Due to the continued weak terminal demand, the performance of the heavy-duty truck industry in September was not satisfactory. The traditional "Golden September" has fallen to become "Copper September" and "Iron September".

Finance and Economics Intelligence APP learned that due to the continued weak terminal demand, the performance of the heavy-duty truck industry in September was not satisfactory. The traditional "Golden September" has fallen to become "Copper September" and "Iron September". According to the preliminary data obtained by the First Commercial Vehicle Network, in September 2024, China's heavy truck market sold approximately 0.058 million units (wholesale basis, including exports and new energy), a 7% decrease from August, a 32% decrease from the same period last year's 0.0857 million units, a reduction of about 0.028 million units.

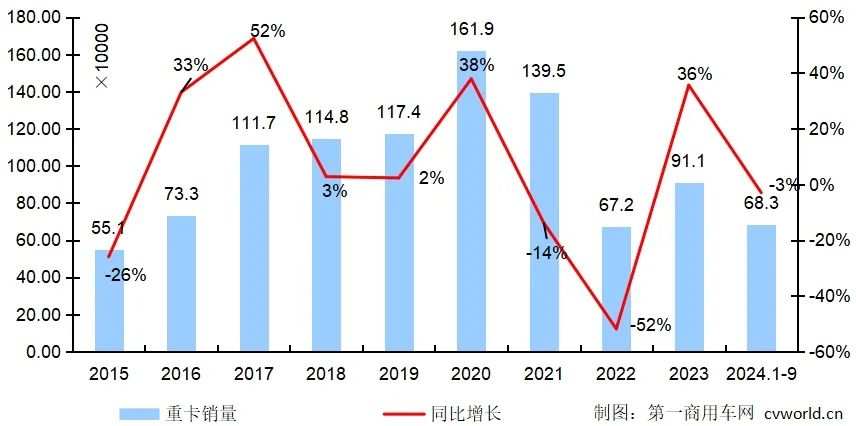

When looking at the past eight years, the 0.058 million vehicles are only higher than September 2022 (0.0518 million vehicles) and lower than the sales volume in September of other years. Looking at the cumulative figures, from January to September 2024, China's heavy truck market sales of various types of vehicles were about 0.683 million vehicles, with the cumulative growth rate turning negative (the cumulative growth rate from January to August was 0.68%), with a decrease of around 3%. The market situation is undoubtedly 'very severe.'

Monthly trend chart of China's heavy truck market sales volume from 2018 to 2024 (unit: units)

Monthly trend chart of China's heavy truck market sales volume from 2018 to 2024 (unit: units)

In September, the heavy truck market sold 0.058 million units, with electric vehicles continuing to surge.

Due to the continued weak terminal demand, the heavy truck industry in September did not perform as expected. The traditional 'Golden September' has fallen to become 'Copper September' and 'Iron September'.

According to the preliminary data obtained by the first commercial vehicle website, in September 2024, China's heavy truck market sales were about 0.058 million vehicles (wholesale caliber, including exports and new energy), a 7% decrease from August, a 32% decrease from the same period last year's 0.0857 million vehicles, a decrease of about 0.028 million vehicles.

When looking at the past eight years, the 0.058 million vehicles are only higher than September 2022 (0.0518 million vehicles) and lower than the sales volume in September of other years. Looking at the cumulative figures, from January to September 2024, China's heavy truck market sales of various types of vehicles were about 0.683 million vehicles, with the cumulative growth rate turning negative (the cumulative growth rate from January to August was 0.68%), with a decrease of around 3%. The market situation is undoubtedly 'very severe.'

Firstly, in terms of overseas exports, China's heavy truck exports in September were basically flat year-on-year. Due to Russia significantly increasing the scrap tax rate for imported cars from October 1st, Chinese manufacturers and Russian dealers have cleared customs in advance, resulting in strong growth in exports to Russia from August to September.

Secondly, as one of the 'three pillars' of the development of China's heavy truck market, new energy heavy trucks in September are already the 'most eye-catching' in the market in the second half of the year. This sub-segment continued its strong momentum since the beginning of the year, with expected terminal sales reaching 6600 vehicles or more, a year-on-year growth of over 110%.

Annual sales trends of China's heavy truck market from 2015 to 2024 (unit: 10,000 vehicles)

Thirdly, domestic wholesale sales are still lower than domestic terminal sales, and the internal driving force of the heavy truck industry is insufficient. According to the first commercial vehicle website's preliminary forecast, the estimated actual terminal sales in the domestic heavy truck market in September are expected to be between 0.041 million and 0.042 million vehicles, showing a slight increase from August, and dropping by 30% compared to the same period last year; wholesale sales are 'unsightly.'

