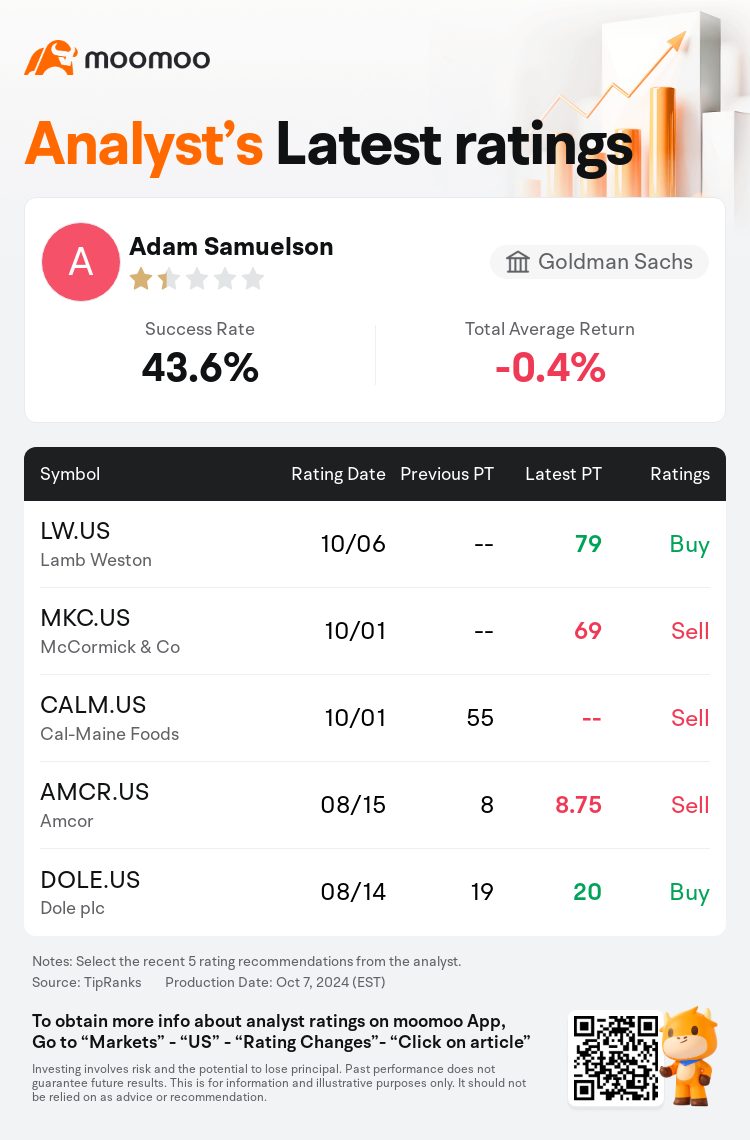

Goldman Sachs analyst Adam Samuelson maintains $Lamb Weston (LW.US)$ with a buy rating, and sets the target price at $79.

According to TipRanks data, the analyst has a success rate of 43.6% and a total average return of -0.4% over the past year.

Furthermore, according to the comprehensive report, the opinions of $Lamb Weston (LW.US)$'s main analysts recently are as follows:

Furthermore, according to the comprehensive report, the opinions of $Lamb Weston (LW.US)$'s main analysts recently are as follows:

The assessment of Lamb Weston's stock now indicates that the risk and reward are considered to be in equilibrium. The demand from restaurants is continuing to show tepid growth, with conditions in Europe having deteriorated and only marginal improvements observed within the U.S. quick service sector. Analysts note that predicting demand is currently more challenging due to its significant reliance on consumer confidence and behavior. Furthermore, even with potential improvements in demand, there is no certainty that it will increase concurrently with global supply.

Lamb Weston's decision to decrease its available potato processing capacity in North America is anticipated to improve its capacity utilization rate in the region to a low- to mid-90% range. This adjustment is expected even considering the presently soft quick service traffic trends. Such a move is likely to contribute to maintaining a balanced, yet competitive, pricing landscape.

