ZKH Group Limited (NYSE:ZKH) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

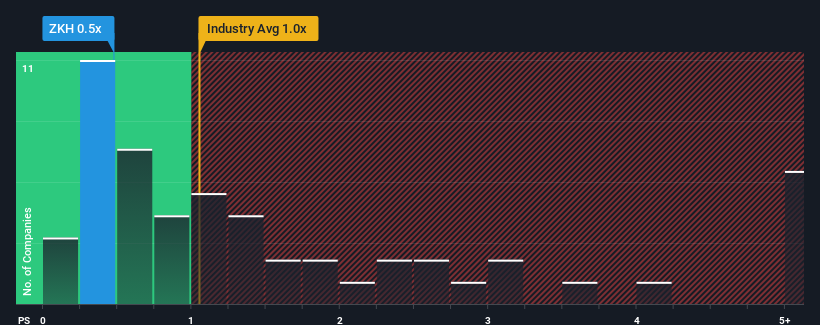

Even after such a large jump in price, considering around half the companies operating in the United States' Trade Distributors industry have price-to-sales ratios (or "P/S") above 1x, you may still consider ZKH Group as an solid investment opportunity with its 0.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

How Has ZKH Group Performed Recently?

With revenue growth that's inferior to most other companies of late, ZKH Group has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on ZKH Group will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

ZKH Group's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

ZKH Group's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Regardless, revenue has managed to lift by a handy 26% in aggregate from three years ago, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 10% over the next year. With the industry only predicted to deliver 4.6%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that ZKH Group's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does ZKH Group's P/S Mean For Investors?

Despite ZKH Group's share price climbing recently, its P/S still lags most other companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look at ZKH Group's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for ZKH Group with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.