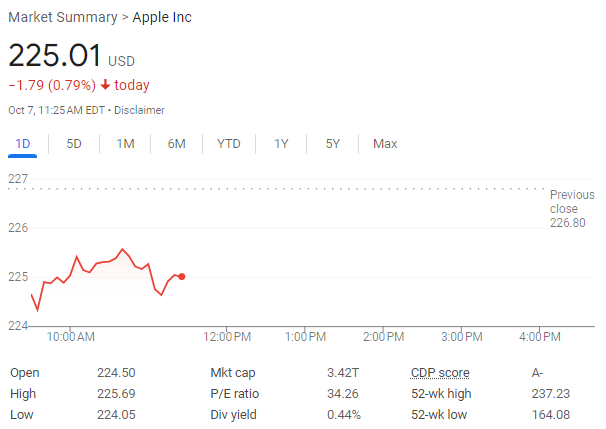

Jefferies analyst believes that the market's expectations for Apple's AI phone are too high, downgrading Apple's rating from buy to hold, and Apple's stock price fell more than 1.2% in Monday morning trading. Previously, the market believed that AI functionality would drive consumer upgrades of phones and re-accelerate Apple's revenue growth. Fueled by this optimism, Apple's stock price has risen by about 36% from its April low.

On Monday, October 7th, US Eastern Time, after Jefferies analyst believed that investors were overly optimistic about the expectations for Apple's latest iPhone, Apple's stock price fell by over 1.2% in early trading.

This new iPhone is the first model equipped with AI functionality. However, analyst Edison Lee stated that the high expectations for iPhone 16 and iPhone 17 are unrealistic. Due to the lack of substantial innovative features and limited AI applications, the market's expectations for sales growth (5%-10%) may not materialize. Therefore, a hold rating was given, instead of the previous buy rating.

Despite a 36% increase in Apple's stock price since the low point in April, many optimistically believe that AI functionality will drive user phone upgrades, leading to revenue growth for Apple. However, early signs indicate that market demand is not as strong as expected.

Despite a 36% increase in Apple's stock price since the low point in April, many optimistically believe that AI functionality will drive user phone upgrades, leading to revenue growth for Apple. However, early signs indicate that market demand is not as strong as expected.

Lee believes that although Apple has potential in the field of AI in the long term, especially as it is the only player capable of providing low-cost, personalized AI services through its own data as a software and hardware integrated player. He also points out that Apple's current valuation is "high" and in the short term, AI will not be the main driver of growth.

He also mentioned that improvements in smart phone hardware are needed to truly support powerful AI functions, which may not be achievable until 2026 or 2027.

Compared to other large technology companies, Wall Street is more cautious about Apple. Only 65% of analysts recommend buying Apple stocks, while this proportion for Microsoft, Nvidia, and Amazon is close to or exceeds 90%.

尽管自4月低点以来苹果股价上涨了36%,很多人乐观地认为AI功能会推动用户升级手机,给苹果带来收入增长,但早期迹象表明,市场需求并不如预期般强劲。

尽管自4月低点以来苹果股价上涨了36%,很多人乐观地认为AI功能会推动用户升级手机,给苹果带来收入增长,但早期迹象表明,市场需求并不如预期般强劲。