In the latest earnings release, Lamb Weston demonstrated a notable performance with sales and earnings exceeding expectations due to effective pricing strategies. Despite a revised earnings outlook indicating a contraction in gross margin by fiscal 2025, and the announcement of certain plant and line closures, the overall market competition in pricing appears to be stable. The company is proactively taking measures to enhance capacity utilization rates. The lowered guidance concerning fixed cost deleverage is specifically tied to Lamb Weston's strategic move to address surplus finished goods inventory. The company's updated forecast is seen as cautious yet sensible, and the market sentiment could potentially continue to improve in favor of the company's stock.

Note:

TipRanks, an independent third party, provides analysis data from financial analysts and calculates the Average Returns and Success Rates of the analysts' recommendations. The information presented is not an investment recommendation and is intended for informational purposes only.

Success rate is the number of the analyst's successful ratings, divided by his/her total number of ratings over the past year. A successful rating is one based on if TipRanks' virtual portfolio earned a positive return from the stock. Total average return is the average rate of return that the TipRanks' virtual portfolio has earned over the past year. These portfolios are established based on the analyst's preliminary rating and are adjusted according to the changes in the rating.

TipRanks provides a ranking of each analyst up to 5 stars, which is representative of all recommendations from the analyst. An analyst's past performance is evaluated on a scale of 1 to 5 stars, with more stars indicating better performance. The star level is determined by his/her total success rate and average return.

