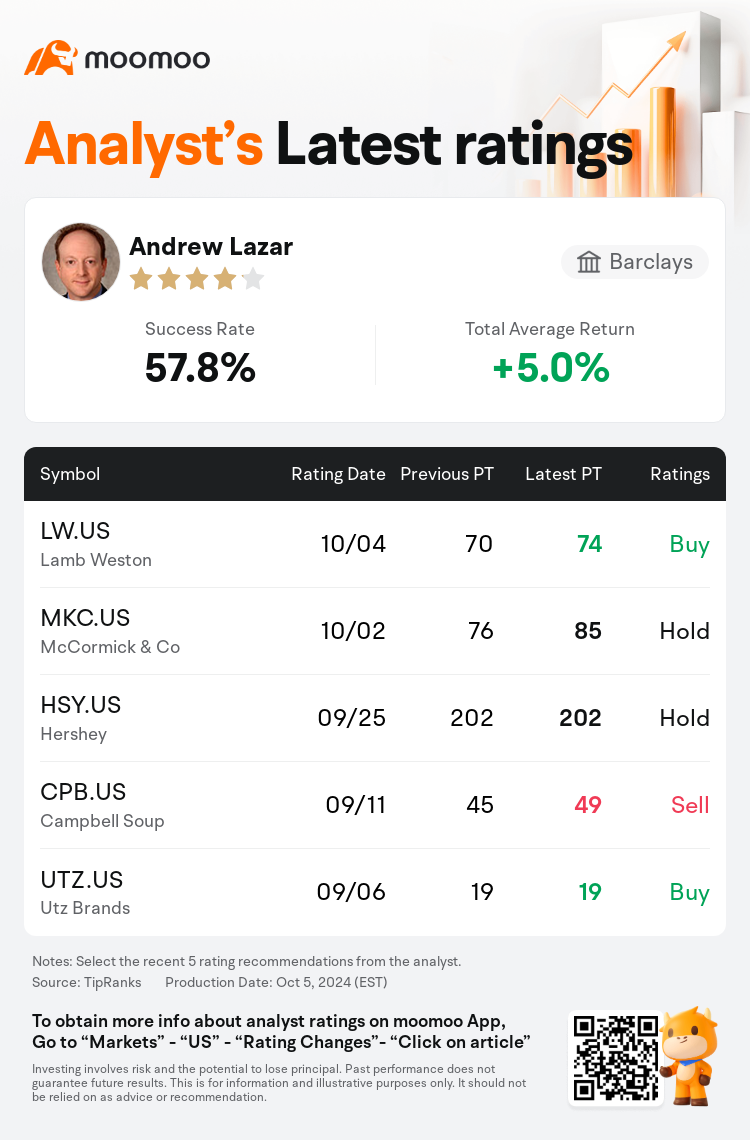

Barclays analyst Andrew Lazar maintains $Lamb Weston (LW.US)$ with a buy rating, and adjusts the target price from $70 to $74.

According to TipRanks data, the analyst has a success rate of 57.8% and a total average return of 5.0% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Lamb Weston (LW.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Lamb Weston (LW.US)$'s main analysts recently are as follows:

The actions taken by Lamb Weston to decrease its available potato processing capacity in North America are likely sufficient to achieve a capacity utilization rate in the low- to mid-90% range, despite the present downturn in quick service traffic. This move is expected to contribute to a sensible, albeit competitive, pricing atmosphere.

In the wake of the fiscal Q1 earnings report, it's evident that there was substantial information to consider, highlighted by a sales and earnings surpass attributed to pricing. Although the outlook for fiscal 2025 gross margin has been adjusted downward, and announcements have been made regarding the closure of various plants and production lines, the key insights are as follows: competitive pricing has not deteriorated as much as some might have feared, proactive measures are being taken to enhance capacity utilization rates, and the guidance adjustment regarding fixed cost deleverage is tied to the company's strategy to address its surplus finished goods inventory. The company's updated forecast is deemed cautious, and the market's perception of the stock may continue to improve.

Following Lamb Weston's report of a stronger than anticipated first quarter, highlighted by robust top-line results, the company has announced a restructuring program to tackle the existing supply/demand mismatch. Additionally, the company has maintained its revenue forecast, now reflecting an anticipation of increased growth internationally, while adjusting its EBITDA expectations to the lower spectrum of its original projection to account for elevated production expenses. The implementation of capacity cuts has bolstered confidence in the stabilization of pricing, although it is anticipated that pricing pressures may persist into FY26.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

