Huang Renxun stated in an interview with CNBC that the upcoming Blackwell AI 'super chip' has a 'crazy' demand. At the same time, nvidia invested 0.1 billion US dollars in the financing of OpenAI, the market sees this cooperation as a symbolic step, and it may enable nvidia to have a deeper understanding of OpenAI's chip procurement plan.

Blackwell's demand is "crazy", and the possible further collaboration with OpenAI may lead to a significant increase in stock price. $NVIDIA (NVDA.US)$ The stock price soared.

On Wednesday, October 2nd, Huang Renxun stated during an interview with CNBC that the upcoming Blackwell AI's "super chip" demand is "crazy," with everyone wanting to have the most and be the first. According to official information, products based on Blackwell will be shipped to the cloud service departments of Oracle, Amazon, Microsoft, and Google later this year.

NVIDIA's Blackwell chip will further solidify its leading position in the artificial intelligence market, while continuing to provide products and services to tech giants like Microsoft, Meta, Alphabet, and Amazon.

NVIDIA's Blackwell chip will further solidify its leading position in the artificial intelligence market, while continuing to provide products and services to tech giants like Microsoft, Meta, Alphabet, and Amazon.

On Wednesday, OpenAI announced raising new funding of $6.6 billion, bringing its total valuation to $157 billion. The Wall Street Journal reported that NVIDIA invested $0.1 billion in this round of fundraising. Despite being relatively small compared to NVIDIA's astonishing $2.9 trillion market cap, the $0.1 billion investment is seen by the market as a symbolic move that further solidifies NVIDIA's position in the field of artificial intelligence. After all, the launch of ChatGPT at the end of 2022 triggered an AI investment frenzy, helping NVIDIA join the ranks of the "seven tech giants."

At the same time, this investment may also enable NVIDIA to gain a deeper understanding of OpenAI's chip procurement plans. NVIDIA's GPUs are the optimal way to power large language models such as ChatGPT, but some competitors are working hard to narrow this gap.

Yesterday, NVIDIA's stock price briefly reached $124.26, closing with a 3.32% increase at $122.8. According to Forbes' estimation, Huang Renxun's net worth increased by $3 billion yesterday to reach $107 billion, making him the twelfth richest person globally.

Some competitors' stocks also rose yesterday. AMD rose 1.9%, Broadcom rose 0.7%, Qualcomm rose 0.4%.

However, Nvidia and the semiconductor sector failed to boost the Nasdaq, dominated by technology stocks, yesterday. The Nasdaq index closed down 0.17%, while the S&P 500 index fell by 0.2%.

However, many large investors are not excessively bullish on Nvidia. Most actively managed fund managers tracked by Bank of America hold positions in Nvidia, but their relative weight in the fund is not considered aggressive.

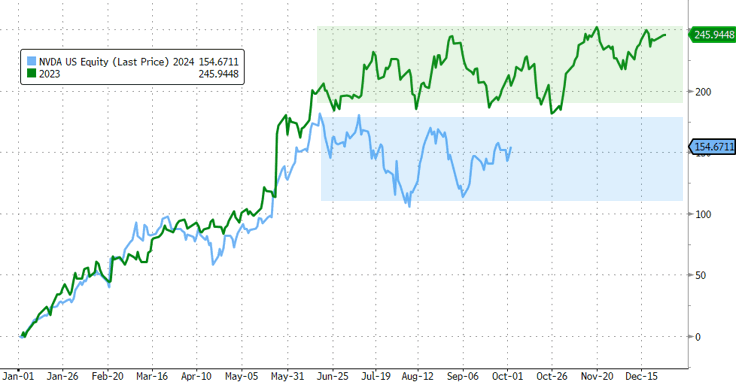

BofA analysts point out that Nvidia's relative weight is 0.99 times, much lower than the top 16 holdings in the information technology and communications services industry. The well-known financial blog Zerohedge also questions in an article whether Nvidia's stock price can break through the record of 2023 in the second half of 2024.

Editor/Somer

英伟达的Blackwell芯片将进一步巩固其在人工智能市场的领导地位,同时继续为微软、Meta、Alphabet和亚马逊等科技巨头提供产品和服务。

英伟达的Blackwell芯片将进一步巩固其在人工智能市场的领导地位,同时继续为微软、Meta、Alphabet和亚马逊等科技巨头提供产品和服务。