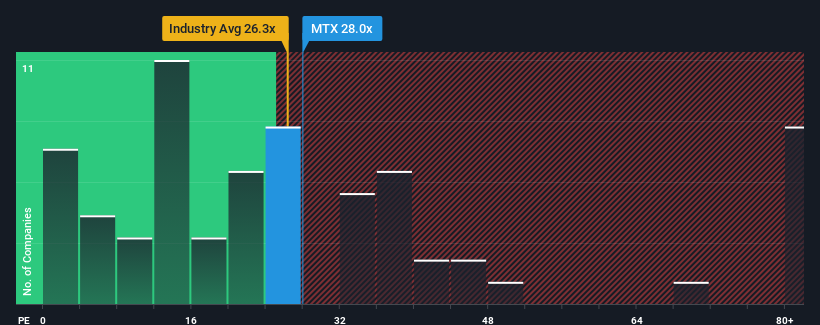

With a price-to-earnings (or "P/E") ratio of 28x Minerals Technologies Inc. (NYSE:MTX) may be sending very bearish signals at the moment, given that almost half of all companies in the United States have P/E ratios under 18x and even P/E's lower than 10x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Recent times haven't been advantageous for Minerals Technologies as its earnings have been falling quicker than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Minerals Technologies would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 10%. The last three years don't look nice either as the company has shrunk EPS by 35% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 10%. The last three years don't look nice either as the company has shrunk EPS by 35% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the four analysts covering the company suggest earnings should grow by 44% each year over the next three years. With the market only predicted to deliver 10% per annum, the company is positioned for a stronger earnings result.

With this information, we can see why Minerals Technologies is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Minerals Technologies maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Minerals Technologies that you should be aware of.

If these risks are making you reconsider your opinion on Minerals Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.