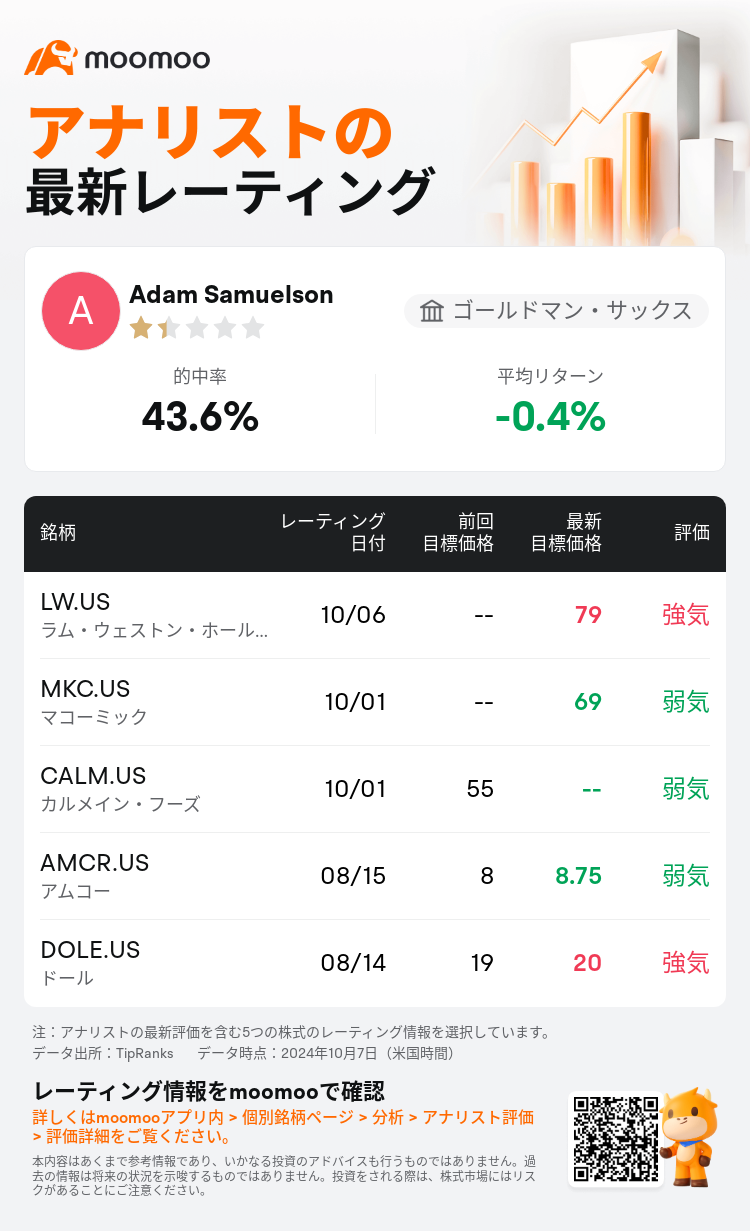

ゴールドマン・サックスのアナリストAdam Samuelsonは$ラム・ウェストン・ホールディングス (LW.US)$のレーティングを強気に据え置き、目標株価を79ドルにした。

TipRanksのデータによると、このアナリストの最近1年間の的中率は43.6%、平均リターンは-0.4%である。

また、$ラム・ウェストン・ホールディングス (LW.US)$の最近の主なアナリストの観点は以下の通りである:

また、$ラム・ウェストン・ホールディングス (LW.US)$の最近の主なアナリストの観点は以下の通りである:

ラム・ウェストンの株式の評価では、リスクとリターンは均衡していると見なされるようになりました。レストランからの需要は引き続き緩やかな伸びを示しており、ヨーロッパの状況は悪化しており、米国のクイックサービス部門ではわずかな改善しか見られません。アナリストは、需要は消費者の信頼と行動に大きく依存しているため、需要を予測することは現在より困難であると述べています。さらに、需要が改善する可能性があっても、世界の供給と同時に増加するかどうかは定かではありません。

ラム・ウェストンが北米で利用可能なジャガイモ加工能力を減らすことを決定したことで、この地域の生産能力利用率は90%台前半から中程度の範囲に改善すると予想されます。この調整は、現在の軟調なクイックサービストラフィックの傾向を考慮しても予想されます。このような動きは、バランスが取れていながら競争力のある価格環境の維持に貢献する可能性があります。

最新の決算発表では、Lamb Westonは効果的な価格戦略により、売上高と収益が予想を上回るという目覚ましい業績を示しました。2025年度までに売上総利益率が縮小することを示す収益見通しの修正と、特定の工場とラインの閉鎖が発表されたにもかかわらず、価格設定における市場全体の競争は安定しているようです。同社は、稼働率を高めるための対策を積極的に講じています。固定費のレバレッジ解消に関するガイダンスの引き下げは、特にラム・ウェストンの余剰完成品在庫への戦略的取り組みに関係しています。同社の最新の予測は慎重でありながら賢明であると見られており、市場のセンチメントは引き続き改善し、同社の株式に有利になる可能性があります。

注

TipRanksは、金融アナリストの分析データと、アナリストの的中率および平均リターンに関する情報を提供している独立第三者です。提供された情報はあくまで参考情報であり、いかなる投資のアドバイスも行うものではありません。本コンテンツでは、レーティング情報などの完全性と正確性を保証しません。

TipRanksは、アナリストの的中率と平均リターンを総合的に算出して評価したスターレーティングを提供しています。1つ星から5つ星のスターレーティングでパフォーマンスを表示しています。星の数が多いほど、そのアナリストのパフォーマンスもより優れています。

アナリストの的中率は、最近1年間におけるアナリストのレーティング的中数がレーティング総数に占める割合を指します。レーティングが的中したかどうかは、TipRanksのバーチャルポートフォリオがその銘柄からプラスのリターンを獲得しているかどうかに基づいています。

平均リターンとは、アナリストの初回レーティングに基づいて作成したバーチャルポートフォリオに対して、レーティングの変化に基づいてポートフォリオを調整することによって獲得した最近一年間のリターン率を指します。

また、$ラム・ウェストン・ホールディングス (LW.US)$の最近の主なアナリストの観点は以下の通りである:

また、$ラム・ウェストン・ホールディングス (LW.US)$の最近の主なアナリストの観点は以下の通りである:

Furthermore, according to the comprehensive report, the opinions of

Furthermore, according to the comprehensive report, the opinions of