China ITS (Holdings) Co., Ltd. (HKG:1900) shares have had a really impressive month, gaining 34% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 52%.

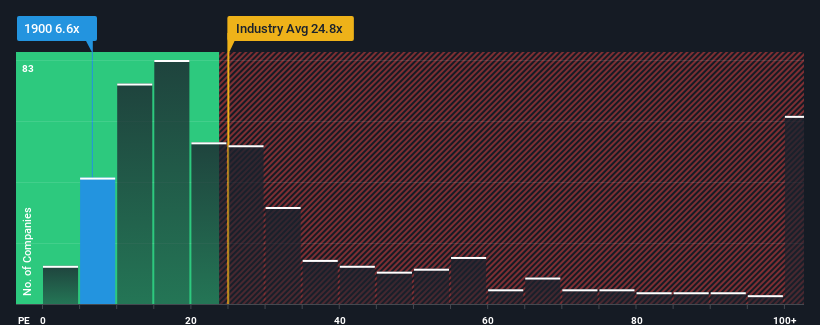

In spite of the firm bounce in price, China ITS (Holdings)'s price-to-earnings (or "P/E") ratio of 6.6x might still make it look like a buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 11x and even P/E's above 21x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For example, consider that China ITS (Holdings)'s financial performance has been poor lately as its earnings have been in decline. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

How Is China ITS (Holdings)'s Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as China ITS (Holdings)'s is when the company's growth is on track to lag the market.

The only time you'd be truly comfortable seeing a P/E as low as China ITS (Holdings)'s is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 61%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

This is in contrast to the rest of the market, which is expected to grow by 22% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that China ITS (Holdings)'s P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On China ITS (Holdings)'s P/E

Despite China ITS (Holdings)'s shares building up a head of steam, its P/E still lags most other companies. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of China ITS (Holdings) revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 3 warning signs for China ITS (Holdings) you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.