The Bank of America strategy team stated that the non-farm data supporting a 'soft landing' for the US economy will keep US Treasury yields fluctuating within a certain range, but 'gushing' data and the surge in US Treasury yields catalyzed by this data will drive market risk asset aversion.

It was reported by the Securities Times app that Michael Hartnett, the Bank of America strategist known as the 'most accurate strategist on Wall Street', stated that if the latest US monthly non-farm employment report released on Friday falls within the bank's expected range, prices of global risk assets including US stocks may significantly rise. The Bank of America strategy team, led by this Wall Street star strategist, indicated that if the September non-farm employment data show an increase of 0.125 million to 0.175 million jobs in the US last month, it will support the market's optimistic expectation of a 'soft landing' for the US economy and keep US Treasury yields within a certain range, thereby heating up risk asset trading.

The latest market survey data shows that economists' median forecast for September non-farm data indicates that US non-farm employment is expected to increase by approximately 0.15 million.

It is understood that this strategist-led Bank of America team had a negative and pessimistic view on the US stock market last year, despite the fact that the benchmark index S&P 500 entered a new bull market last year and rose significantly over 24%. For 2024, he indicated a preference for bond assets over risk assets such as stocks.

It is understood that this strategist-led Bank of America team had a negative and pessimistic view on the US stock market last year, despite the fact that the benchmark index S&P 500 entered a new bull market last year and rose significantly over 24%. For 2024, he indicated a preference for bond assets over risk assets such as stocks.

In a market research report dated October 3rd, the strategy team led by Hartnett stated that the long positions have 'the upper hand', and the 'convincing description' will be signs that China's fiscal and financial stimulus plan is 'working', and signals that the Federal Reserve has clearly indicated future plans to implement more monetary easing policy.

