The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Intuitive Surgical (NASDAQ:ISRG). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Intuitive Surgical's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. We can see that in the last three years Intuitive Surgical grew its EPS by 8.7% per year. That growth rate is fairly good, assuming the company can keep it up.

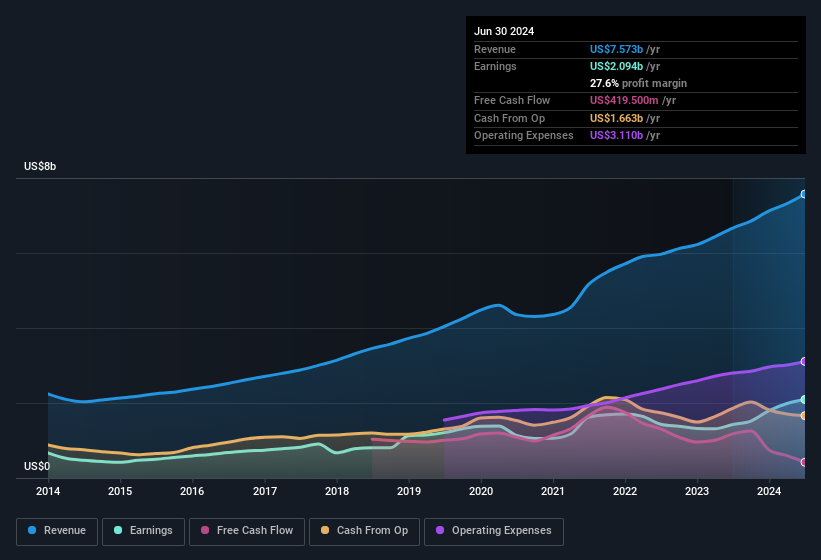

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Intuitive Surgical achieved similar EBIT margins to last year, revenue grew by a solid 14% to US$7.6b. That's a real positive.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Intuitive Surgical achieved similar EBIT margins to last year, revenue grew by a solid 14% to US$7.6b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Intuitive Surgical.

Are Intuitive Surgical Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$172b company like Intuitive Surgical. But we do take comfort from the fact that they are investors in the company. We note that their impressive stake in the company is worth US$849m. While that is a lot of skin in the game, we note this holding only totals to 0.5% of the business, which is a result of the company being so large. This should still be a great incentive for management to maximise shareholder value.

Does Intuitive Surgical Deserve A Spot On Your Watchlist?

One positive for Intuitive Surgical is that it is growing EPS. That's nice to see. If that's not enough on its own, there is also the rather notable levels of insider ownership. The combination definitely favoured by investors so consider keeping the company on a watchlist. Still, you should learn about the 1 warning sign we've spotted with Intuitive Surgical.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.