Deep-pocketed investors have adopted a bearish approach towards Texas Instruments (NASDAQ:TXN), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in TXN usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 9 extraordinary options activities for Texas Instruments. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 44% leaning bullish and 55% bearish. Among these notable options, 5 are puts, totaling $337,703, and 4 are calls, amounting to $406,592.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $200.0 to $215.0 for Texas Instruments over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $200.0 to $215.0 for Texas Instruments over the last 3 months.

Analyzing Volume & Open Interest

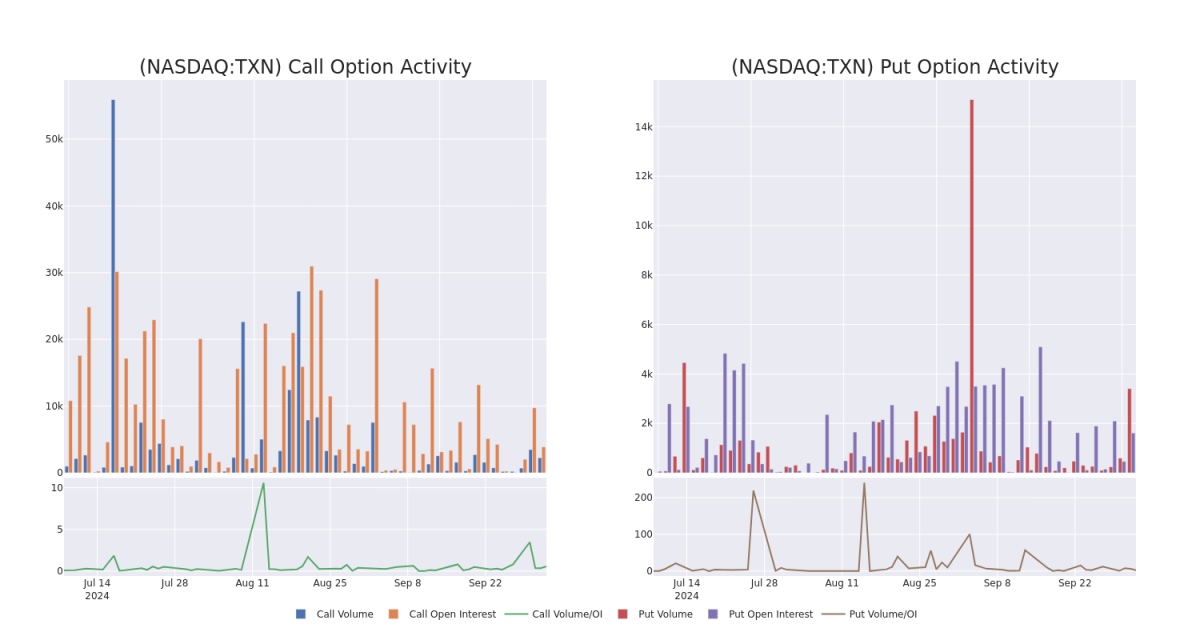

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Texas Instruments's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Texas Instruments's substantial trades, within a strike price spectrum from $200.0 to $215.0 over the preceding 30 days.

Texas Instruments Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TXN | CALL | SWEEP | BULLISH | 10/11/24 | $2.65 | $2.64 | $2.65 | $205.00 | $198.8K | 1.3K | 614 |

| TXN | PUT | SWEEP | BEARISH | 03/21/25 | $18.95 | $18.6 | $18.95 | $210.00 | $117.4K | 184 | 123 |

| TXN | CALL | SWEEP | BULLISH | 11/15/24 | $11.7 | $11.65 | $11.7 | $200.00 | $117.0K | 909 | 0 |

| TXN | PUT | SWEEP | BEARISH | 03/21/25 | $18.95 | $18.65 | $18.95 | $210.00 | $115.5K | 184 | 61 |

| TXN | CALL | SWEEP | BULLISH | 11/08/24 | $3.85 | $3.8 | $3.85 | $215.00 | $47.3K | 5 | 138 |

About Texas Instruments

Dallas-based Texas Instruments generates over 95% of its revenue from semiconductors and the remainder from its well-known calculators. Texas Instruments is the world's largest maker of analog chips, which are used to process real-world signals such as sound and power. Texas Instruments also has a leading market share position in processors and microcontrollers used in a wide variety of electronics applications.

Having examined the options trading patterns of Texas Instruments, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Texas Instruments

- With a trading volume of 1,854,754, the price of TXN is up by 2.15%, reaching $206.0.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 18 days from now.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.