The Keen Ocean International Holding Limited (HKG:8070) share price has done very well over the last month, posting an excellent gain of 44%. Looking back a bit further, it's encouraging to see the stock is up 62% in the last year.

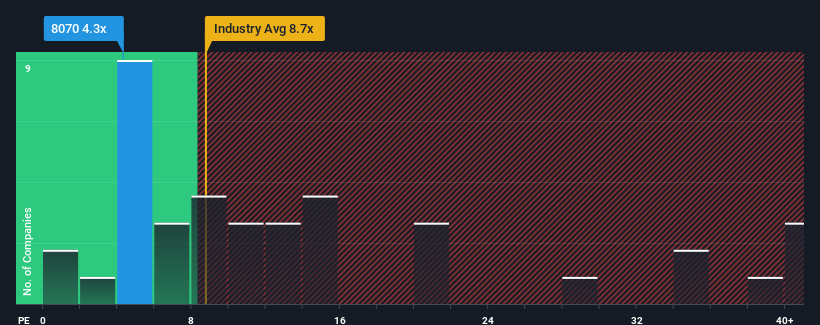

Even after such a large jump in price, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 11x, you may still consider Keen Ocean International Holding as a highly attractive investment with its 4.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

For instance, Keen Ocean International Holding's receding earnings in recent times would have to be some food for thought. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

How Is Keen Ocean International Holding's Growth Trending?

In order to justify its P/E ratio, Keen Ocean International Holding would need to produce anemic growth that's substantially trailing the market.

In order to justify its P/E ratio, Keen Ocean International Holding would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 21%. Even so, admirably EPS has lifted 94% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 22% shows it's noticeably more attractive on an annualised basis.

In light of this, it's peculiar that Keen Ocean International Holding's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Even after such a strong price move, Keen Ocean International Holding's P/E still trails the rest of the market significantly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Keen Ocean International Holding revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Keen Ocean International Holding that you should be aware of.

If you're unsure about the strength of Keen Ocean International Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.