During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the industrials sector.

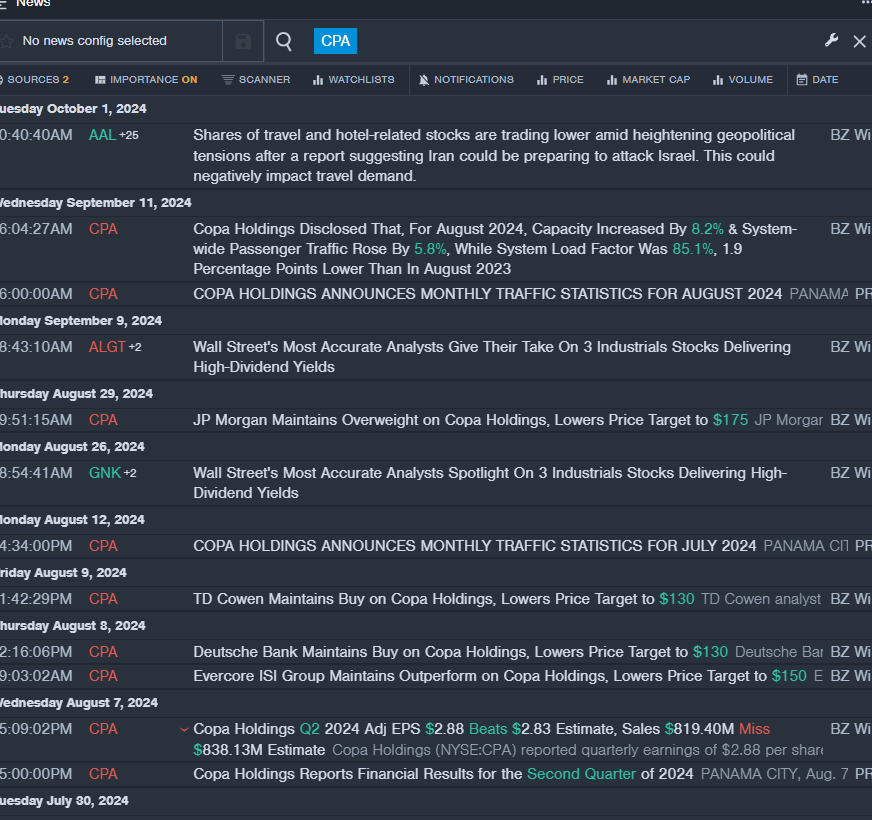

Copa Holdings, S.A. (NYSE:CPA)

- Dividend Yield: 6.76%

- Deutsche Bank analyst Michael Linenberg maintained a Buy rating and cut the price target from $145 to $130 on Aug. 8. This analyst has an accuracy rate of 75%.

- Raymond James analyst Savanthi Syth maintained a Strong Buy rating and raised the price target from $165 to $168 on May 17. This analyst has an accuracy rate of 65%.

- Recent News: On Sept. 11, Copa Holdings said, for Aug. 2024, capacity increased by 8.2% and system-wide passenger traffic rose by 5.8%.

- Benzinga Pro's real-time newsfeed alerted to latest CPA news.

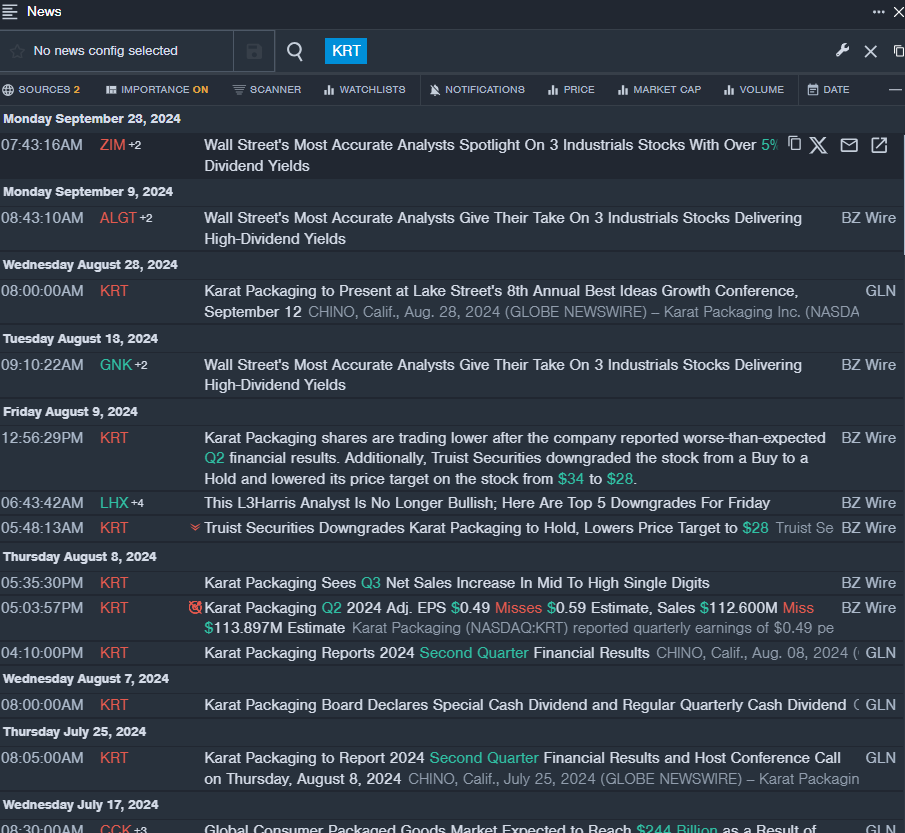

Karat Packaging Inc. (NASDAQ:KRT)

- Dividend Yield: 5.47%

- Truist Securities analyst Jake Bartlett downgraded the stock from Buy to Hold and slashed the price target from $34 to $28 on Aug. 9. This analyst has an accuracy rate of 76%.

- Stifel analyst Michael Hoffman reiterated a Buy rating and boosted the price target from $30 to $32 on March 15. This analyst has an accuracy rate of 84%.

- Recent News: On Aug. 8, Karat Packaging reported worse-than-expected second-quarter financial results.

- Benzinga Pro's real-time newsfeed alerted to latest KRT news.

United Parcel Service, Inc. (NYSE:UPS)

- Dividend Yield: 4.97%

- BMO Capital analyst Fadi Chamoun maintained a Market Perform rating and cut the price target from $169 to $155 on July 24. This analyst has an accuracy rate of 80%.

- Wells Fargo analyst Christian Wetherbee maintained an Overweight rating and slashed the price target from $156 to $134 on July 24. This analyst has an accuracy rate of 74%.

- Recent News: On Aug. 7, UPS announced its regular quarterly dividend of $1.63 per share on all outstanding Class A and Class B shares.

- Benzinga Pro's charting tool helped identify the trend in UPS stock.

Read More:

Read More:

- Dow Dips Around 400 Points As Treasury Yields Top 4%: Investor Optimism Declines, But Fear Index Remains In 'Greed' Zone