The Farasis Energy (Gan Zhou) Co., Ltd. (SHSE:688567) share price has done very well over the last month, posting an excellent gain of 40%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 37% in the last twelve months.

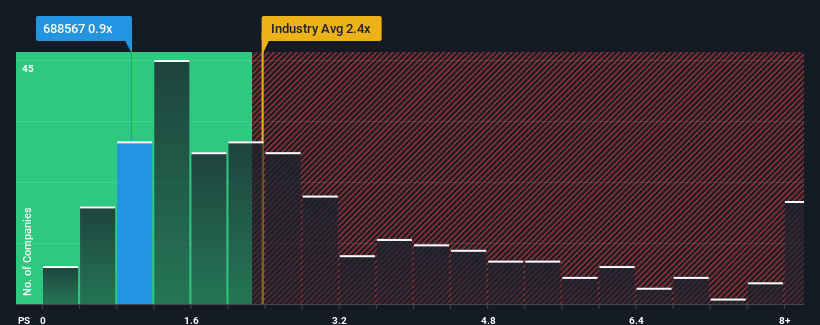

Although its price has surged higher, Farasis Energy (Gan Zhou)'s price-to-sales (or "P/S") ratio of 0.9x might still make it look like a buy right now compared to the Electrical industry in China, where around half of the companies have P/S ratios above 2.4x and even P/S above 5x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Farasis Energy (Gan Zhou) Has Been Performing

With revenue growth that's superior to most other companies of late, Farasis Energy (Gan Zhou) has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Farasis Energy (Gan Zhou)'s future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Farasis Energy (Gan Zhou)?

The only time you'd be truly comfortable seeing a P/S as low as Farasis Energy (Gan Zhou)'s is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as Farasis Energy (Gan Zhou)'s is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 23% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 12% as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 23%, which is noticeably more attractive.

With this information, we can see why Farasis Energy (Gan Zhou) is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Farasis Energy (Gan Zhou)'s P/S Mean For Investors?

Farasis Energy (Gan Zhou)'s stock price has surged recently, but its but its P/S still remains modest. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Farasis Energy (Gan Zhou)'s analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for Farasis Energy (Gan Zhou) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.