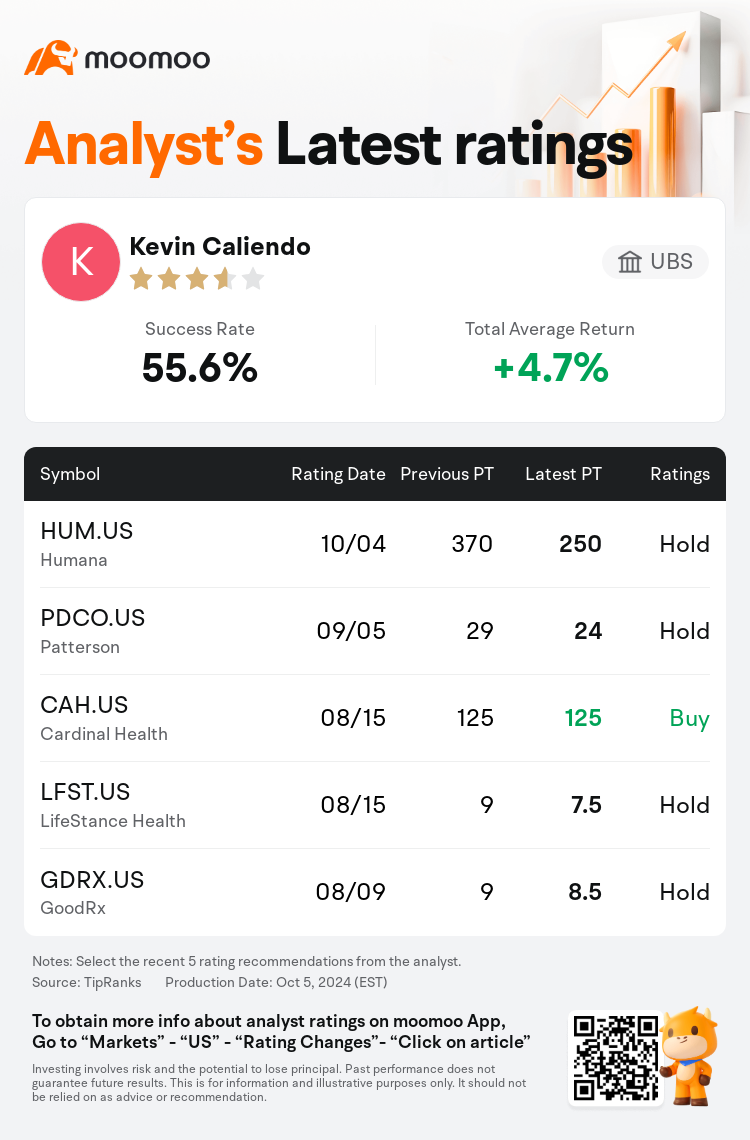

UBS analyst Kevin Caliendo maintains $Humana (HUM.US)$ with a hold rating, and adjusts the target price from $370 to $250.

According to TipRanks data, the analyst has a success rate of 55.6% and a total average return of 4.7% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Humana (HUM.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Humana (HUM.US)$'s main analysts recently are as follows:

The performance of Humana is seen to hinge on the outcome of their appeal with CMS concerning the reported decrease in the 2025 Star ratings for payment year 2026. It is considered 'unlikely' that a resolution will be reached by the commencement of open enrollment.

For 2025, a mere 25% of Humana's members are enrolled in plans eligible for bonuses, a stark decrease from 94% in the previous year. According to the analyst, the preliminary star results did not meet investor expectations and present a considerable risk factor for the company's financial outlook for 2026.

Following a review of Star ratings, analysts indicate that Humana is close to reaching the crucial 4-Star threshold in three of the four affected plans, a factor that could become significant pending the outcome of the appeal. Regardless of the appeal's result, there's a positive outlook for the company's potential to recover in the following year. Management is exploring all possible options to mitigate the situation, although it's premature to provide precise guidance due to the numerous variables at play. This recent update has raised questions about the company's ability to achieve its 3% margin target by 2027.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

