Microsoft Corp. (NASDAQ:MSFT) has been riding high in 2024, with the stock up 11.38% year-to-date and 25.21% over the past year.

However, dark clouds may be forming on two fronts: technical indicators are flashing bearish signals and Microsoft's high-profile partnership with OpenAI is showing signs of strain.

Death Cross Looming: Bearish Signals Pile Up

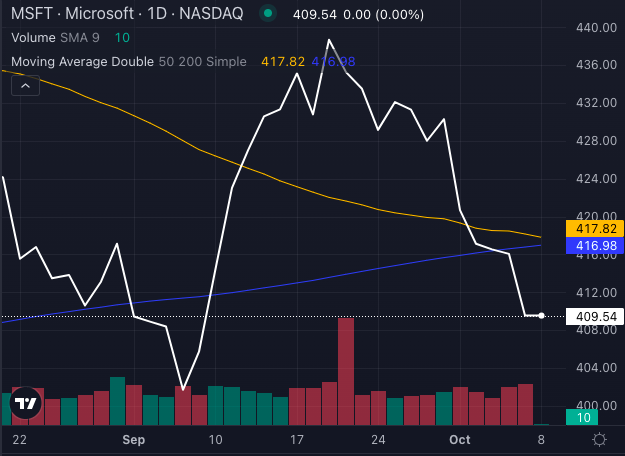

Chart created using Benzinga Pro

Microsoft stock is inching closer to forming a Death Cross, a technical pattern where the 50-day moving average dips below the 200-day moving average, signaling a potential shift from bullish to bearish momentum.

Microsoft stock is inching closer to forming a Death Cross, a technical pattern where the 50-day moving average dips below the 200-day moving average, signaling a potential shift from bullish to bearish momentum.

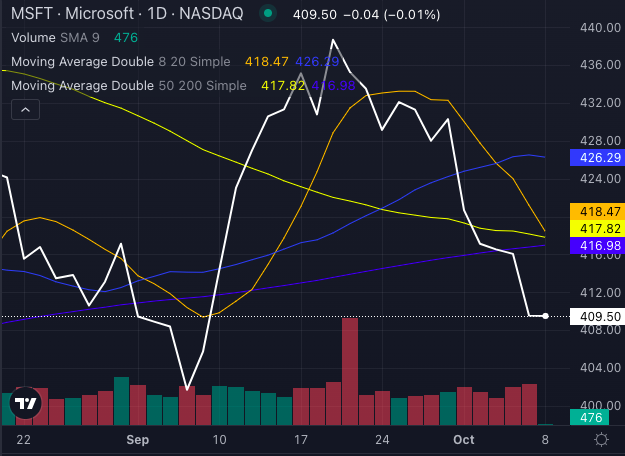

Chart created using Benzinga Pro

Right now, Microsoft stock is already trading below key moving averages, indicating that selling pressure is building.

- Eight-day SMA: $418.47 (Bearish)

- 20-day SMA: $426.29 (Bearish)

- 50-day SMA: $417.82 (Bearish)

- 200-day SMA: $416.98 (Bearish)

At a share price of $409.50, Microsoft's stock is clearly under pressure, with bearish signals stacking up. A Death Cross would only solidify this, potentially signaling a deeper downtrend.

OpenAI Moves To Oracle: Cracks In The Microsoft Partnership?

Adding to Microsoft's troubles is the evolving relationship with OpenAI. According to The Information, OpenAI is seeking more independence from Microsoft's cloud services, opting to lease data centers from Oracle Corp (NYSE:ORCL) in Texas. This shift comes as OpenAI raised $6.6 billion in new funding and looks to expand its capabilities without being solely dependent on Microsoft.

Read Also: Intel Vs. Oracle: Can Apollo's Rescue Plan Beat Oracle's AI Cloud Domination?

Concerns have emerged over Microsoft's ability to meet OpenAI's growing need for computing power, prompting OpenAI's search for alternative solutions. Though OpenAI maintains that its strategic relationship with Microsoft remains strong, the move toward Oracle signals some level of dissatisfaction.

Time To Lock In Gains?

With Microsoft stock on the brink of a Death Cross and its once rock-solid partnership with OpenAI showing cracks, now might be the perfect time for investors to consider locking in gains.

The combination of bearish technicals and potential shifts in cloud business partnerships adds to the risk of a downturn.

Investors riding Microsoft's strong 2024 performance might want to reevaluate whether to stay in or take profits before the Death Cross becomes a reality.

- Here's How Much $100 Invested In Microsoft 20 Years Ago Would Be Worth Today

Photo: Shutterstock