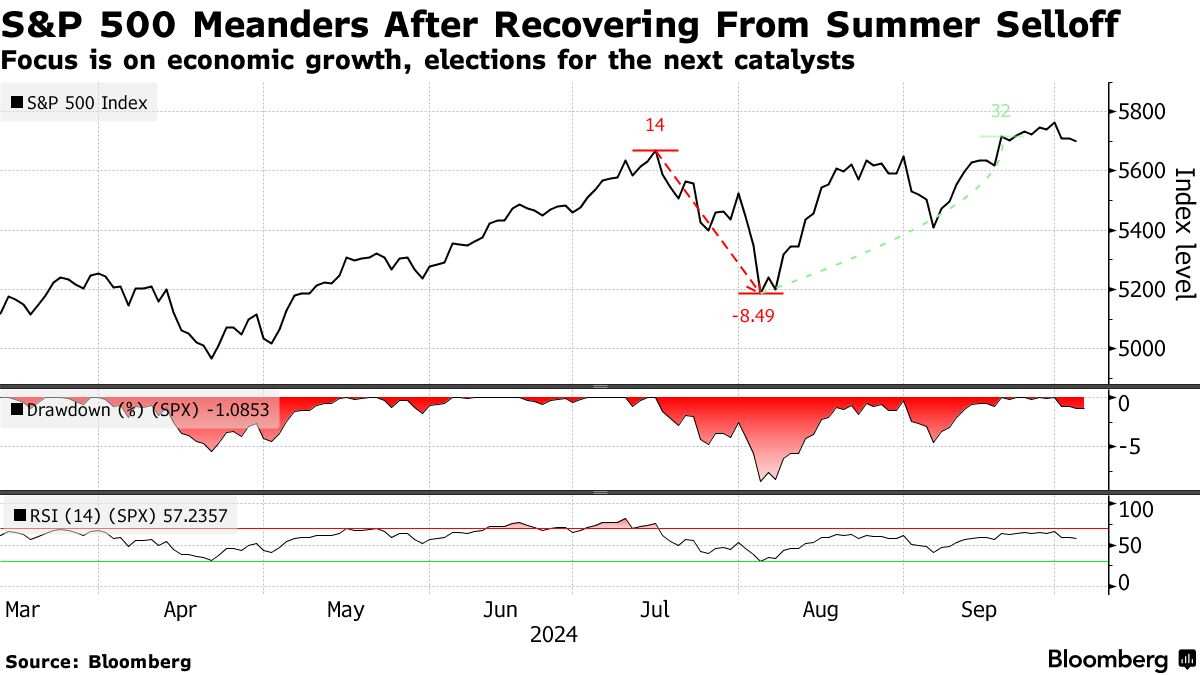

After a continuous rise lasting five months and reaching new highs, the US stock market showed a downward trend in the first few trading days of October. Investors are assessing geopolitical risks in the Middle East, global economic growth, and expectations of interest rate cuts by the Federal Reserve. According to compiled statistics from institutions, US stock options traders generally expect the S&P 500 index to fluctuate by approximately 1% after the release of the non-farm employment report on Friday.

A 'sudden' strong non-farm payroll report led by Hartnett's strategy team is defined by non-farm payrolls exceeding 0.225 million people, with an unemployment rate below 4.1%. Such 'sudden' data is not what risk asset investors such as stocks would like to see, as it is highly likely to drive the 30-year treasury yield above 4.5% and steer the market towards risk asset aversion. A core catalyst for a significant increase in 'recession expectations' would be an unemployment rate exceeding 4.3% and job positions below 0.075 million, something that risk asset investors would also not like to see.

Therefore, according to Hartnett's strategy team, an increase in non-farm data by 0.125-0.175 million job positions in the United States, a neutral employment data, may support the market's optimistic expectation of a 'soft landing' for the US economy.

In the US stock market, the spreading 'bull market' rally across various sectors continues. The benchmark S&P 500 index has recently hit numerous historical highs, mainly due to the Fed's larger-than-expected 50 basis points rate cut bringing substantial liquidity, and the expectation of a 'soft landing' for the US economy driven by significant rate cuts and a resilient labor market.

Overall, global stock market investors prefer a 'neither good nor bad' non-farm data worldwide. This data could significantly boost confidence in a 'soft landing' for the US economy, while also stimulating expectations for a 50% probability of a 50 basis points rate cut. Although a severely below-expectation non-farm data could significantly boost expectations of a 50 basis points Fed rate cut, it will also fuel a significant increase in market expectations of a US economic recession, potentially causing global stock markets to slump at least in the short term.

As of the week ending on October 2, Bank of America's compiled 'Custom Bull & Bear Indicator' jumped from 5.4 to 6.0, marking the largest single-week increase since December last year. A reading above 8 is considered by Bank of America's strategists as a key reference indicator for 'contrarian selling'.

Another Wall Street giant, JPMorgan, stated that a strong employment report - adding over 0.2 million non-farm job positions - will indicate a 'reboot' of the 'US economy from this summer's weakness', leading some investors to believe that the Fed may refuse further rate cuts at the November meeting (i.e., no cut in November, choosing to cut in December). In this scenario, JPMorgan expects the S&P 500 index to remain flat to rise by 0.5%.

With the US adding non-farm employment figures ranging from 0.16 million to 0.2 million, JPMorgan predicts the S&P 500 index may rise by 1%-1.5%. JPMorgan's strategists view non-farm figures within this ideal range as a 'golden girl scenario', as it would indicate higher growth for the US economy without a resurgence of inflation. In this scenario, the market is most likely to expect the Fed to cut rates by 25 basis points at the next November meeting.

Non-farm job additions in September ranged from 0.11 million to 0.14 million, with JPMorgan expecting the S&P 500 index to decline by 0.5%-1.5%. JPMorgan's strategists state that if non-farm employment data falls within this range, it could reignite concerns about US economic growth and generate a market narrative that the Fed is lagging behind the economic situation and reacting too slowly to the potential economic downturn. In this scenario, JPMorgan expects defensive assets to perform well, and US bond yields to decrease.

据了解,这位策略师领导的美银团队在去年对于美国股市持负面的悲观态度,尽管美股基准指数——标普500指数在去年步入新一轮牛市,且大幅上涨超24%。对于2024年,他则表示相比于股票等风险资产而言更青睐债券资产。

据了解,这位策略师领导的美银团队在去年对于美国股市持负面的悲观态度,尽管美股基准指数——标普500指数在去年步入新一轮牛市,且大幅上涨超24%。对于2024年,他则表示相比于股票等风险资产而言更青睐债券资产。