摩根大通認爲,中國股市的遠期市盈率顯著回升,表明政策正朝着貨幣/地產「組合拳」所釋放的資產再通脹方向轉變,也反映了市場對財政刺激政策的高度期待,但是短期來看可能過於樂觀。在A股開盤後,隨着更多個人投資者進入,其表現或將優於港股。

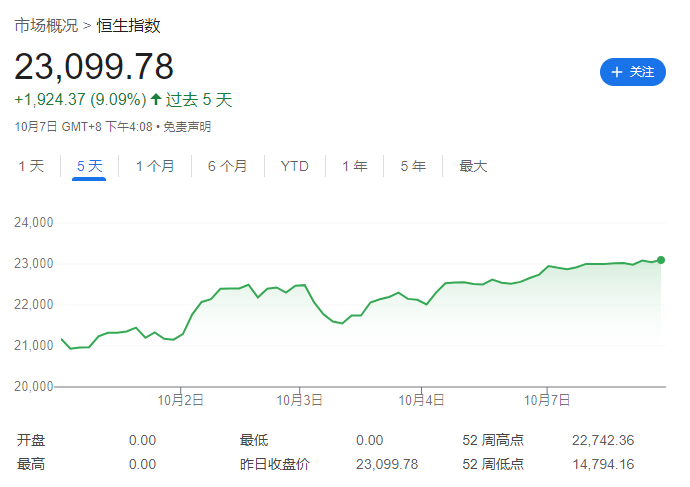

在國慶假期A股休市期間,中國資產依舊交出了一份亮眼的答卷,其中MSCI中國指數、恒生指數和恒生科技指數分別累漲11%、10%和17%,給市場打了一劑有力的強心針。

10月8日A股將開盤交易,是否能再次帶動港股等市場再上一個臺階?摩根大通在10月6日發佈的報告中寫道,A股開盤後港股地產、消費和金融股可能將出現回調,但這是健康的。隨着更多個人投資者進入A股,其表現或將優於港股。

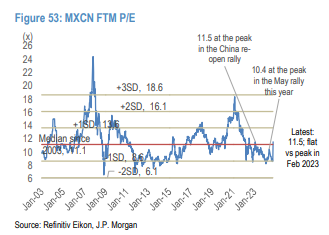

摩根大通分析師表示,自9月中旬以來,中國股市的遠期市盈率已從低於歷史平均值近 1 個標準差回升至歷史平均水平,漲幅達到約35%。

摩根大通分析師表示,自9月中旬以來,中國股市的遠期市盈率已從低於歷史平均值近 1 個標準差回升至歷史平均水平,漲幅達到約35%。

摩根大通認爲,這個跡象表明政策正朝着貨幣/地產「組合拳」所釋放的資產再通脹方向轉變,也反映了市場對財政刺激政策的高度期待,但是短期來看可能過於樂觀。

此外,摩根大通以日本東證指數 (1994-1998) 爲參考框架,認爲MSCI中國指數正處於長達54個月下降通道的第43個月,而中國股市也已經達到了更低的遠期市盈率水平(2024年9月中旬爲8.6倍,而東證指數同等階段爲34倍)。

但值得注意的是,東證指數從低谷 (1998 年 10 月) 到峯值 (2000 年 2 月) 上漲約81%,是在日本實現大規模債務重組之後實現的。

摩根大通維持MSCI中國指數的超額目標爲75(11.5倍的遠期市盈率,市場普遍認爲遠期每股收益將同比增長11%,2024/2025每股收益增長15%/11%。對於滬深300指數,他們將超額目標定在4150(13.8倍遠期市盈率,市場普遍預計遠期每股收益同比增長13%,2024/2025每股收益同比增長8%/14%)。

摩根大通分析师表示,自9月中旬以来,中国股市的远期市盈率已从低于历史平均值近 1 个标准差回升至历史平均水平,涨幅达到约35%。

摩根大通分析师表示,自9月中旬以来,中国股市的远期市盈率已从低于历史平均值近 1 个标准差回升至历史平均水平,涨幅达到约35%。