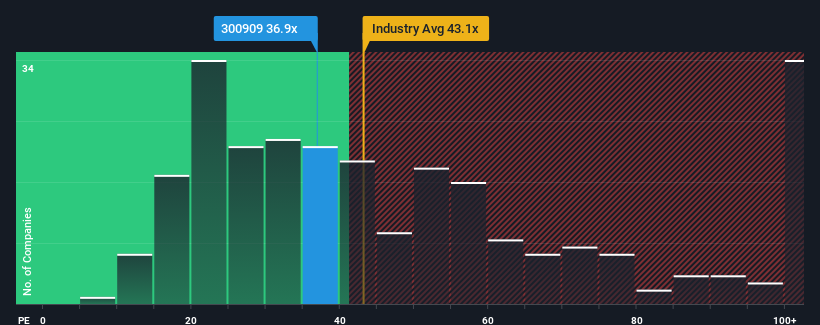

Shenzhen Hui Chuang Da Technology Co., Ltd.'s (SZSE:300909) price-to-earnings (or "P/E") ratio of 36.9x might make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 33x and even P/E's below 20x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Shenzhen Hui Chuang Da Technology has been doing a good job lately as it's been growing earnings at a solid pace. It might be that many expect the respectable earnings performance to beat most other companies over the coming period, which has increased investors' willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

Does Growth Match The High P/E?

In order to justify its P/E ratio, Shenzhen Hui Chuang Da Technology would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 16% last year. Still, incredibly EPS has fallen 28% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Taking a look back first, we see that the company grew earnings per share by an impressive 16% last year. Still, incredibly EPS has fallen 28% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 36% shows it's an unpleasant look.

With this information, we find it concerning that Shenzhen Hui Chuang Da Technology is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Bottom Line On Shenzhen Hui Chuang Da Technology's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Shenzhen Hui Chuang Da Technology revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Shenzhen Hui Chuang Da Technology that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.