holdings, and Sompo Holdings Inc. all exhibit characteristics that align with Berkshire Hathaway's investment portfolio.

However, some observers believe that given Berkshire Hathaway's recent frequent sale of Bank of America stocks, Buffett's focus will still be on trading companies. Mineo Bito, President and CEO of Bito Financial Service Co., which often attends Berkshire Hathaway's shareholders' meeting, said: "I don't think Buffett will buy Japanese bank stocks while selling Bank of America stocks."

伯克希尔哈撒韦的筹资计划受到股市投资者的密切关注,因为今年早些时候该公司购买日本五大商社股份的举措曾助推日经225指数创下历史新高。而在今年2月,伯克希尔哈撒韦在年度股东信中提到,该公司通过发行日元债券的做法为投资日本公司提供了大部分的资金。

伯克希尔哈撒韦的筹资计划受到股市投资者的密切关注,因为今年早些时候该公司购买日本五大商社股份的举措曾助推日经225指数创下历史新高。而在今年2月,伯克希尔哈撒韦在年度股东信中提到,该公司通过发行日元债券的做法为投资日本公司提供了大部分的资金。