The Jiangsu Haili Wind Power Equipment Technology Co., Ltd. (SZSE:301155) share price has done very well over the last month, posting an excellent gain of 50%. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

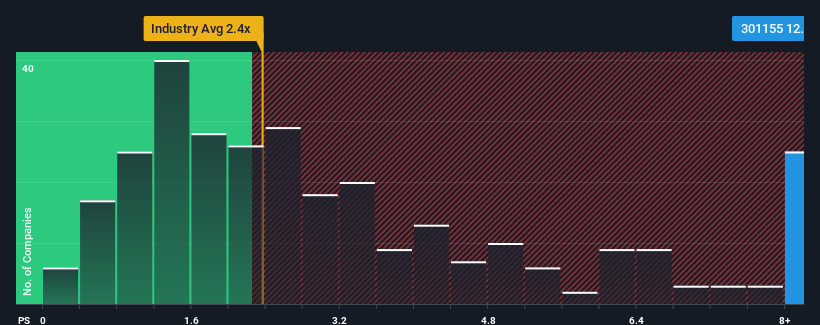

Following the firm bounce in price, you could be forgiven for thinking Jiangsu Haili Wind Power Equipment Technology is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 12.7x, considering almost half the companies in China's Electrical industry have P/S ratios below 2.4x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Jiangsu Haili Wind Power Equipment Technology's P/S Mean For Shareholders?

Jiangsu Haili Wind Power Equipment Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Jiangsu Haili Wind Power Equipment Technology will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Jiangsu Haili Wind Power Equipment Technology?

Jiangsu Haili Wind Power Equipment Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Jiangsu Haili Wind Power Equipment Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 50%. This means it has also seen a slide in revenue over the longer-term as revenue is down 81% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 267% during the coming year according to the five analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 23%, which is noticeably less attractive.

With this information, we can see why Jiangsu Haili Wind Power Equipment Technology is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Jiangsu Haili Wind Power Equipment Technology's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Jiangsu Haili Wind Power Equipment Technology's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Jiangsu Haili Wind Power Equipment Technology is showing 1 warning sign in our investment analysis, you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.