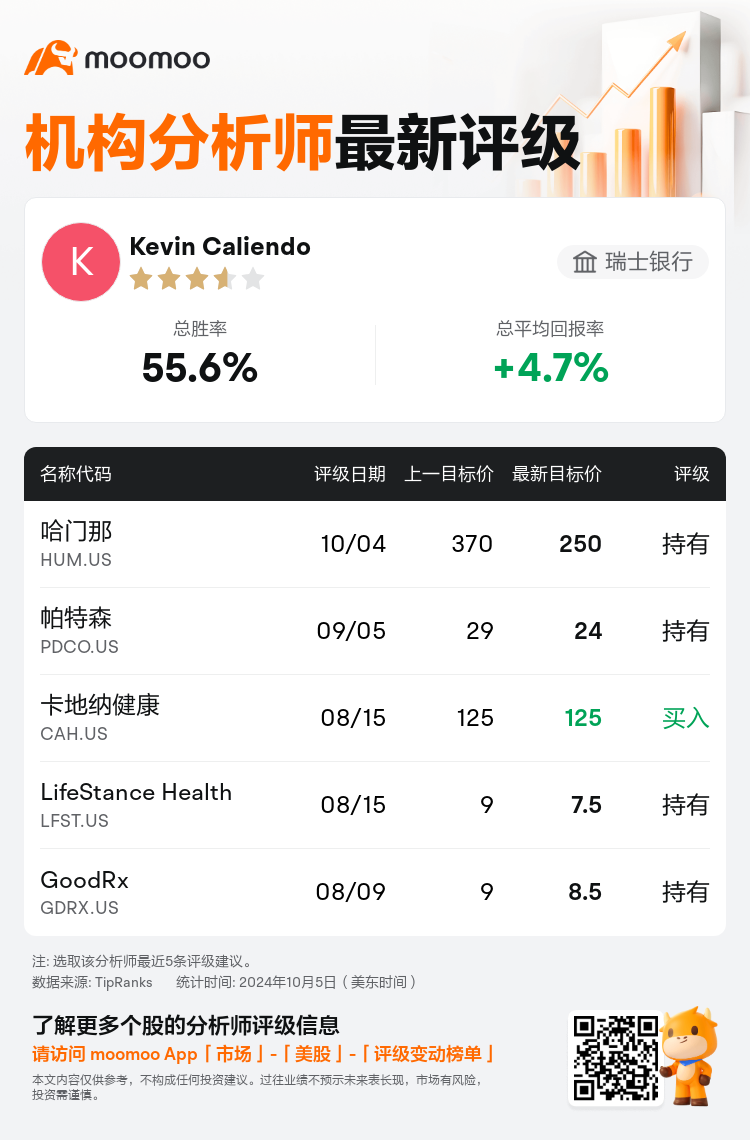

瑞士银行分析师Kevin Caliendo维持$哈门那 (HUM.US)$持有评级,并将目标价从370美元下调至250美元。

根据TipRanks数据显示,该分析师近一年总胜率为55.6%,总平均回报率为4.7%。

此外,综合报道,$哈门那 (HUM.US)$近期主要分析师观点如下:

此外,综合报道,$哈门那 (HUM.US)$近期主要分析师观点如下:

据报道,Humana的业绩取决于他们就2026年付款年度的2025年星级评级下降向CMS提出上诉的结果。人们认为,在开始公开招生之前达成解决方案 “不太可能”。

到2025年,只有25%的Humana会员注册了有资格获得奖金的计划,与去年的94%相比明显下降。根据分析师的说法,初步的明星业绩没有达到投资者的预期,对公司2026年的财务前景构成了相当大的风险因素。

在对星级评级进行审查后,分析师表示,在四个受影响的计划中,有三个计划中,Humana已接近关键的四星门槛,在上诉结果出来之前,这一因素可能会变得很重要。无论上诉的结果如何,该公司在次年的复苏潜力前景乐观。管理层正在探索所有可能的选择来缓解这种情况,尽管由于存在许多变量,现在提供精确的指导还为时过早。最近的更新引发了人们对该公司到2027年实现3%利润率目标的能力的质疑。

提示:

TipRanks为独立第三方,提供金融分析师的分析数据,并计算分析师推荐的平均回报率和胜率。提供的信息并非投资建议,仅供参考。本文不对评级数据和报告的完整性与准确性做出认可、声明或保证。

TipRanks提供每位分析师的星级,分析师星级代表分析师所有推荐的过往表现,通过分析师的总胜率和平均回报率综合计算得出,星星越多,则该分析师过往表现越优异,最高为5颗星。

分析师总胜率为近一年分析师的评级成功次数占总评级次数的比率。评级的成功与否,取决于TipRanks的虚拟投资组合是否从该股票中产生正回报。

总平均回报率为基于分析师的初始评级创建虚拟投资组合,并根据评级变化对组合进行调整,在近一年中该投资组合所获得的回报率。

此外,综合报道,$哈门那 (HUM.US)$近期主要分析师观点如下:

此外,综合报道,$哈门那 (HUM.US)$近期主要分析师观点如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of