Passive investing in index funds can generate returns that roughly match the overall market. But investors can boost returns by picking market-beating companies to own shares in. For example, the Jiangsu Hengrui Medicine Co., Ltd. (SHSE:600276) share price is up 16% in the last 1 year, clearly besting the market return of around 1.2% (not including dividends). That's a solid performance by our standards! Unfortunately the longer term returns are not so good, with the stock falling 3.5% in the last three years.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

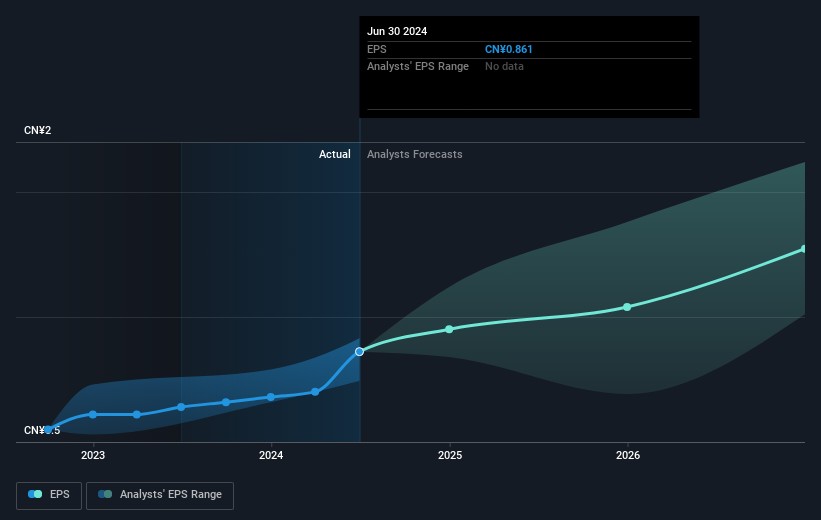

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year Jiangsu Hengrui Medicine grew its earnings per share (EPS) by 35%. It's fair to say that the share price gain of 16% did not keep pace with the EPS growth. Therefore, it seems the market isn't as excited about Jiangsu Hengrui Medicine as it was before. This could be an opportunity. Of course, with a P/E ratio of 61.29, the market remains optimistic.

During the last year Jiangsu Hengrui Medicine grew its earnings per share (EPS) by 35%. It's fair to say that the share price gain of 16% did not keep pace with the EPS growth. Therefore, it seems the market isn't as excited about Jiangsu Hengrui Medicine as it was before. This could be an opportunity. Of course, with a P/E ratio of 61.29, the market remains optimistic.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Jiangsu Hengrui Medicine has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Jiangsu Hengrui Medicine will grow revenue in the future.

A Different Perspective

It's good to see that Jiangsu Hengrui Medicine has rewarded shareholders with a total shareholder return of 17% in the last twelve months. And that does include the dividend. That certainly beats the loss of about 1.6% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. Is Jiangsu Hengrui Medicine cheap compared to other companies? These 3 valuation measures might help you decide.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.