Specifically from the demand side, on one hand, in a market environment of low freight rates, low profits, and low demand, the freight market's prosperity is low, overall terminal demand is weak, and this situation has not improved even during the traditional peak season, resulting in generally 'lackluster' car purchase demand across the country. On the other hand, gas prices remain high, with strong market sentiment of waiting and seeing, dragging down the overall performance of heavy trucks in September. LNG prices have been rising since July in various regions, peaking in mid-September, with retail prices reaching over 5.6 yuan/kg in some areas. In September, LNG prices showed a trend of rising first and then falling, but overall rising more and falling less; as of September 30th, the average wholesale price of LNG is still above 5000 yuan/ton, with retail prices in many northern regions remaining at 5.2 yuan, 5.3 yuan, or even higher; on the other hand, finished oil prices have been continuously reduced recently, with the retail price of No. 0 diesel entering the era of 6 yuan. The rapid narrowing of the oil and gas price difference has greatly weakened the economic advantages of gas vehicles (compared to diesel vehicles), fueling user wait-and-see sentiment (many users neither want to buy gas vehicles nor diesel vehicles), making the terminal market in September even more 'dismal.'

Diyi Commercial Vehicle Network believes that in September, the terminal actual sales volume of natural gas heavy trucks decreased by more than 60% year-on-year, nearly 30% month-on-month, with a penetration rate dropping to below 25%; the natural gas penetration rate in the domestic traction truck market dropped to below 45%, hitting a new low since February this year.

Multiple bullish factors! The market in the fourth quarter may be worth looking forward to.

"Golden September" has turned into "Copper September", will "Silver October" arrive?

Considering the recent macro bullish factors, the market in the fourth quarter may be worth a little anticipation.

Firstly, the entire macroeconomic situation has been activated recently, improving market expectations significantly. On the last day of September, A-shares closed high, with all three major indexes opening high and closing higher, with the SSE Composite Index closing up 8.06%, surpassing 3300 points; the Shenzhen Component Index rose 10.67%; Chinext Price Index up 15.36%; Growth Enterprise Market 50 Index rose 22.84%, and the SSE Science and Technology Innovation Board 50 Index rose 17.88%, all setting historical records for the largest daily gains. That day, the trading volume in both markets reached 2593 billion yuan, setting a new historical high, with a volume increase of over 1147 billion yuan compared to the previous trading day; a net outflow of over 51.7 billion yuan in the large cap market. It is evident that recently, the country has implemented a series of monetary and fiscal policies, effectively improving the market's expectations for the medium to long term fundamentals. In the fourth quarter of 2024, the overall performance of the macro economy is expected to be better than that of the third quarter, thereby stimulating the freight market and truck market with new momentum.

Secondly, with the stock market surging, people's money becomes more abundant (whether to escape losses or make profits), enhancing consumer spending power, leading to expected sequential growth in demand in the fourth quarter. Once demand grows, the total retail sales of social consumer goods will increase, indicating a need for increased transportation of goods in the freight industry (increased road freight volume and freight turnover), which will indirectly boost the downstream heavy truck new vehicle market.

Thirdly, the policy of replacing old trucks with new ones is expected to have a positive effect in the fourth quarter. Since the implementation plans for replacing old trucks with new ones in various provinces and autonomous regions were not released until late August and early to mid-September, combined with a period of promotion, the policy information reaching end-users is likely around late September, hence, the policy will truly take effect in the fourth quarter. Due to the wait-and-see attitude and hesitation, suppressed terminal demand and orders will gradually be released in the fourth quarter, thereby providing some support for the market in October and November-December, showing more significant sequential growth compared to the third quarter. Additionally, as the deadline for the policy of replacing old trucks with new ones is December 31, 2024, the positive effect of the favorable policy in bringing new vehicle increments is likely to increase monthly, and may even create a small "tail effect" at the end of the year.

Finally, it should be mentioned that the penetration rate of gas trucks for the whole year of 2024 is expected to be significantly lower than anticipated, unlikely to reach 30%. According to data from the Diyi Commercial Vehicle Network, the gas penetration rate of domestic heavy trucks from January to September 2024 was 35%, a decrease of around 1 percentage point compared to January to August, even if this sub-market achieves sequential growth in October, the monthly penetration rate for gas heavy trucks will fall again after the arrival of the northern heating season in November. For natural gas heavy trucks to return to rapid growth "spring", it will require at least until after the start of next year.

2018-2024年我国重卡市场销量月度走势图(单位:辆)

2018-2024年我国重卡市场销量月度走势图(单位:辆)