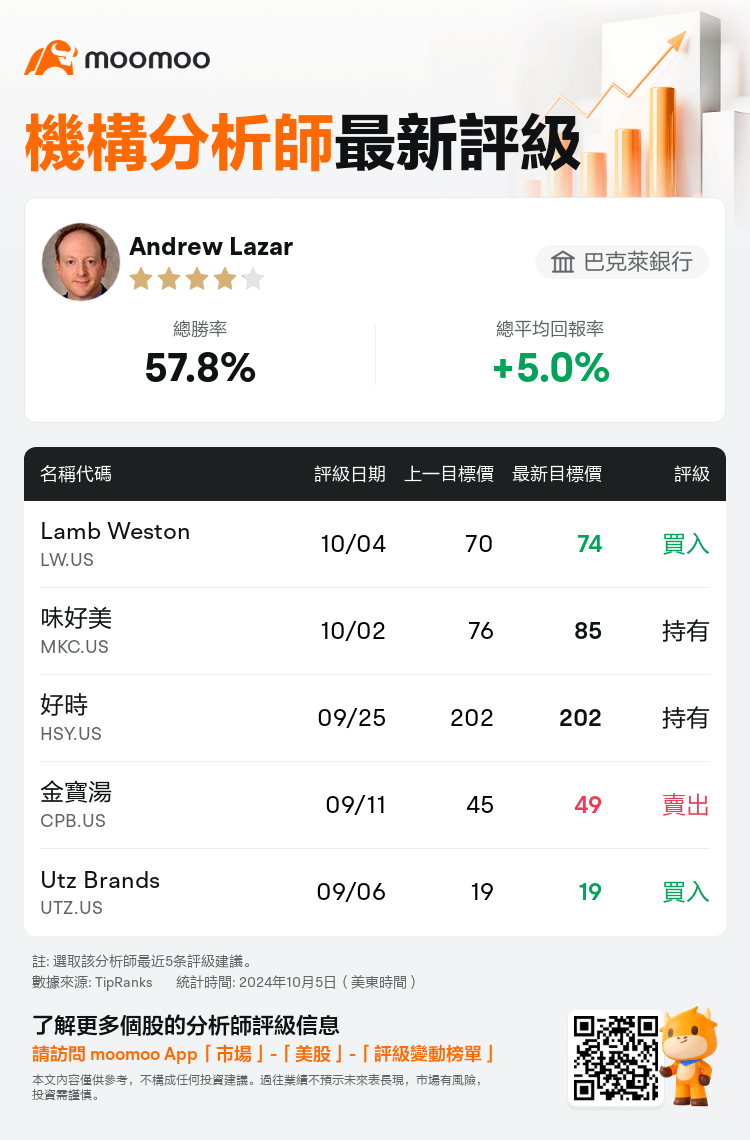

巴克萊銀行分析師Andrew Lazar維持$Lamb Weston (LW.US)$買入評級,並將目標價從70美元上調至74美元。

根據TipRanks數據顯示,該分析師近一年總勝率為57.8%,總平均回報率為5.0%。

此外,綜合報道,$Lamb Weston (LW.US)$近期主要分析師觀點如下:

此外,綜合報道,$Lamb Weston (LW.US)$近期主要分析師觀點如下:

儘管目前快速服務運輸量有所下降,但Lamb Weston爲減少其在北美的可用馬鈴薯加工能力而採取的行動可能足以將產能利用率保持在-90%的低至中等範圍內。此舉有望營造明智但競爭激烈的定價氛圍。

在第一財季業績發佈之後,顯然有大量信息需要考慮,定價帶來的銷售額和收益超額突顯了這一點。儘管2025財年毛利率前景已向下調整,並且已經宣佈關閉各工廠和生產線,但關鍵見解如下:競爭性定價沒有像某些人所擔心的那樣惡化,正在採取積極措施提高產能利用率,有關固定成本去槓桿化的指導調整與公司解決剩餘製成品庫存的戰略息息相關。該公司最新的預測被認爲是謹慎的,市場對該股的看法可能會繼續改善。

蘭姆·韋斯頓報告稱,第一季度業績強於預期,業績強勁,此後,該公司宣佈了一項重組計劃,以解決現有的供需不匹配問題。此外,該公司維持了其收入預測,這反映了對國際增長增長的預期,同時將息稅折舊攤銷前利潤預期調整至其最初預測的較低範圍,以應對生產開支的增加。儘管預計定價壓力可能會持續到26財年,但產能削減的實施增強了人們對穩定定價的信心。

提示:

TipRanks為獨立第三方,提供金融分析師的分析數據,並計算分析師推薦的平均回報率和勝率。提供的信息並非投資建議,僅供参考。本文不對評級數據和報告的完整性與準確性做出認可、聲明或保證。

TipRanks提供每位分析師的星級,分析師星級代表分析師所有推薦的過往表現,通過分析師的總勝率和平均回報率综合計算得出,星星越多,則該分析師過往表現越優異,最高爲5颗星。

分析師總勝率為近一年分析師的評級成功次數占總評級次數的比率。評级的成功與否,取決於TipRanks的虚擬投資組合是否從該股票中產生正回報。

總平均回報率為基於分析師的初始評級創建虚擬投資組合,並根據評級變化對組合進行調整,在近一年中該投資組合所獲得的回報率。

此外,綜合報道,$Lamb Weston (LW.US)$近期主要分析師觀點如下:

此外,綜合報道,$Lamb Weston (LW.US)$近期主要分析師觀點如下:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of