Whales with a lot of money to spend have taken a noticeably bearish stance on Morgan Stanley.

Looking at options history for Morgan Stanley (NYSE:MS) we detected 20 trades.

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 65% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $272,134 and 16, calls, for a total amount of $1,768,416.

From the overall spotted trades, 4 are puts, for a total amount of $272,134 and 16, calls, for a total amount of $1,768,416.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $95.0 to $115.0 for Morgan Stanley over the recent three months.

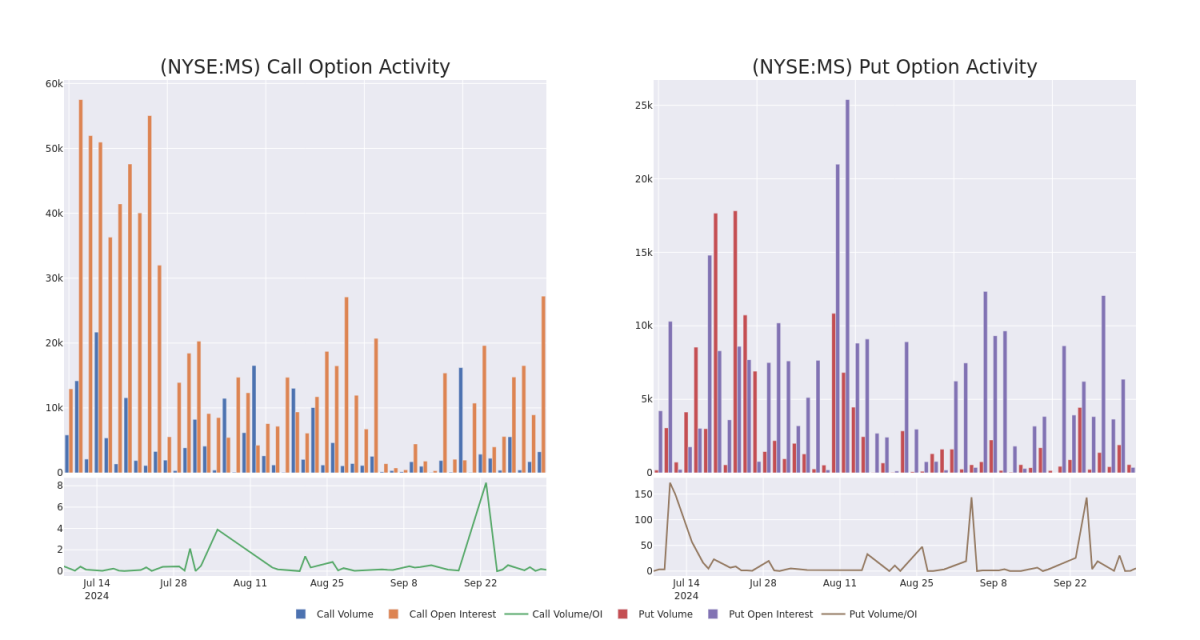

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Morgan Stanley options trades today is 1971.21 with a total volume of 3,792.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Morgan Stanley's big money trades within a strike price range of $95.0 to $115.0 over the last 30 days.

Morgan Stanley Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MS | CALL | TRADE | BULLISH | 11/15/24 | $9.05 | $8.9 | $9.0 | $100.00 | $630.0K | 1.7K | 739 |

| MS | CALL | SWEEP | BEARISH | 10/04/24 | $6.0 | $5.75 | $5.7 | $102.00 | $199.5K | 1.0K | 358 |

| MS | CALL | TRADE | NEUTRAL | 11/15/24 | $5.25 | $5.15 | $5.2 | $105.00 | $140.9K | 7.1K | 367 |

| MS | CALL | SWEEP | BEARISH | 10/04/24 | $13.3 | $12.45 | $12.59 | $95.00 | $126.1K | 306 | 61 |

| MS | PUT | SWEEP | BEARISH | 02/21/25 | $5.45 | $5.4 | $5.4 | $105.00 | $104.2K | 102 | 45 |

About Morgan Stanley

Morgan Stanley is a global investment bank whose history, through its legacy firms, can be traced back to 1924. The company has institutional securities, wealth management, and investment management segments with approximately 45% of net revenue from its institutional securities business, 45% from wealth management, and 10% from investment management. About 30% of its total revenue is from outside the Americas. The company had over $5 trillion of client assets as well as around 80,000 employees at the end of 2023.

Following our analysis of the options activities associated with Morgan Stanley, we pivot to a closer look at the company's own performance.

Morgan Stanley's Current Market Status

- Currently trading with a volume of 2,391,337, the MS's price is up by 2.55%, now at $107.24.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 12 days.

Professional Analyst Ratings for Morgan Stanley

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $109.66666666666667.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from HSBC has elevated its stance to Buy, setting a new price target at $118. * An analyst from Goldman Sachs has decided to maintain their Neutral rating on Morgan Stanley, which currently sits at a price target of $106. * In a cautious move, an analyst from Goldman Sachs downgraded its rating to Neutral, setting a price target of $105.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Morgan Stanley options trades with real-time alerts from Benzinga Pro.