①諾泰生物率先發布2024年第三季度業績預告,受益於多肽原料藥的銷售增長,預計實現歸母淨利潤1億元-1.4億元,同比增長100.56%-180.78%。②諾泰生物正擴建多肽車間滿足GLP-1的火熱需求,預計至2025年上半年進一步增加多肽產能10噸/年。

《科創板日報》10月8日訊(記者 鄭炳巽)繼在今年率先披露A股首份生物醫藥半年度業績預告之後,諾泰生物(688076.SH)又成爲首家披露2024年三季度業績預告的科創板企業。

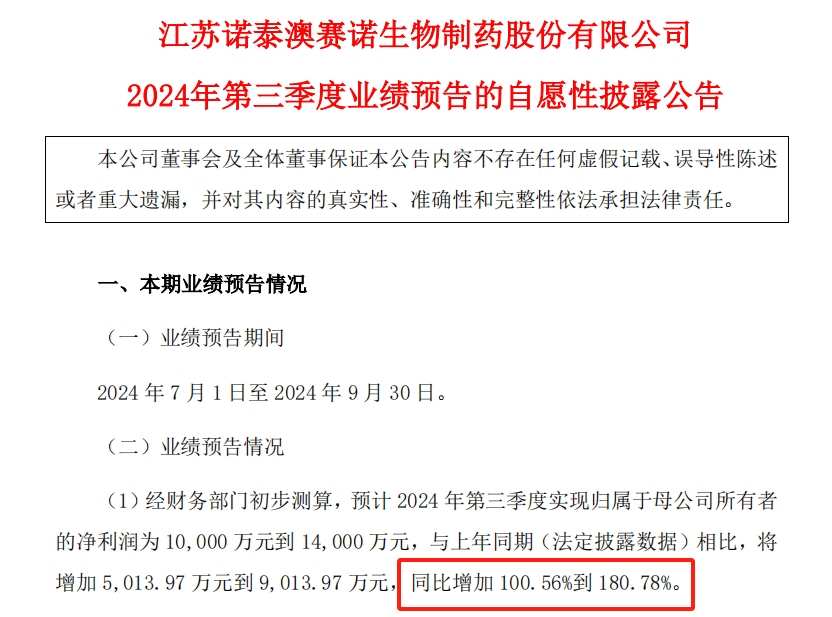

根據業績預告,諾泰生物預計2024年Q3實現歸母淨利潤1億元-1.4億元,將增加5013.97萬元-9013.97萬元,預計同比增長100.56%-180.78%。去年同期,諾泰生物的歸母淨利潤爲4986.03萬元。

今年半年度時,諾泰生物曾預計上半年實現歸母淨利潤1.8億元-2.5億元,同比增長330.08%-497.34%。實際披露的半年報顯示歸母淨利潤爲2.27億元,同比增長442.77%,增速落在預測區間的上沿。

今年半年度時,諾泰生物曾預計上半年實現歸母淨利潤1.8億元-2.5億元,同比增長330.08%-497.34%。實際披露的半年報顯示歸母淨利潤爲2.27億元,同比增長442.77%,增速落在預測區間的上沿。

針對第三季度淨利潤預增,諾泰生物則表示,公司多肽原料藥等銷售收入同比有較大增長,帶動業績同比增長。

作爲一家圍繞多肽藥物及小分子化藥開展自主研發與定製研發生產業務的醫藥企業,諾泰生物當前的收入主要來自於「自主選擇產品」與「定製類產品及技術服務」兩大板塊。

Wind數據顯示,近年來,諾泰生物自主選擇產品的收入快速增長,已經在2023年實現對定製類業務收入的反超,成爲公司最主要的收入來源。

具體來看,2021-2023年,自主選擇產品分別實現營收1.31億元、2.56億元、6.29億元,佔比整體收入分別爲20.34%、39.33%、60.84%。同期,定製類業務分別實現收入5.11億元、3.92億元、4.04億元,佔整體收入的79.32%、60.17%、39.08%。

2024年上半年,諾泰生物兩大業務板塊的收入差距進一步拉大,自主選擇產品實現收入5.45億元,整體佔比爲65.53%,定製類業務收入爲2.86億元,整體佔比爲34.53%。

據悉,在自主選擇產品方面,諾泰生物以多肽藥物爲主,輔以小分子化藥,圍繞糖尿病、心血管疾病、腫瘤等疾病治療方向開展研發、銷售工作。目前,諾泰生物已經搭建起覆蓋司美格魯肽、利拉魯肽、替爾泊肽、磷酸奧司他韋等品種在內的管線。

《科創板日報》記者發現,諾泰生物在多肽原料藥上實現銷售增長,或許與其相關技術持續取得突破有關。

首先,諾泰生物在2023年分別取得利拉魯肽、司美格魯肽等原料藥的FDA DMF First Adequate Letter(FA Letter),意味着相關多肽原料藥的質量已獲得FDA的認可。其次,今年2月,諾泰生物的替爾泊肽原料藥取得全球首家美國FDA DMF(Drug Master File,藥物主文件)。

在不久之前召開的投資者交流會上,諾泰生物表示,司美格魯肽等品種取得的FA Letter之後,相關技術及經驗的積累同樣能夠應用到其他多肽品種,並直言,「海外客戶對於FA Letter的認可度是非常高的,對於公司業務拓展能起到官方認證、事半功倍的效果。」

此外,面對當前GLP-1需求火熱、產能緊張的情況,諾泰生物正在擴建601、602多肽車間進行產能佈局。其中,601車間預計2024年底完成安裝調試,602車間預計2025年上半年完成建設、安裝及調試,合計將增加多肽產能10噸/年。

但是,諾泰生物也提醒,多肽產品到了商業化階段,隨着供應量隨着數量級的提升,價格將往下走。不過,諾泰生物也表示,「公司能夠通過很多種降本增效措施來降低生產成本,實現規模效應以及更大的毛利潤。」

今年半年度时,诺泰生物曾预计上半年实现归母净利润1.8亿元-2.5亿元,同比增长330.08%-497.34%。实际披露的半年报显示归母净利润为2.27亿元,同比增长442.77%,增速落在预测区间的上沿。

今年半年度时,诺泰生物曾预计上半年实现归母净利润1.8亿元-2.5亿元,同比增长330.08%-497.34%。实际披露的半年报显示归母净利润为2.27亿元,同比增长442.77%,增速落在预测区间的上沿。