Celsius Holdings Unusual Options Activity

Celsius Holdings Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Celsius Holdings.

擁有大量資金的鯨魚已明顯看好Celsius Holdings。

Looking at options history for Celsius Holdings (NASDAQ:CELH) we detected 23 trades.

查看Celsius Holdings(納斯達克:CELH)的期權歷史,我們檢測到23筆交易。

If we consider the specifics of each trade, it is accurate to state that 52% of the investors opened trades with bullish expectations and 34% with bearish.

如果我們考慮每筆交易的具體細節,可以準確地說,52%的投資者持有看好期望,34%持有看淡期望。

From the overall spotted trades, 11 are puts, for a total amount of $729,151 and 12, calls, for a total amount of $559,641.

從整體交易中發現,有11筆看跌期權,總額爲$729,151,還有12筆看漲期權,總額爲$559,641。

Expected Price Movements

預期價格波動

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $15.0 to $70.0 for Celsius Holdings over the recent three months.

根據交易活動,重要的投資者似乎瞄準了Celsius Holdings在最近三個月內的價格區間,範圍從$15.0到$70.0。

Volume & Open Interest Trends

成交量和未平倉量趨勢

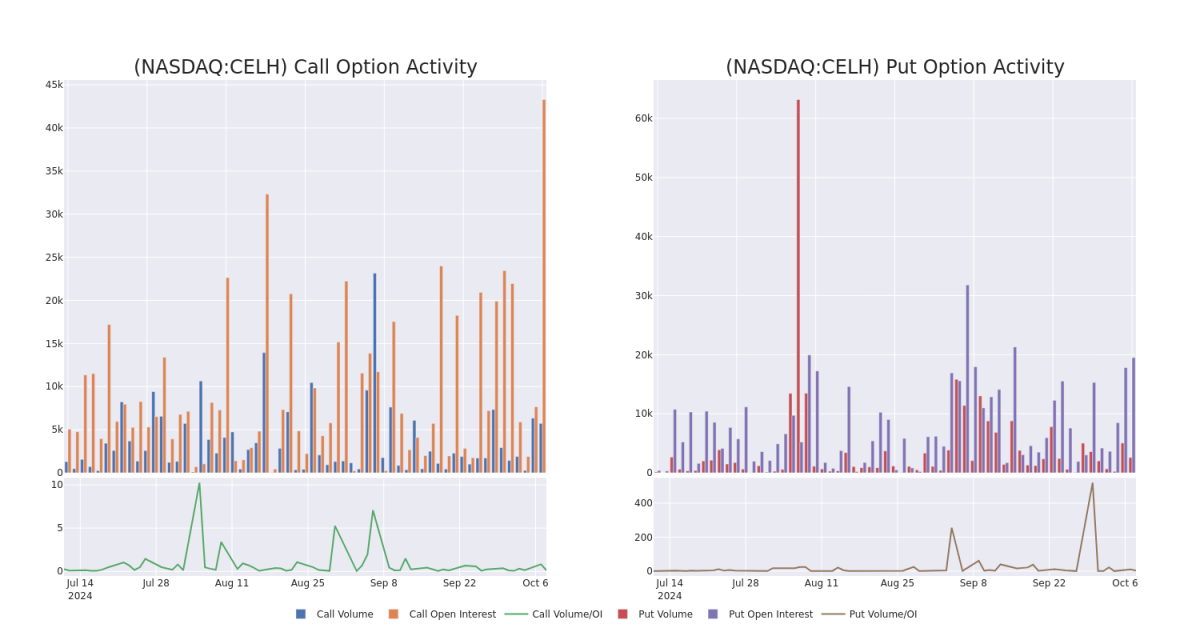

In today's trading context, the average open interest for options of Celsius Holdings stands at 3304.68, with a total volume reaching 8,322.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Celsius Holdings, situated within the strike price corridor from $15.0 to $70.0, throughout the last 30 days.

在今天的交易背景下,Celsius Holdings期權的平均未平倉量爲3304.68,總成交量達到8322.00。隨附的圖表描述了Celsius Holdings高價交易的看漲和看跌期權成交量和未平倉量的發展情況,這些交易位於$15.0至$70.0的行權價格走廊內,在過去30天內。

