JinGuan Electric Co., Ltd. (SHSE:688517) shareholders would be excited to see that the share price has had a great month, posting a 42% gain and recovering from prior weakness. Notwithstanding the latest gain, the annual share price return of 7.7% isn't as impressive.

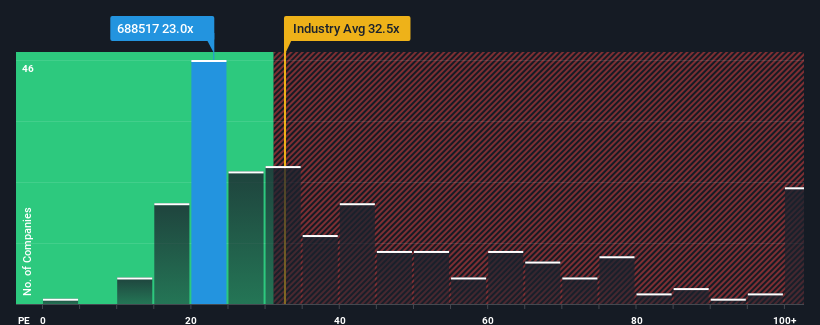

In spite of the firm bounce in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 34x, you may still consider JinGuan Electric as an attractive investment with its 23x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, JinGuan Electric has been doing quite well of late. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like JinGuan Electric's to be considered reasonable.

There's an inherent assumption that a company should underperform the market for P/E ratios like JinGuan Electric's to be considered reasonable.

Retrospectively, the last year delivered a decent 11% gain to the company's bottom line. The latest three year period has also seen a 6.2% overall rise in EPS, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 164% as estimated by the lone analyst watching the company. Meanwhile, the rest of the market is forecast to only expand by 37%, which is noticeably less attractive.

In light of this, it's peculiar that JinGuan Electric's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

The latest share price surge wasn't enough to lift JinGuan Electric's P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of JinGuan Electric's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for JinGuan Electric that you should be aware of.

Of course, you might also be able to find a better stock than JinGuan Electric. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.