Tesla's stock price trend will depend on Elon Musk's performance on Robotaxi Day on October 10th. Investors are focusing on whether Tesla can solidify its positioning as an "AI company" through Robotaxi, and also paying attention to whether Tesla will launch a more affordable new car model, Model 2, at this event.

On the eve of the Robotaxi event held by Tesla on the 10th, Tesla's Chief Information Officer (CIO) announced his resignation.

According to sources cited by Bloomberg, Tesla's CIO Nagesh Saldi is set to resign. Saldi joined Tesla from HP in 2012 and gradually became the Chief Information Officer by 2018, during which he was involved in the construction of new data centers in Texas and New York.

With less than a week to go before Tesla's official launch of the Robotaxi 'Cybercab,' in terms of the company's stock price, the performance on the day of the event may be more important than the departure of key executives.

With less than a week to go before Tesla's official launch of the Robotaxi 'Cybercab,' in terms of the company's stock price, the performance on the day of the event may be more important than the departure of key executives.

The success or failure hinges on this one move.

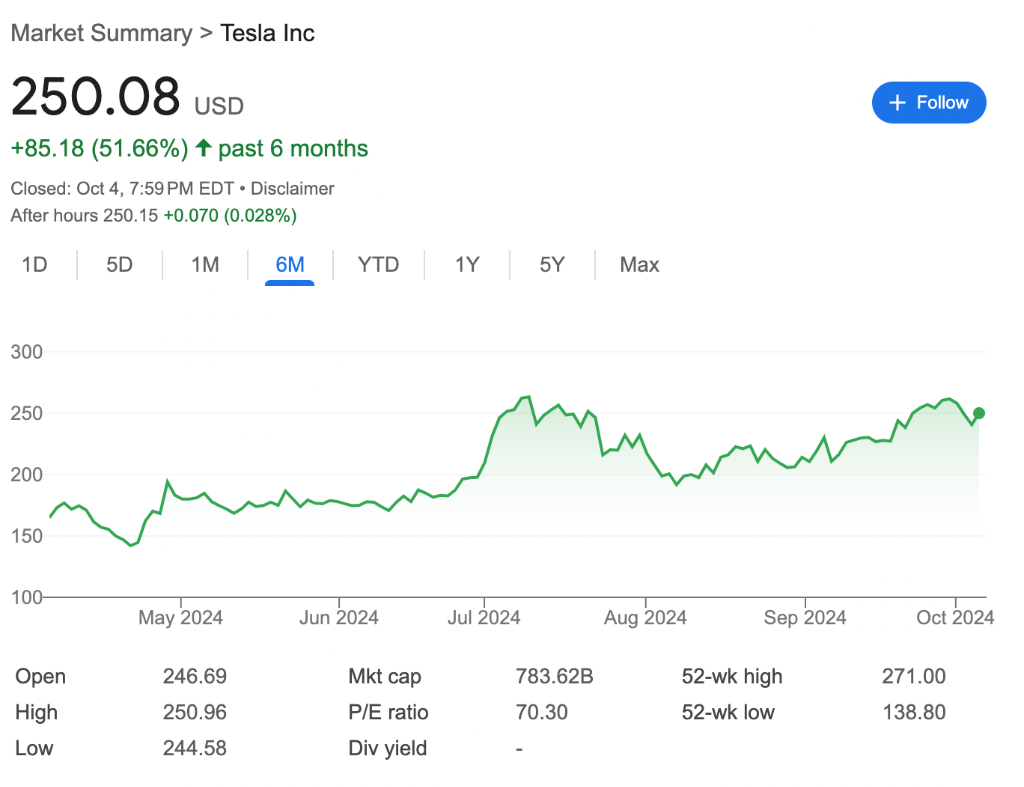

So far this year, Tesla's stock price has fluctuated significantly, rising by 0.67% by the end of this week.

However, since Musk announced Robotaxi Day on April 5th, Tesla's stock price has risen by nearly 50%, recovering from a sharp drop of about 35% at the beginning of the year, indicating the market's high expectations for this event.

In history, important new product events of Tesla have always brought significant stock price fluctuations. A few days after the debut of Model 3 in March 2016, Tesla's stock price rose by 12%; a few days after the official debut of the humanoid robot Optimus at AI Day in 2022, Tesla's stock price dropped by 16%.

It can be said that whether Tesla's stock price will recover to previous highs or fall to lows will depend on Musk's performance on Robotaxi Day on October 10th.

To meet market expectations, Tesla needs to ensure that physical Robotaxis are deployed, and plan to launch unsupervised services by at least 2026, explaining to investors how Tesla will commercialize autonomous driving rental services.

Analyst Emmanuel Rosner of Wolfe Research stated:

"There are few industry events that are as widely anticipated as Tesla's Robotaxi Day, the opportunity is huge, but they still have a lot to prove."

Investors are focusing on whether Tesla can maintain its position as an 'AI company'

Some analysts point out that on the surface, Robotaxi Day appears to be an event launching autonomous driving technology, but in reality Musk needs to convince investors during this event that Tesla is a 'technology company' rather than an 'auto manufacturer'.

Wall Street generally believes that Tesla's future growth will mainly come from the execution of AI projects, especially Robotaxi and humanoid robot Optimus, which is also the reason why Tesla's stock price is supported amid the weak trend in electric car sales.

Currently, Tesla's valuation remains very high, with a forward pe ratio of up to 90 times in the next 12 months, exceeding the other 6 companies in the technology sector's 'Seven Sisters,' ranking among rapidly growing technology companies like Palantir and Snowflake.

Some opinions believe that the success of the Robotaxi Day event largely depends on Musk.

Tesla shorts believe that Musk is shifting investors' focus, diverting attention from larger issues facing the company such as declining sales, increased competition, and decreased profitability of electric cars.

On the other hand, Tesla longs believe that Musk has signaled progress in AI-driven autonomous driving technology, further indicating that Tesla is not just an auto manufacturer — and Musk is also responsible for oversight.

Model 2 is also receiving a lot of attention.

In addition to Robotaxi itself, investors are also focusing on whether Tesla will introduce a more affordable new Model 2 in this event.

The budget-friendly Model 2 (starting at less than 0.03 million USD) is expected to expand Tesla's potential market, as Tesla's current sales have shown a softening trend.

According to data from Wards Automotive, as of August, Tesla's sales in the USA decreased by nearly 10% year-on-year, while the overall sales of electric cars only increased by 7%. At the same time, the sales of plug-in hybrid cars in the USA also increased by 18% year-on-year.

Currently, Wall Street generally expects Tesla's delivery volume in 2024 to be around 1.8 million units, which is roughly the same as 2023, lower than the 2.3 million units predicted by analysts a year ago.

距离特斯拉正式发布Robotaxi“Cybercab”仅剩不到一周,对公司股价而言,比起核心高管离职,活动当日的表现或更为重要。

距离特斯拉正式发布Robotaxi“Cybercab”仅剩不到一周,对公司股价而言,比起核心高管离职,活动当日的表现或更为重要。