A key dove official of the Bank of Japan's Policy Board emphasized the need to maintain an accommodative monetary environment until inflation expectations are firmly anchored, reinforcing the Bank of Japan's stance of not raising interest rates prematurely.

According to the Wisdom Finance app, a key dovish official from the Bank of Japan's Policy Board emphasized the need to maintain an accommodative monetary environment until inflation expectations are firmly anchored, reinforcing the Bank of Japan's stance of not raising interest rates prematurely. Just the day before, the new Japanese government also urged caution on raising rates.

Asahi Noguchi, a member of the board of directors of the Bank of Japan, stated on Thursday in Nagasaki, southwestern Japan: "It still takes time to build a public sentiment consistent with the 2% inflation target. It is more important to patiently maintain an accommodative monetary environment than anything else before that."

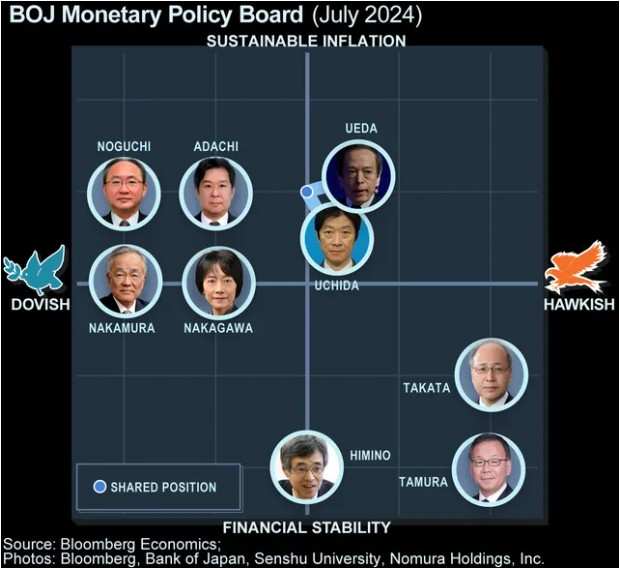

It is understood that Noguchi was one of the two dissenters in the interest rate decision on July 31. Before he spoke, the new Japanese Prime Minister Shizo Kawamoto said on Wednesday that he did not see the need to raise rates at the moment. Noguchi's remarks confirmed the market's view that despite the authorities' attempt to normalize policies by tightening ultra-loose policies, there are still some dovish views within the nine-member committee.

It is understood that Noguchi was one of the two dissenters in the interest rate decision on July 31. Before he spoke, the new Japanese Prime Minister Shizo Kawamoto said on Wednesday that he did not see the need to raise rates at the moment. Noguchi's remarks confirmed the market's view that despite the authorities' attempt to normalize policies by tightening ultra-loose policies, there are still some dovish views within the nine-member committee.

When voting against the rate hike in July, Noguchi expressed the hope of having more time to study the data in order to make cautious decisions.

Noguchi's tone in Thursday's speech was more or less in line with the views expressed by Bank of Japan Governor Haruo Ueda, who previously stated that he was not in a rush to raise the benchmark interest rate. Economists generally predict that the Bank of Japan will keep rates unchanged at the next policy meeting on October 31, with many believing that the next action will not take place until January of next year.

On Thursday, the Japanese stock market rose, with the yen continuing to weaken. The day before, Fumio Kishida expressed in discussions with Taro Aso that the current environment is not suitable for another interest rate hike, leading to the largest drop in the yen since June 2022.

In his speech, Noguchi also emphasized the positive changes in service prices, wages, and consumer spending, indicating that future interest rate hikes are not completely impossible.

After the speech, Noguchi refused to comment on Fumio Kishida's remarks during an interview with reporters. He stated that he takes politicians' comments seriously because they represent the public, but the goal of monetary policy is to achieve price targets.

Noguchi mentioned that even after two interest rate hikes this year, Japan's financial conditions remain loose. He acknowledged the possibility of further adjustments to the degree of looseness, but emphasized the need to be very cautious as it is impossible to know the most appropriate level of benchmark interest rates in advance.

"We must crawl forward as if crawling with elbows, knees, and belly," Noguchi stated.

据了解,Noguchi是7月31日加息决定的两名反对者之一,在他发表讲话之前,日本新任首相石破茂周三表示,他认为目前没有必要加息。Noguchi的言论证实了市场的观点,即尽管当局试图通过收紧超宽松政策来使政策正常化,但在九人委员会中仍有一些鸽派观点。

据了解,Noguchi是7月31日加息决定的两名反对者之一,在他发表讲话之前,日本新任首相石破茂周三表示,他认为目前没有必要加息。Noguchi的言论证实了市场的观点,即尽管当局试图通过收紧超宽松政策来使政策正常化,但在九人委员会中仍有一些鸽派观点。