Sinarmas Land Limited (SGX:A26) shares have continued their recent momentum with a 43% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 78% in the last year.

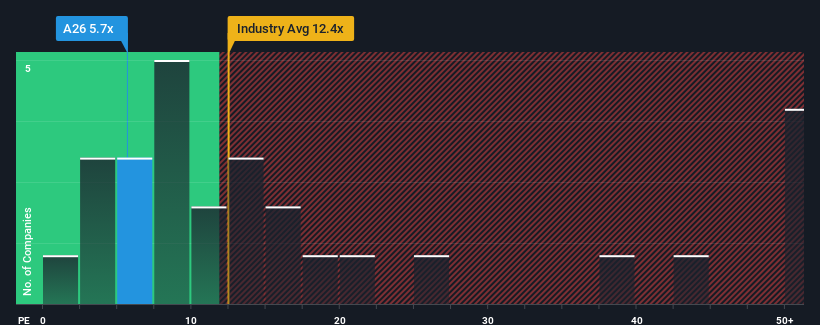

Even after such a large jump in price, given about half the companies in Singapore have price-to-earnings ratios (or "P/E's") above 12x, you may still consider Sinarmas Land as a highly attractive investment with its 5.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

For instance, Sinarmas Land's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Does Growth Match The Low P/E?

Sinarmas Land's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Sinarmas Land's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 23%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 34% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 7.7% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that Sinarmas Land is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Sinarmas Land's P/E?

Sinarmas Land's recent share price jump still sees its P/E sitting firmly flat on the ground. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Sinarmas Land currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

Plus, you should also learn about these 2 warning signs we've spotted with Sinarmas Land (including 1 which is potentially serious).

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.