Should You Be Adding Shandong Sunpaper (SZSE:002078) To Your Watchlist Today?

Should You Be Adding Shandong Sunpaper (SZSE:002078) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Shandong Sunpaper (SZSE:002078), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

How Fast Is Shandong Sunpaper Growing Its Earnings Per Share?

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So EPS growth can certainly encourage an investor to take note of a stock. Shandong Sunpaper's EPS skyrocketed from CN¥0.87 to CN¥1.29, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 47%.

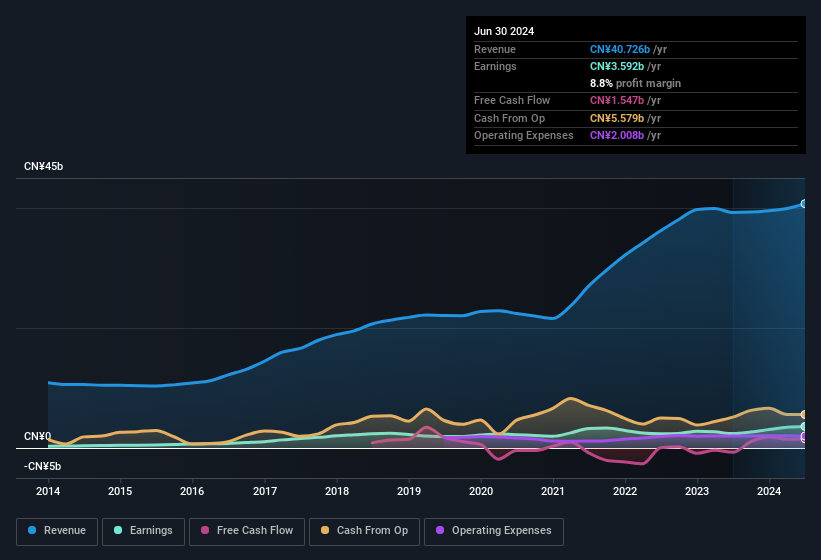

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Shandong Sunpaper shareholders is that EBIT margins have grown from 8.6% to 12% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Shandong Sunpaper shareholders is that EBIT margins have grown from 8.6% to 12% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Shandong Sunpaper's forecast profits?

Are Shandong Sunpaper Insiders Aligned With All Shareholders?

Owing to the size of Shandong Sunpaper, we wouldn't expect insiders to hold a significant proportion of the company. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Given insiders own a significant chunk of shares, currently valued at CN¥387m, they have plenty of motivation to push the business to succeed. This would indicate that the goals of shareholders and management are one and the same.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. A brief analysis of the CEO compensation suggests they are. Our analysis has discovered that the median total compensation for the CEOs of companies like Shandong Sunpaper with market caps between CN¥28b and CN¥85b is about CN¥1.9m.

Shandong Sunpaper's CEO took home a total compensation package of CN¥928k in the year prior to December 2023. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Is Shandong Sunpaper Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Shandong Sunpaper's strong EPS growth. If you still have your doubts, remember too that company insiders have a considerable investment aligning themselves with the shareholders and CEO pay is quite modest compared to similarly sized companiess. The overarching message here is that Shandong Sunpaper has underlying strengths that make it worth a look at. We should say that we've discovered 1 warning sign for Shandong Sunpaper that you should be aware of before investing here.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.