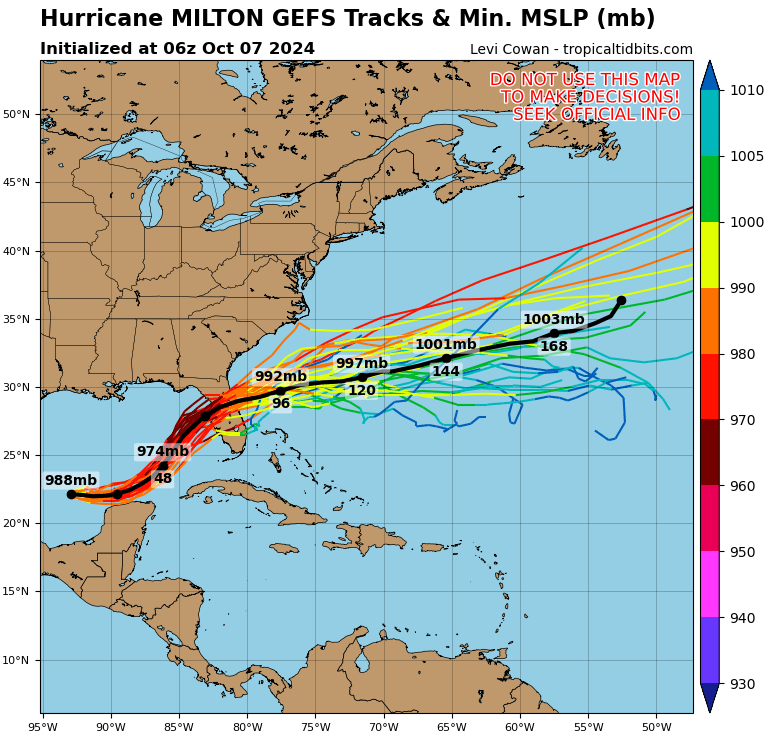

Over the weekend until Monday, Israel was successively attacked by missiles from Lebanon and Hamas. Hurricane Milton rapidly escalated into a Category 5 hurricane in the Gulf of Mexico on Monday, threatening local fuel supplies. The meteorological department warned that the Tampa area in Florida will face the most severe storm in over a century.

Amid the risk posed by the Middle East conflict and Hurricane Milton, international crude oil, which saw a reduced rally last Friday, regained strong momentum this Monday.

During the midday session of US stocks on Monday, October 7, WTI crude oil rose to $77.4, up nearly 4.1% intraday. Brent crude oil broke through the $80 level for the first time since the end of August, approaching $81.20, up nearly 4% intraday. In the end, WTI November crude oil futures closed up 3.71% at $77.14 per barrel, Brent December crude oil futures closed up 3.69% at $80.93 per barrel, both hitting the highest closing levels since late August, with gains for five consecutive trading days.

Some comments have mentioned that the recent surge in crude oil prices is due to a short-covering effect. Due to declining demand prospects, hedge funds and fund managers had accumulated record put bets on oil futures as of mid-September.

Some comments have mentioned that the recent surge in crude oil prices is due to a short-covering effect. Due to declining demand prospects, hedge funds and fund managers had accumulated record put bets on oil futures as of mid-September.

UBS analyst Giovanni Staunovo believes that the rise in oil prices this Monday may be due to fund managers closing out their bearish bets on crude oil, as the risk of disruptions in Middle East oil supply is increasing. Brent Belote, founder of Cayler Capital, a hedge fund focused on commodities, said, "Until a week ago, I thought oil prices would fall below $60."

Last week, international crude oil rose by over 9%, with US oil experiencing its largest weekly gain since March 31, 2023, and Brent oil seeing its biggest weekly gain since October 7, 2022. The main driver was Iran's retaliation against Israel after the Lebanese Hezbollah was attacked and launched multiple missiles towards Israel, escalating the Middle East conflict. Iran, the third largest oil-producing country in OPEC, may suffer a supply disruption.

If Iran's oil infrastructure becomes a target of Israeli attacks, global supply could decrease by up to 4%. Iran's oil production is close to full capacity, and with the escalating tension, production could face further blows. Moreover, if the scope of attacks expands to the strategic Strait of Hormuz, through which Saudi Arabia, Iraq, UAE, Kuwait, and Qatar ship goods, the impact would be even greater.

Last Friday, usa President Biden claimed to be unaware of when Israel would respond to the missile strike by Iran last Tuesday, instead urging Israel to consider alternative options, revealing a tendency to persuade Israel not to attack Iran's oil fields. On the day of his speech, most of the more than 2% increase in crude oil during the session was given back. However, the news from last weekend to this Monday shows that the Middle East situation remains tense.

According to CCTV News, the Israel Defense Forces stated on the evening of the 6th local time that about five projectiles were found to have entered Israeli territory from Lebanon. According to Israeli media reports, the Israeli air defense system failed to intercept the rockets launched from Lebanon, resulting in several injuries.

On the morning of the 7th, the Israeli Defense Forces stated that after sirens sounded in several areas near the Gaza Strip, four rockets were fired from southern Gaza towards Israeli territory, with three rockets intercepted by the defense system, and the fourth rocket hitting an open area. The Palestinian Islamic resistance movement (Hamas) claimed responsibility for the rocket attack.

Rebecca Babin, a senior energy trader at the Canadian Imperial Bank of Commerce (CIBC) Private Wealth Group, commented, 'Anxiety is intensifying. I think the longer we wait, the stronger the fear becomes, like when you're on a roller coaster, expecting to drop when you reach the peak.'

Another driver for oil prices on Monday was Hurricane Milton. On Monday local time, Milton rapidly strengthened into a Category 5 hurricane in the eastern Gulf of Mexico and headed towards Florida, potentially causing interruptions in oil supplies in the Gulf of Mexico. Energy giant Chevron had evacuated workers from an offshore drilling platform in the Gulf of Mexico on Monday, halting production.

Category 5 hurricanes mean that when the hurricane passes through, roofs of residences and industrial buildings may 'completely collapse,' while mobile homes may be 'completely blown away.'

The usa National Hurricane Center (NWS) stated on Monday that Milton's maximum sustained wind speed is 175 miles per hour (282 kilometers per hour). Local officials in Florida stated that they are preparing for the largest evacuation since Hurricane Irma in 2017, when about 7 million state residents left their homes. NWS's forecast warning for Tampa Bay, Florida stated, 'If Milton continues on its current path of wind and development, the Tampa area will face the most severe storm in over 100 years.'

有评论提到了空头撤退对最近原油走高的影响。由于需求前景下降,截至9月中旬,对冲基金和基金经理在石油期货上积累了创纪录的看跌押注。

有评论提到了空头撤退对最近原油走高的影响。由于需求前景下降,截至9月中旬,对冲基金和基金经理在石油期货上积累了创纪录的看跌押注。