Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Digital Domain Holdings Limited (HKG:547) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Digital Domain Holdings's Net Debt?

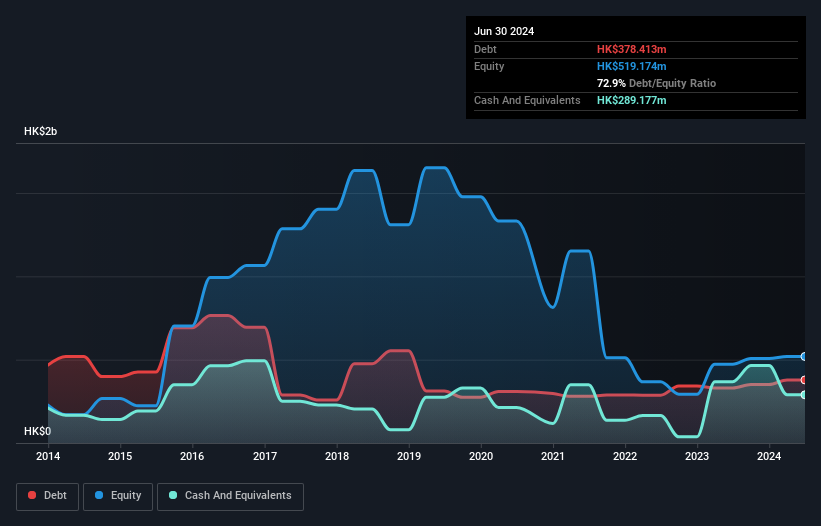

As you can see below, at the end of June 2024, Digital Domain Holdings had HK$378.4m of debt, up from HK$330.0m a year ago. Click the image for more detail. On the flip side, it has HK$289.2m in cash leading to net debt of about HK$89.2m.

How Healthy Is Digital Domain Holdings' Balance Sheet?

We can see from the most recent balance sheet that Digital Domain Holdings had liabilities of HK$464.3m falling due within a year, and liabilities of HK$251.1m due beyond that. Offsetting this, it had HK$289.2m in cash and HK$66.5m in receivables that were due within 12 months. So it has liabilities totalling HK$359.7m more than its cash and near-term receivables, combined.

We can see from the most recent balance sheet that Digital Domain Holdings had liabilities of HK$464.3m falling due within a year, and liabilities of HK$251.1m due beyond that. Offsetting this, it had HK$289.2m in cash and HK$66.5m in receivables that were due within 12 months. So it has liabilities totalling HK$359.7m more than its cash and near-term receivables, combined.

Since publicly traded Digital Domain Holdings shares are worth a total of HK$3.59b, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. When analysing debt levels, the balance sheet is the obvious place to start. But it is Digital Domain Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Digital Domain Holdings had a loss before interest and tax, and actually shrunk its revenue by 34%, to HK$587m. That makes us nervous, to say the least.

Caveat Emptor

Not only did Digital Domain Holdings's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost HK$180m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. However, it doesn't help that it burned through HK$283m of cash over the last year. So in short it's a really risky stock. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for Digital Domain Holdings (1 is a bit concerning!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.