Uber Stock Stalls At A Crossroad: Short-Term Dips, Long-Term Hopes

Uber Stock Stalls At A Crossroad: Short-Term Dips, Long-Term Hopes

Uber Technologies Inc. (NYSE:UBER) stock has been on quite a ride, climbing 24.94% year-to-date and 62.31% over the past year. But while the company's robot-filled future is making headlines, the technicals tell a different story.

Uber Technologies Inc.(紐交所:UBER)股票一路狂飆,年初至今上漲24.94%,過去一年上漲62.31%。但儘管該公司充滿機器人的未來成爲頭條新聞,技術指標卻講述着一個不同的故事。

Uber may be automating deliveries, but its stock movement is hitting some resistance.

Uber可能正在自動化交付,但其股票走勢遇到了一些阻力。

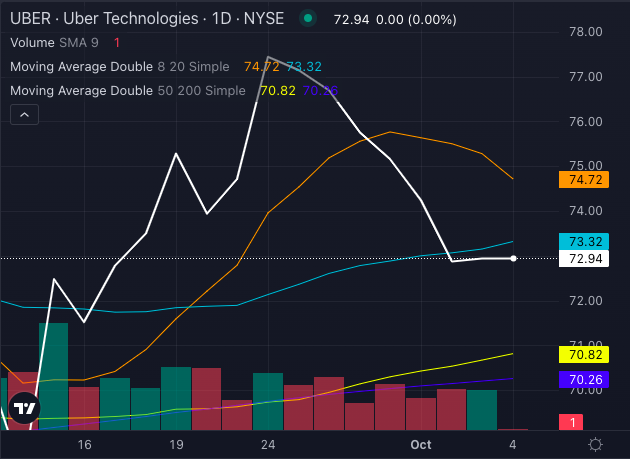

UBER Stock Chart: Short-Term Bears, Long-Term Bulls

UBER股票圖表:短期看淡,長期看好

Chart created using Benzinga Pro

使用Benzinga Pro創建的圖表

Currently, Uber stock's price is $72.94, just below its eight-day and 20-day simple moving averages (SMA) of $74.72 and $73.32, respectively, signaling short-term bearishness.

目前,Uber股價爲72.94美元,略低於其8日和20日簡單移動平均線分別爲74.72美元和73.32美元,顯示出短期看淡信號。

But don't hit the brakes just yet. The stock is above its 50-day SMA of $70.82 and 200-day SMA of $70.26, showing that long-term trends are still bullish, despite the recent pullback.

但是不要急於剎車。該股票高於其50日簡單移動平均線70.82美元和200日簡單移動平均線70.26美元,顯示出儘管最近回調,長期趨勢仍然看好。

Chart created using Benzinga Pro

使用Benzinga Pro創建的圖表

Bullish Indicators Flashing Amid The Dip

看好因子在市場低迷中閃現

The MACD (Moving Average Convergence Divergence) indicator is flashing a 0.93 reading, which suggests potential bullish momentum might be brewing. Similarly, Uber's RSI (Relative Strength Index) sits at 49.25 and is heading lower towards oversold territory.

MACD(移動平均收斂差異)指標顯示0.93,這表明潛在的看好動能可能在醞釀。同樣,優步的RSI(相對強弱指數)爲49.25,正在向超賣區域走低。

This could mean Uber stock might be poised for a rebound after this recent dip.

這可能意味着優步股票在最近的下跌後可能會迎來反彈。

As for Bollinger Bands? They're hovering between $67.97 and $77.88, and with the stock currently in this range, things could get bumpy before a potential breakout.

至於布林帶呢?它們在67.97美元和77.88美元之間盤旋,而目前股價處於這個區間,事情在潛在的突破之前可能會變得顛簸。

Partnerships Fuel Uber's Future — But Can They Power UBER Stock?

合作伙伴關係推動着優步的未來 — 但它們能推動優步股價嗎?

So, what's weighing on Uber stock despite some promising technicals? It could be the balance between short-term bearish signals and long-term bullish potential.

那麼,儘管一些有前景的技術面,但爲什麼優步股票仍然受到壓力呢?這可能是短期看淡信號和長期看好潛力之間的平衡。

While Uber's partnerships, including a multiyear deal with Avride to deploy delivery robots and autonomous vehicles, have wowed the market, these innovations haven't fully taken control of the stock price yet. This partnership will roll out in Austin, Dallas, and Jersey City, eventually bringing robotaxis into the mix.

雖然優步的合作伙伴關係,包括與Avride簽訂的多年交易部署交付機器人和自動車輛,讓市場感到驚訝,但這些創新尚未完全控制股價。該合作將在奧斯汀、達拉斯和澤西城推出,最終將機器人出租車融入其中。

Read More: Uber & Avride Join Forces for Autonomous Delivery; Partners With ENSO For Low-Emission EV Tires

閱讀更多:Uber與Avride聯手進行自動送貨;並與ENSO合作推出低排放電動車輪胎

At the same time, Uber's recent three-year strategic partnership with tire company ENSO to introduce low-emission EV tires could help Uber align with the sustainability movement.

與此同時,Uber最近與輪胎公司ENSO達成了爲期三年的戰略合作伙伴關係,推出低排放電動車輪胎,有助於Uber與可持續發展運動保持一致。

However, while these initiatives are future-forward, investors seem focused on the now, where technical indicators remain mixed.

然而,儘管這些舉措具有未來導向性,投資者似乎更關注現在,技術指標仍然表現不一。

Uber's stock may be down from its highs, but it's not out. Short-term signals flash bearish, yet long-term indicators still show bullish promise.

Uber的股價可能從高點回落,但並未淘汰。短期信號顯示看淡,但長期因子仍顯示看好前景。

With innovation and strong technical support on the horizon, Uber stock has the potential for upward momentum. But, monitoring key indicators like moving averages for signs of continued growth is crucial.

隨着創新和強勁的技術支持即將到來,Uber股票有朝上動能。但是,監控諸如移動平均線之類的關鍵因子,以觀察持續增長跡象至關重要。

- EVgo Vs. ChargePoint: Analyst Verdict On Which Stock Leads The EV Charging Race?

- EVgo對決ChargePoint:分析師對哪家股票領先充電樁之爭的判斷?

Photo: Shutterstock

Photo: shutterstock

Currently, Uber stock's price is $72.94, just below its eight-day and 20-day simple moving averages (SMA) of $74.72 and $73.32, respectively, signaling short-term bearishness.

Currently, Uber stock's price is $72.94, just below its eight-day and 20-day simple moving averages (SMA) of $74.72 and $73.32, respectively, signaling short-term bearishness.