Celsius Holdings Option Activity Analysis: Last 30 Days

Celsius Holdings期權活動分析:最近30天

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CELH | PUT | SWEEP | BULLISH | 01/16/26 | $15.7 | $15.4 | $15.4 | $40.00 | $385.0K | 2.3K | 250 |

| CELH | CALL | SWEEP | BEARISH | 11/15/24 | $2.71 | $2.64 | $2.64 | $30.00 | $114.3K | 1.8K | 1.6K |

| CELH | CALL | SWEEP | BEARISH | 01/16/26 | $9.05 | $8.8 | $8.8 | $30.00 | $88.0K | 930 | 167 |

| CELH | PUT | TRADE | BULLISH | 04/17/25 | $9.5 | $9.35 | $9.4 | $35.00 | $62.0K | 722 | 66 |

| CELH | CALL | SWEEP | BULLISH | 03/21/25 | $9.4 | $9.3 | $9.4 | $22.50 | $49.8K | 17 | 54 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| celsius holdings | 看跌 | SWEEP | 看好 | 01/16/26 | 15.7 | $15.4 | $15.4 | $40.00 | $385.0K | 2.3K | 250 |

| celsius holdings | 看漲 | SWEEP | 看淡 | 11/15/24 | $2.71 | 2.64美元 | 2.64美元 | $30.00 | $114.3K | 1.8K | 1.6K |

| celsius holdings | 看漲 | SWEEP | 看淡 | 01/16/26 | $9.05 | $ 8.8 | $ 8.8 | $30.00 | $88.0千美元 | 930 | 167 |

| celsius holdings | 看跌 | 交易 | 看好 | 04/17/25 | $9.5 | $9.35 | 9.4美元 | 35.00美元 | $62.0K | 722 | 66 |

| celsius holdings | 看漲 | SWEEP | 看好 | 03/21/25 | 9.4美元 | $9.3 | 9.4美元 | $22.50 | $49.8K | 17 | 54 |

About Celsius Holdings

關於Celsius Holdings

Celsius Holdings plays in the energy drink subsegment of the global nonalcoholic beverage market, with 96% of revenue concentrated in North America. Celsius' products contain natural ingredients and a metabolism-enhancing formulation, appealing to fitness and active lifestyle enthusiasts. The firm's portfolio includes its namesake Celsius Originals beverages (including those that are naturally caffeinated with stevia), Celsius Essentials line (containing aminos), and Celsius On-the-Go powder packets. Celsius dedicates its efforts to branding and innovation, while it utilizes third parties for the manufacturing, packaging, and distribution of its products. In 2022, Celsius forged a 20-year distribution agreement with PepsiCo, which holds an 8.5% stake in the business.

Celsius Holdings是全球非酒精飲料市場中能量飲料子領域的企業,96%的營收集中於北美。Celsius的產品含天然成分和代謝增強配方,吸引健身和積極生活方式的愛好者。該公司的產品組合包括其同名的Celsius Originals飲料(包括天然咖啡因飲料,含有甜菜鹼),Celsius Essentials系列(含氨基酸)和Celsius On-the-Go粉末包。Celsius致力於品牌和創新,同時利用第三方公司來製造,包裝和分銷其產品。 2022年,Celsius與百事可樂簽署了一項爲期20年的分銷協議,百事可樂佔Celsius的8.5%股份。

Following our analysis of the options activities associated with Celsius Holdings, we pivot to a closer look at the company's own performance.

在分析了與Celsius Holdings相關的期權交易活動後,我們將轉向更詳細地了解該公司的業績表現。

Present Market Standing of Celsius Holdings

Celsius Holdings現市場立場

- Currently trading with a volume of 6,364,055, the CELH's price is down by -0.45%, now at $28.69.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 28 days.

- 目前交易量爲6,364,055,celsius holdings的價格下跌了-0.45%,目前爲$28.69。

- RSI讀數表明該股票目前可能接近超賣狀態。

- 預期業績發佈在28天后。

Expert Opinions on Celsius Holdings

Celsius Holdings的專家意見

In the last month, 2 experts released ratings on this stock with an average target price of $45.0.

在過去一個月中,有2位專家對這隻股票發佈了評級,平均目標價爲$45.0。

Turn $1000 into $1270 in just 20 days?

在短短20天內,將1000美元變成1270美元?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Maintaining their stance, an analyst from Piper Sandler continues to hold a Overweight rating for Celsius Holdings, targeting a price of $47. * Maintaining their stance, an analyst from Roth MKM continues to hold a Buy rating for Celsius Holdings, targeting a price of $43.

20年期權交易老手透露了他的一行圖表技術,顯示何時買入和賣出。複製他的交易,平均每20天有27%的利潤。 點擊這裏獲取更多信息。* 派傑投資的分析師繼續維持對celsius holdings的超配評級,目標價爲$47。* 羅斯MKm的分析師繼續維持對celsius holdings的買入評級,目標價爲$43。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Celsius Holdings options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在收益。精明的交易者通過不斷學習、調整策略、監控多個因子,並密切關注市場動向來管理這些風險。通過Benzinga Pro的實時警報及時了解最新的Celsius Holdings期權交易。

From the overall spotted trades, 11 are puts, for a total amount of $729,151 and 12, calls, for a total amount of $559,641.

From the overall spotted trades, 11 are puts, for a total amount of $729,151 and 12, calls, for a total amount of $559,641.