On Thursday, a new exchange-traded fund (ETF) aimed at capturing the performance of large Chinese enterprises was officially launched.

According to the Securities Times app, on Thursday, a new exchange-traded fund (ETF) aimed at capturing the performance of large Chinese enterprises was officially launched.

This fund, named the Roundhill China Dragons ETF (DRAG.US), tracks an equally weighted basket of stocks composed of 5 to 10 of China's largest and most innovative technology companies, with constituents currently including Tencent (TCEHY.US), Pinduoduo (PDD.US), Alibaba (BABA.US), Meituan (MPNGY.US), BYD Company Limited (BYDDY.US), Xiaomi (XIACY.US), jd.com (JD.US), Baidu (BIDU.US), and Netease (NTES.US). At the close, the ETF closed up 0.6% at $25.14.

According to Roundhill Investments, nine behemoth technology companies exhibited relative scale economics, solid fundamentals, and impressive growth advantages compared to peers at launch. The ETF will be rebalanced quarterly.

According to Roundhill Investments, nine behemoth technology companies exhibited relative scale economics, solid fundamentals, and impressive growth advantages compared to peers at launch. The ETF will be rebalanced quarterly.

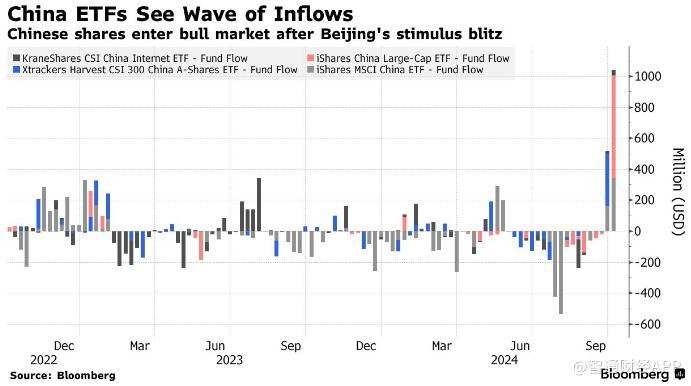

Dave Mazza, CEO of Roundhill, stated that compared to other ETFs providing exposure to the Chinese market, such as KraneShares CSI China Internet ETF (KWEB.US) with $7.9 billion in assets and iShares China Large-Cap ETF (FXI.US) with $6.4 billion, DRAG stands out for its higher concentration.

This week, a total of 4 largest China-related ETFs attracted $2.5 billion in inflows, with KraneShares's KWEB seeing the largest single-day inflow in history on Tuesday. Earlier, Peking introduced a series of stimulus measures to boost the economy, leading to China's stock market posting its best single-day performance since 2008. Fund managers and hedge funds, after years of underweighting, are flooding into the Chinese stock market at a record pace.

"We are seeing funds slowly flowing back into emerging markets," said Mohit Bajaj, ETF director at WallachBeth Capital. "If the market believes that China will continue its current performance, this ETF may perform well."

Among the nearly 20 ETFs under Roundhill, the best performing product is its $0.78 billion Roundhill Magnificent Seven ETF (MAGS.US), which tracks the stocks of the seven major US tech giants. Mazza believes that this ETF is the American version of DRAG. Since its launch in April 2023, MAGS has already risen by 40% this year.

根据Roundhill Investments,九家市值巨大的科技公司在推出时集体展现出相对于同行的规模经济、坚实的基本面和令人印象深刻的增长优势。该ETF将按季度进行再平衡。

根据Roundhill Investments,九家市值巨大的科技公司在推出时集体展现出相对于同行的规模经济、坚实的基本面和令人印象深刻的增长优势。该ETF将按季度进行再平衡。