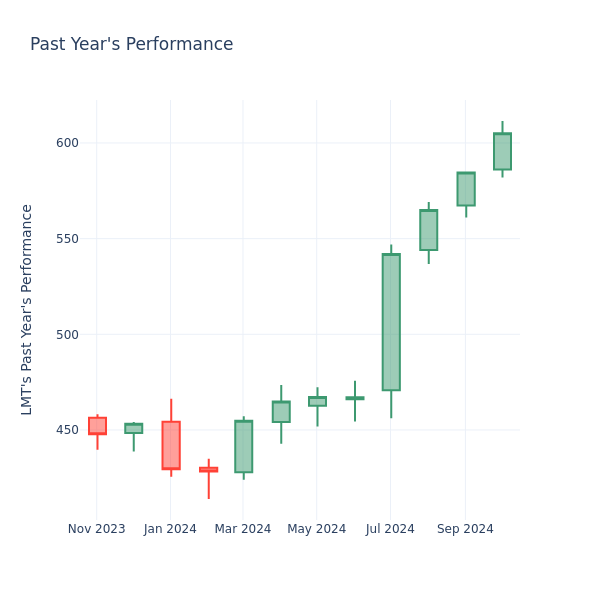

In the current market session, Lockheed Martin Inc. (NYSE:LMT) stock price is at $605.14, after a 0.11% decrease. However, over the past month, the company's stock increased by 6.80%, and in the past year, by 38.63%. Shareholders might be interested in knowing whether the stock is overvalued, even if the company is not performing up to par in the current session.

How Does Lockheed Martin P/E Compare to Other Companies?

The P/E ratio is used by long-term shareholders to assess the company's market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Compared to the aggregate P/E ratio of the 85.93 in the Aerospace & Defense industry, Lockheed Martin Inc. has a lower P/E ratio of 21.99. Shareholders might be inclined to think that the stock might perform worse than it's industry peers. It's also possible that the stock is undervalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company's market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company's stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company's market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company's stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.

現在の市場セッションでは、Lockheed Martin Inc.(NYSE:LMT)の株価は605.14ドルで、0.11%下落しています。ただし、過去1ヶ月で、同社の株価は6.80%上昇し、過去1年間で38.63%上昇しました。株主は、現在のセッションで同社が十分にパフォーマンスを発揮できていなくても、株価が過大評価されているかどうかに興味があるかもしれません。

ロッキードマーチンのP/Eは他の企業と比べてどうですか?

P/E比率は、長期の株主が会社の市場パフォーマンスを、市場全体のデータ、歴史的な利益、業界全体と比較して評価するために使用されます。低いP/E比率は、株主が将来的に株式のパフォーマンスが向上しないと予想していることを示唆するか、あるいは会社が過小評価されていることを意味する可能性があります。

航空宇宙・ディフェンス業界の85.93の集計P/E比に比べると、Lockheed Martin Inc.のP/E比率は21.99と低いです。株主は、株価が業種の競合他社よりも悪い結果を出す可能性があると考えるかもしれません。株価が過小評価されている可能性もあります。

結論として、株価収益率は企業の市場パフォーマンスを分析するための有用な指標ですが、限界もあります。低いP/Eは企業が過小評価されていることを示す可能性がありますが、将来の成長を期待していない株主も示す可能性があります。また、P/E比率は業種のトレンドや業績サイクルなど、他の要因と組み合わせて使用すべきです。したがって、投資家は他の財務指標や質的分析と組み合わせて情報を得て、慎重な投資判断を行うべきです。

結論として、株価収益率は企業の市場パフォーマンスを分析するための有用な指標ですが、限界もあります。低いP/Eは企業が過小評価されていることを示す可能性がありますが、将来の成長を期待していない株主も示す可能性があります。また、P/E比率は業種のトレンドや業績サイクルなど、他の要因と組み合わせて使用すべきです。したがって、投資家は他の財務指標や質的分析と組み合わせて情報を得て、慎重な投資判断を行うべきです。

結論として、株価収益率は企業の市場パフォーマンスを分析するための有用な指標ですが、限界もあります。低いP/Eは企業が過小評価されていることを示す可能性がありますが、将来の成長を期待していない株主も示す可能性があります。また、P/E比率は業種のトレンドや業績サイクルなど、他の要因と組み合わせて使用すべきです。したがって、投資家は他の財務指標や質的分析と組み合わせて情報を得て、慎重な投資判断を行うべきです。

結論として、株価収益率は企業の市場パフォーマンスを分析するための有用な指標ですが、限界もあります。低いP/Eは企業が過小評価されていることを示す可能性がありますが、将来の成長を期待していない株主も示す可能性があります。また、P/E比率は業種のトレンドや業績サイクルなど、他の要因と組み合わせて使用すべきです。したがって、投資家は他の財務指標や質的分析と組み合わせて情報を得て、慎重な投資判断を行うべきです。

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company's market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company's market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry